Question: please help to answer the Average collection period correctly and time interest ratio. The company is Apollo, kindly refer to Bursa and search Apollo company.

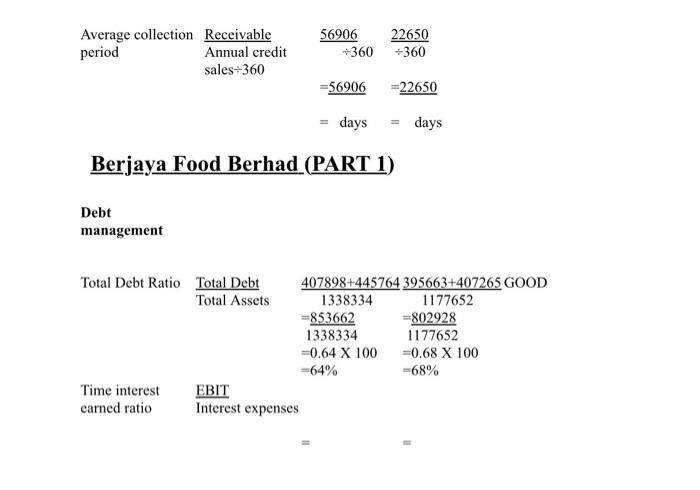

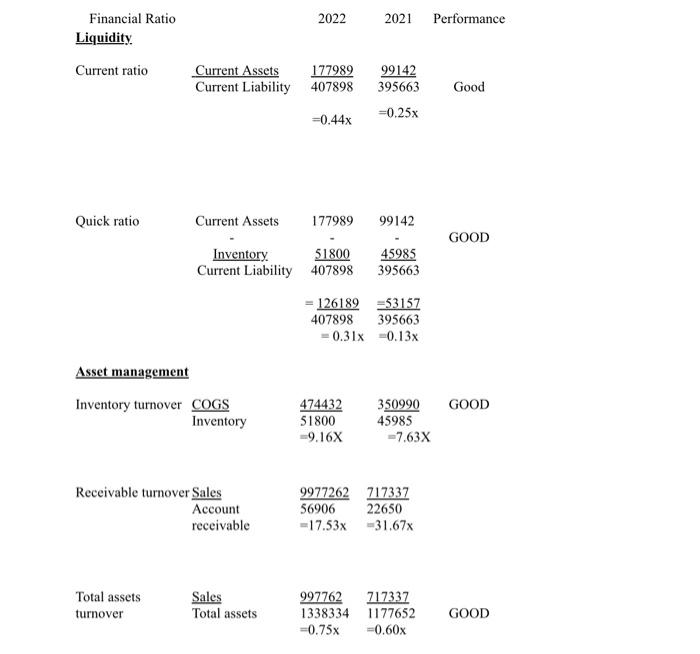

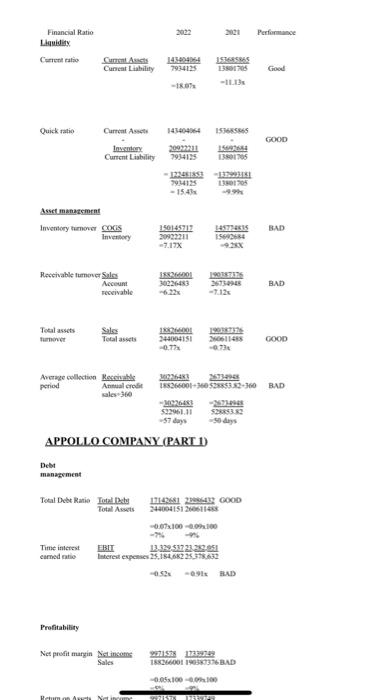

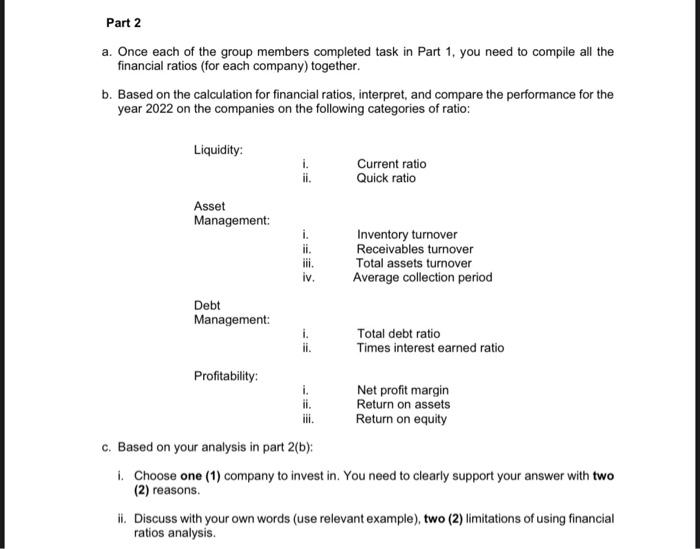

Berjaya Food Berhad (PART 1) Debt management Financial Ratio 20222021 Performance Liquidity. Current ratio CurrentAssetsCurrentLiability407898177989=0.44x39566399142=0.25x Quick ratio Asset management Asset manatemrnt APPOULO COMIPANY (PART 1) Delt manaterment 0.52s =evis Bad Proftability a. Once each of the group members completed task in Part 1, you need to compile all the financial ratios (for each company) together. b. Based on the calculation for financial ratios, interpret, and compare the performance for the year 2022 on the companies on the following categories of ratio: c. Based on your analysis in part 2(b): i. Choose one (1) company to invest in. You need to clearly support your answer with two (2) reasons. ii. Discuss with your own words (use relevant example), two (2) limitations of using financial ratios analysis. Berjaya Food Berhad (PART 1) Debt management Financial Ratio 20222021 Performance Liquidity. Current ratio CurrentAssetsCurrentLiability407898177989=0.44x39566399142=0.25x Quick ratio Asset management Asset manatemrnt APPOULO COMIPANY (PART 1) Delt manaterment 0.52s =evis Bad Proftability a. Once each of the group members completed task in Part 1, you need to compile all the financial ratios (for each company) together. b. Based on the calculation for financial ratios, interpret, and compare the performance for the year 2022 on the companies on the following categories of ratio: c. Based on your analysis in part 2(b): i. Choose one (1) company to invest in. You need to clearly support your answer with two (2) reasons. ii. Discuss with your own words (use relevant example), two (2) limitations of using financial ratios analysis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts