Question: Please help to answer the above question. If you dont understand part of it, leave a message i will send a new photo. Thanks. Finance

Please help to answer the above question. If you dont understand part of it, leave a message i will send a new photo. Thanks.

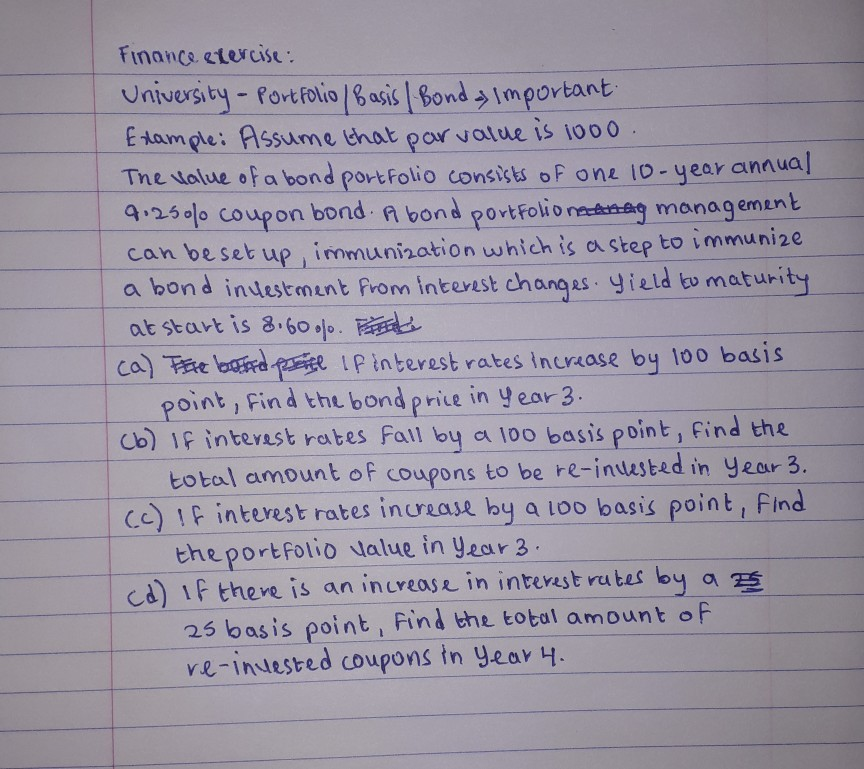

Finance exercise: University - Portfolio / Basis / Bond Important Example: Assume that par value is 1000 The value of a bond portfolio consists of one 10-year annual 9.250/ coupon bond. Abond portfolionanag management can be set up, immunization which is a step to immunize a bond investment from interest changes. Yield to maturity, at start is 8.600p. Pri ca) Efe bond price if interest rates increase by 100 basis point, find the bondprice in Year 3. (b) If interest rates fall by a 100 basis point, find the total amount of coupons to be re-invested in year 3. (c) If interest rates increase by a 100 basis point, find the portfolio value in Year 3. (d) If there is an increase in interest rates by a zs 25 basis point, find the total amount of re-invested coupons in year 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts