Question: Please help to answer the feedback, I'd already answered some but theres still some errors. Feedback can be found under Transactions General Journal Date Particulars

Please help to answer the feedback, I'd already answered some but theres still some errors. Feedback can be found under "Transactions"

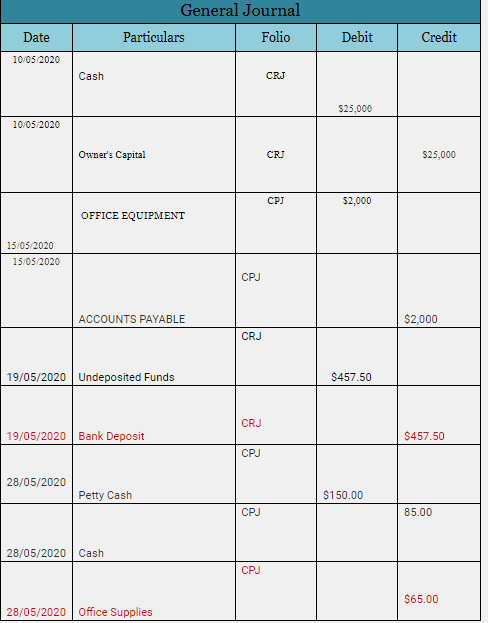

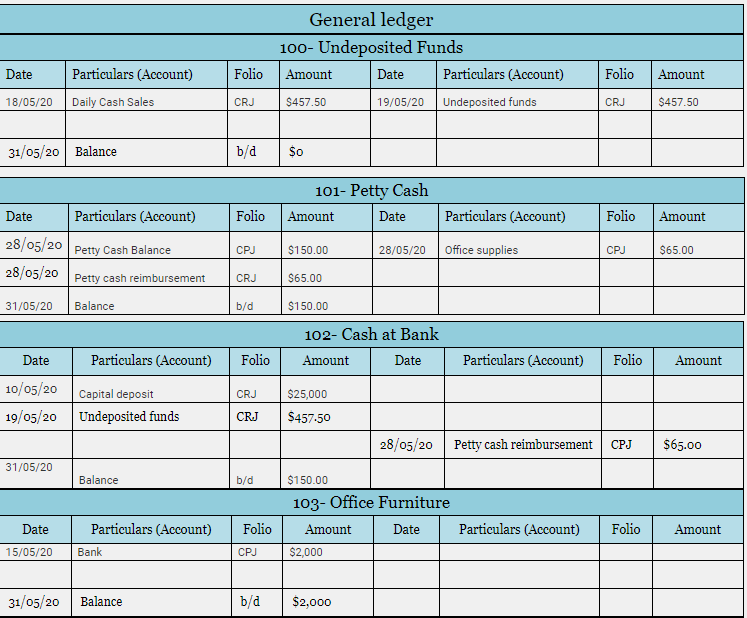

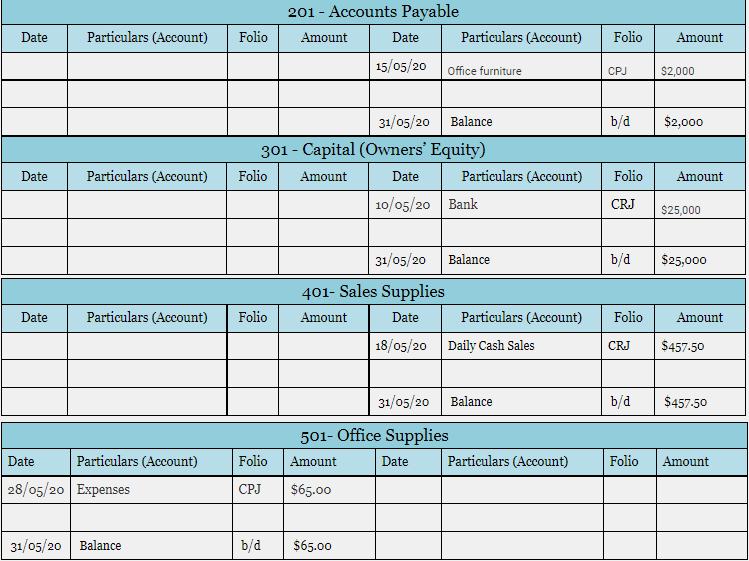

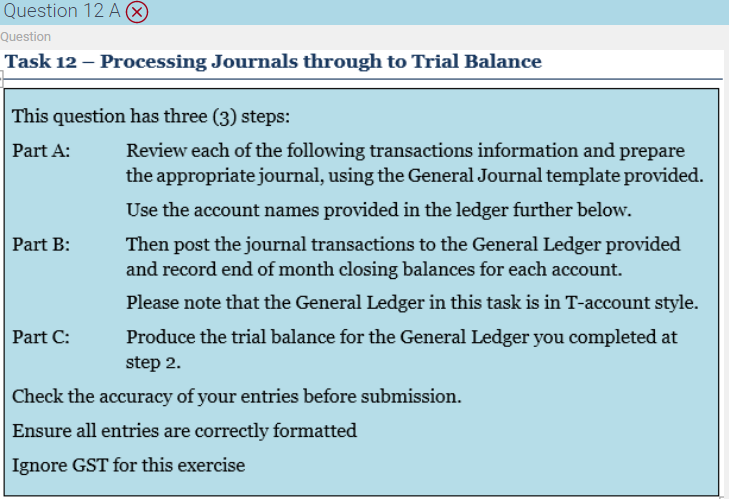

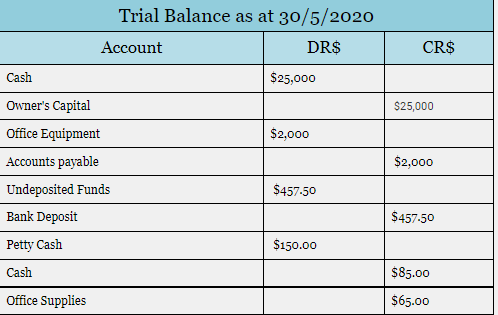

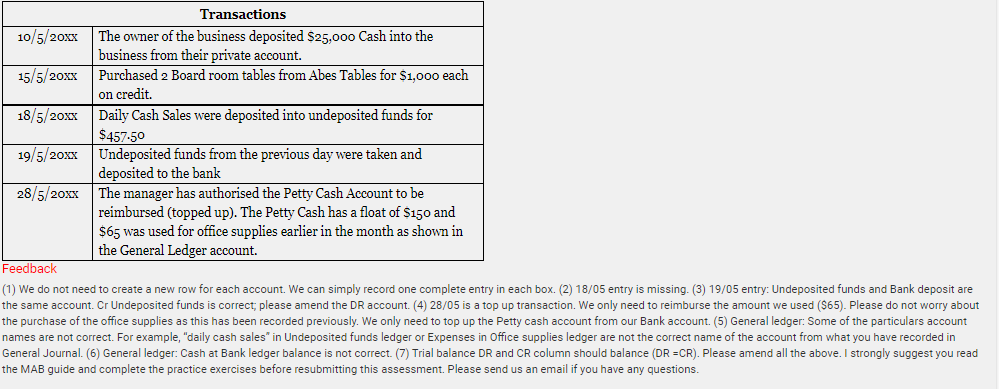

General Journal Date Particulars Folio Debit Credit 10/05/2020 Cash CRJ $25,000 10/05/2020 Owner's Capital CRJ 525,000 CPJ $2,000 OFFICE EQUIPMENT 15/05/2020 15/05/2020 CPJ ACCOUNTS PAYABLE $2,000 CRJ 19/05/2020 Undeposited Funds $457.50 CRJ 19/05/2020 Bank Deposit $457.50 CPJ 28/05/2020 Petty Cash $150.00 CPJ 85.00 28/05/2020 Cash CPJ $65.00 28/05/2020 Office SuppliesGeneral ledger 100- Undeposited Funds Date Particulars (Account) Folio Amount Date Particulars (Account) Folio Amount 18/05/20 Daily Cash Sales CRJ $457.50 19/05/20 Undeposited funds CRJ $457.50 31/05/20 Balance b/d So 101- Petty Cash Date Particulars (Account) Folio Amount Date Particulars (Account) Folio Amount 28/05/20 Petty Cash Balance CPJ $150.00 28/05/20 Office supplies CPJ $65.00 28/05/20 Petty cash reimbursement CRJ $65.00 31/05/20 Balance b/d $150.00 102- Cash at Bank Date Particulars (Account) Folio Amount Date Particulars (Account) Folio Amount 10/05/20 Capital deposit CRJ $25,000 19/05/20 Undeposited funds CRJ $457.50 28/05/20 Petty cash reimbursement CPJ $65.00 31/05/20 Balance b/d $150.00 103- Office Furniture Date Particulars (Account) Folio Amount Date Particulars (Account) Folio Amount 15/05/20 Bank CPJ $2,000 31/05/20 Balance b/d $2,000201 - Accounts Payable Date Particulars (Account) Folio Amount Date Particulars (Account) Folio Amount 15/05/20 Office furniture CPJ $2,000 31/05/20 Balance b/d $2,000 301 - Capital (Owners' Equity) Date Particulars (Account) Folio Amount Date Particulars (Account) Folio Amount 10/05/20 Bank CRJ $25,000 31/05/20 Balance b/d $25,000 401- Sales Supplies Date Particulars (Account) Folio Amount Date Particulars (Account) Folio Amount 18/05/20 Daily Cash Sales CRJ $457.50 31/05/20 Balance b/d $457.50 501- Office Supplies Date Particulars (Account) Folio Amount Date Particulars (Account) Folio Amount 28/05/20 Expenses CPJ $65.00 31/05/20 Balance b/d $65.00Question 12 A x) Question Task 12 - Processing Journals through to Trial Balance This question has three (3) steps: Part A: Review each of the following transactions information and prepare the appropriate journal, using the General Journal template provided. Use the account names provided in the ledger further below. Part B: Then post the journal transactions to the General Ledger provided and record end of month closing balances for each account. Please note that the General Ledger in this task is in T-account style. Part C: Produce the trial balance for the General Ledger you completed at step 2. Check the accuracy of your entries before submission. Ensure all entries are correctly formatted Ignore GST for this exerciseTrial Balance as at 30/5/2020 Account DR$ CR$ Cash $25,000 Owner's Capital $25,000 Office Equipment $2,000 Accounts payable $2,000 Undeposited Funds $457.50 Bank Deposit $457.50 Petty Cash $150.00 Cash $85.00 Office Supplies $65.00Transactions 10/5/20XX The owner of the business deposited $25,000 Cash into the business from their private account. 15/5/20XX Purchased 2 Board room tables from Abes Tables for $1,000 each on credit. 18/5/20XX Daily Cash Sales were deposited into undeposited funds for $457-50 19/5/ 20XX Undeposited funds from the previous day were taken and deposited to the bank 28/5/ 20XX The manager has authorised the Petty Cash Account to be reimbursed (topped up). The Petty Cash has a float of $150 and $65 was used for office supplies earlier in the month as shown in the General Ledger account. Feedback (1) We do not need to create a new row for each account. We can simply record one complete entry in each box. (2) 18/05 entry is missing. (3) 19/05 entry: Undeposited funds and Bank deposit are the same account. Or Undeposited funds is correct; please amend the DR account. (4) 28/05 is a top up transaction. We only need to reimburse the amount we used ($65). Please do not worry about the purchase of the office supplies as this has been recorded previously. We only need to top up the Petty cash account from our Bank account. (5) General ledger: Some of the particulars account names are not correct. For example, "daily cash sales" in Undeposited funds ledger or Expenses in Office supplies ledger are not the correct name of the account from what you have recorded in General Journal. (6) General ledger: Cash at Bank ledger balance is not correct. (7) Trial balance DR and CR column should balance (DR =CR). Please amend all the above. I strongly suggest you read the MAB guide and complete the practice exercises before resubmitting this assessment. Please send us an email if you have any questions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts