Question: please help to answer below (52) and (54), do not use excel, please give the equaion thanks! Montreal Construction needs to replace one of their

please help to answer below (52) and (54), do not use excel, please give the equaion thanks!

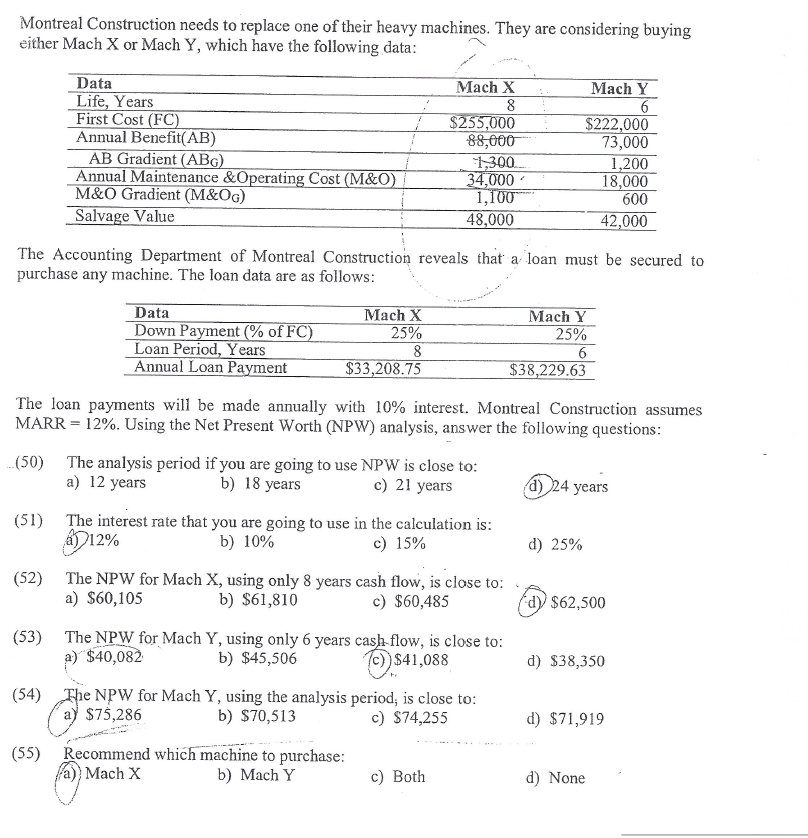

Montreal Construction needs to replace one of their heavy machines. They are considering buying either Mach X or Mach Y, which have the following data: The Accounting Department of Montreal Construction reveals that a loan must be secured to purchase any machine. The loan data are as follows: The loan payments will be made annually with 10% interest. Montreal Construction assumes MARR = 12%. Using the Net Present Worth (NPW) analysis, answer the following questions: The analysis period if you are going to use NPW is close to: a) 12 years b) 18 years c) 21 years d) 24 years The interest rate that you are going to use in the calculation is: a) 12% b) 10% c) 15% d) 25% The NPW for Mach X, using only 8 years cash flow, is close to: a) $60, 105 b) $61, 810 c) $60, 485 d) $62, 500 The NPW for Mach Y, using only 6 years cash flow, is close to: a) $40, 085 b) $45, 506 c) $41, 088 d) $38, 350 The NPW for Mach Y, using the analysis period; is close to: a.) $75, 286 b) $70, 513 c) $74, 255 d) $71, 919 Recommend which machine to purchase: (a) Mach X b) Mach Y c) Both d) None

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts