Question: please help to answer the question and calculation. Being a careful investor, Ms. Sally always examines a company thoroughly before purchasing shares of its stock

please help to answer the question and calculation.

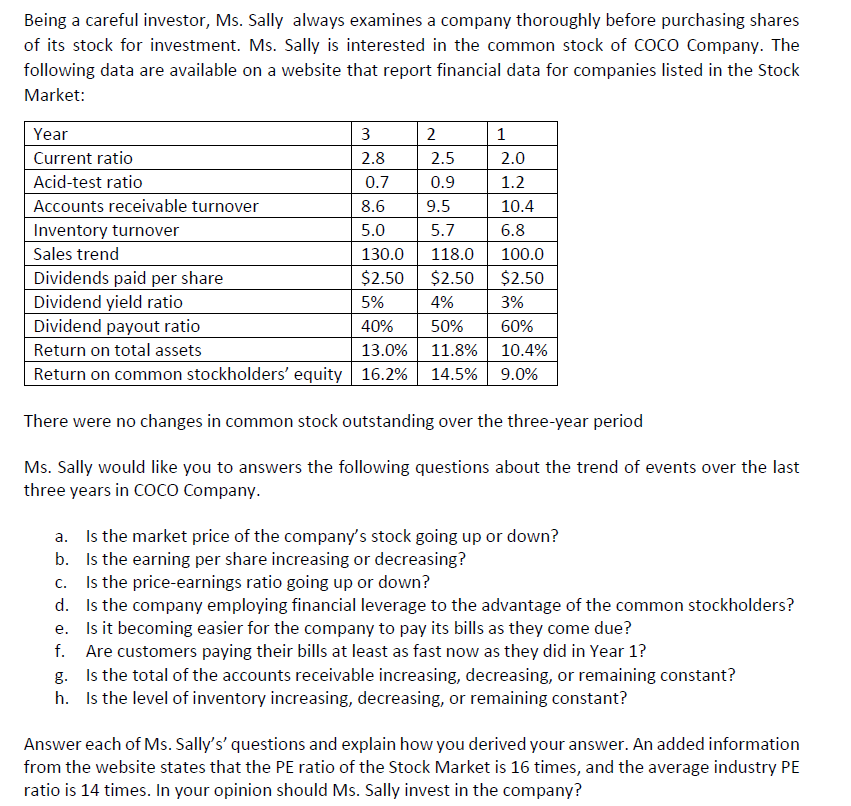

Being a careful investor, Ms. Sally always examines a company thoroughly before purchasing shares of its stock for investment. Ms. Sally is interested in the common stock of COCO Company. The following data are available on a website that report financial data for companies listed in the Stock Market: Year Current ratio Acid-test ratio Accounts receivable turnover Inventory turnover Sales trend Dividends paid per share Dividend yield ratio Dividend payout ratio Return on total assets Return on common stockholders' equity 3 2 1 2.8 2.5 2.0 0.7 0.9 1.2 8.6 9.5 10.4 5.0 5.7 6.8 130.0 118.0 100.0 $2.50 $2.50 $2.50 5% 4% 3% 40% 50% 60% 13.0% 11.8% 10.4% 16.2% 14.5% 9.0% There were no changes in common stock outstanding over the three-year period Ms. Sally would like you to answers the following questions about the trend of events over the last three years in COCO Company. a. Is the market price of the company's stock going up or down? b. Is the earning per share increasing or decreasing? c. Is the price-earnings ratio going up or down? d. Is the company employing financial leverage to the advantage of the common stockholders? e. Is it becoming easier for the company to pay its bills as they come due? f. Are customers paying their bills at least as fast now as they did in Year 1? g. Is the total of the accounts receivable increasing, decreasing, or remaining constant? h. Is the level of inventory increasing, decreasing, or remaining constant? Answer each of Ms. Sally's' questions and explain how you derived your answer. An added information from the website states that the PE ratio of the Stock Market is 16 times, and the average industry PE ratio is 14 times. In your opinion should Ms. Sally invest in the company? Being a careful investor, Ms. Sally always examines a company thoroughly before purchasing shares of its stock for investment. Ms. Sally is interested in the common stock of COCO Company. The following data are available on a website that report financial data for companies listed in the Stock Market: Year Current ratio Acid-test ratio Accounts receivable turnover Inventory turnover Sales trend Dividends paid per share Dividend yield ratio Dividend payout ratio Return on total assets Return on common stockholders' equity 3 2 1 2.8 2.5 2.0 0.7 0.9 1.2 8.6 9.5 10.4 5.0 5.7 6.8 130.0 118.0 100.0 $2.50 $2.50 $2.50 5% 4% 3% 40% 50% 60% 13.0% 11.8% 10.4% 16.2% 14.5% 9.0% There were no changes in common stock outstanding over the three-year period Ms. Sally would like you to answers the following questions about the trend of events over the last three years in COCO Company. a. Is the market price of the company's stock going up or down? b. Is the earning per share increasing or decreasing? c. Is the price-earnings ratio going up or down? d. Is the company employing financial leverage to the advantage of the common stockholders? e. Is it becoming easier for the company to pay its bills as they come due? f. Are customers paying their bills at least as fast now as they did in Year 1? g. Is the total of the accounts receivable increasing, decreasing, or remaining constant? h. Is the level of inventory increasing, decreasing, or remaining constant? Answer each of Ms. Sally's' questions and explain how you derived your answer. An added information from the website states that the PE ratio of the Stock Market is 16 times, and the average industry PE ratio is 14 times. In your opinion should Ms. Sally invest in the company

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts