Question: please help to do it Block Show Me How Providing for Doubtful Accounts At the end of the current year, the accounts receivable account has

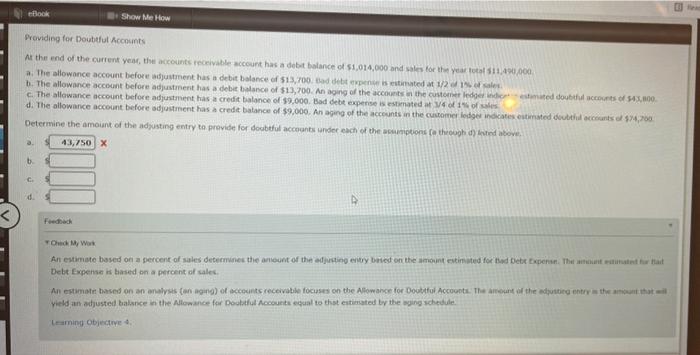

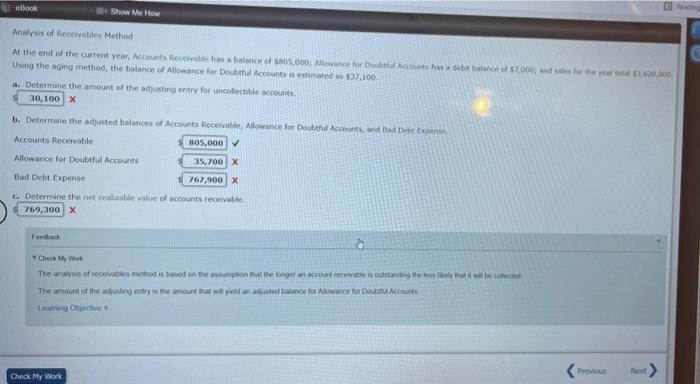

Block Show Me How Providing for Doubtful Accounts At the end of the current year, the accounts receivable account has a debt balance of $1,014,000 and sales for the year to 11.400.000 a. The allowance account before adjustment has a debit balance of $13.700 de pe strated at 1/2 Io saler b. The allowance account before adjustment has a debit balance of $13,700. An aging of the accounts in the customer ledger stated doubtful counts of 543,000 The allowance account before adjustment has a credit balance of $9,000. Bad debt expense is estimated 14 of 1 of sales d. The allowance account before adjustment has a credit balance of $9,000. An aging of the accounts on the customer lodges indicates estimated doubtl accounts of $4,700 Determine the amount of the adjusting entry to provide for doubtful accounts under each of the sumptions through dy tested above. a 43,750 X b C Feedback Oh My Work An estimate based on a percent of sales determines the arount of the adjusting entry besed on the amount estimated for ad Debt Expense. The te for at Debt Expense is based on a percent of sales An estimate based on an analysis on aging) of accounts receivable focuses on the Allowance for Doubtful Accounts the amount of the disting entry is the amount that vield an adjusted balance in the Allowance for Doubtful Accounts equal to that estimated by the aging schedule. Leaming Objective eBock e Show Me How Analysis of Receivables Method At the end of the current year, Accounts Recent has a balance of SRO,000, wce for both the balance 57,000, and was for the year 120.000 Using the aging method, the balance of Allowance for Doubtful Account estimated $37.100 a. Determine the amount of the adjusting entry for uncollectible accounts 30,100 x 6. Determine the adjusted balances of Accounts Receivable. Allowance for Doubtful Accounts, and Bad Debt Accounts Receivable 305,000 Allowance for Doubtful Accounts 35,700 X Bad Debt Expense 767,900 X Determine the net reakable value of accounts receivable 769,300 x Feedback Check My Wor The analysis of receives metod is based on reason that the beger an accountries outstanding the year walte coco The amount of the adjusting entry as the amount that will yield and hance for lowance to con Lig Obec Previous Net Check My Work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts