Question: Please help to check whether my answer is correct and answer the questions. Thank you!!! 1/1/x1, ABC Inc. sold the Inventory of $300,000 to a

Please help to check whether my answer is correct and answer the questions. Thank you!!!

Please help to check whether my answer is correct and answer the questions. Thank you!!!

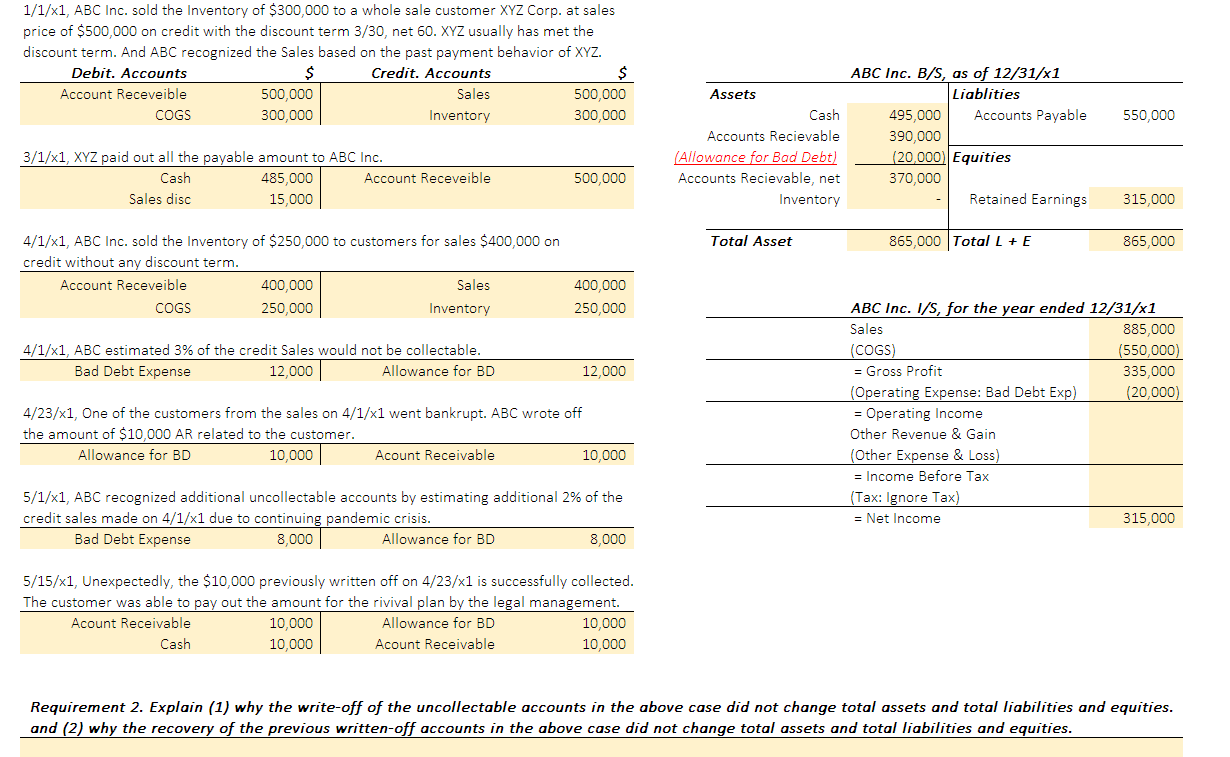

1/1/x1, ABC Inc. sold the Inventory of $300,000 to a whole sale customer XYZ Corp. at sales price of $500,000 on credit with the discount term 3/30, net 60. XYZ usually has met the discount term. And ABC recognized the Sales based on the past payment behavior of XYZ. Debit. Accounts $ Credit. Accounts $ Account Receveible 500,000 Sales 500 000 COGS 300,000 Inventory 300,000 550,000 Assets Cash Accounts Recievable Allowance for Bad Debt) Accounts Recievable, net Inventory ABC Inc. B/S, as of 12/31/x1 Liablities 495,000 Accounts Payable 390,000 (20.000 Equities 370,000 Retained Earnings 3/1/X1, XYZ paid out all the payable amount to ABC Inc. Cash 485,000 Account Receveible Sales disc 15,000 500,000 315,000 Total Asset 865,000 Total L + E 865,000 4/1/x1, ABC Inc. sold the Inventory of $250,000 to customers for sales $400,000 on credit without any discount term. Account Receveible 400,000 Sales COGS 250,000 Inventory 400,000 250,000 4/1/x1, ABC estimated 3% of the credit Sales would not be collectable. Bad Debt Expense 12,000 Allowance for BD 12,000 4/23/x1, One of the customers from the sales on 4/1/x1 went bankrupt. ABC wrote off the amount of $10,000 AR related to the customer. Allowance for BD 10,000 Acount Receivable 10,000 ABC Inc. I/S, for the year ended 12/31/x1 Sales 885,000 (COGS) (550,000) = Gross Profit 335,000 (Operating Expense: Bad Debt Exp) (20,000) = Operating Income Other Revenue & Gain (Other Expense & Loss) = Income Before Tax (Tax: Ignore Tax) = Net Income 315,000 5/1/x1, ABC recognized additional uncollectable accounts by estimating additional 2% of the credit sales made on 4/1/x1 due to continuing pandemic crisis. Bad Debt Expense 8,000 Allowance for BD 8,000 5/15/x1, Unexpectedly, the $10,000 previously written off on 4/23/x1 is successfully collected. The customer was able to pay out the amount for the rivival plan by the legal management. Acount Receivable 10,000 Allowance for BD 10,000 10,000 Acount Receivable 10,000 Cash Requirement 2. Explain (1) why the write-off of the uncollectable accounts in the above case did not change total assets and total liabilities and equities. and (2) why the recovery of the previous written-off accounts in the above case did not change total assets and total liabilities and equities. 1/1/x1, ABC Inc. sold the Inventory of $300,000 to a whole sale customer XYZ Corp. at sales price of $500,000 on credit with the discount term 3/30, net 60. XYZ usually has met the discount term. And ABC recognized the Sales based on the past payment behavior of XYZ. Debit. Accounts $ Credit. Accounts $ Account Receveible 500,000 Sales 500 000 COGS 300,000 Inventory 300,000 550,000 Assets Cash Accounts Recievable Allowance for Bad Debt) Accounts Recievable, net Inventory ABC Inc. B/S, as of 12/31/x1 Liablities 495,000 Accounts Payable 390,000 (20.000 Equities 370,000 Retained Earnings 3/1/X1, XYZ paid out all the payable amount to ABC Inc. Cash 485,000 Account Receveible Sales disc 15,000 500,000 315,000 Total Asset 865,000 Total L + E 865,000 4/1/x1, ABC Inc. sold the Inventory of $250,000 to customers for sales $400,000 on credit without any discount term. Account Receveible 400,000 Sales COGS 250,000 Inventory 400,000 250,000 4/1/x1, ABC estimated 3% of the credit Sales would not be collectable. Bad Debt Expense 12,000 Allowance for BD 12,000 4/23/x1, One of the customers from the sales on 4/1/x1 went bankrupt. ABC wrote off the amount of $10,000 AR related to the customer. Allowance for BD 10,000 Acount Receivable 10,000 ABC Inc. I/S, for the year ended 12/31/x1 Sales 885,000 (COGS) (550,000) = Gross Profit 335,000 (Operating Expense: Bad Debt Exp) (20,000) = Operating Income Other Revenue & Gain (Other Expense & Loss) = Income Before Tax (Tax: Ignore Tax) = Net Income 315,000 5/1/x1, ABC recognized additional uncollectable accounts by estimating additional 2% of the credit sales made on 4/1/x1 due to continuing pandemic crisis. Bad Debt Expense 8,000 Allowance for BD 8,000 5/15/x1, Unexpectedly, the $10,000 previously written off on 4/23/x1 is successfully collected. The customer was able to pay out the amount for the rivival plan by the legal management. Acount Receivable 10,000 Allowance for BD 10,000 10,000 Acount Receivable 10,000 Cash Requirement 2. Explain (1) why the write-off of the uncollectable accounts in the above case did not change total assets and total liabilities and equities. and (2) why the recovery of the previous written-off accounts in the above case did not change total assets and total liabilities and equities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts