Question: please help to figure out this problem for me. Thank you A financial planner has presented a financial plan to a client and recommended some

please help to figure out this problem for me. Thank you

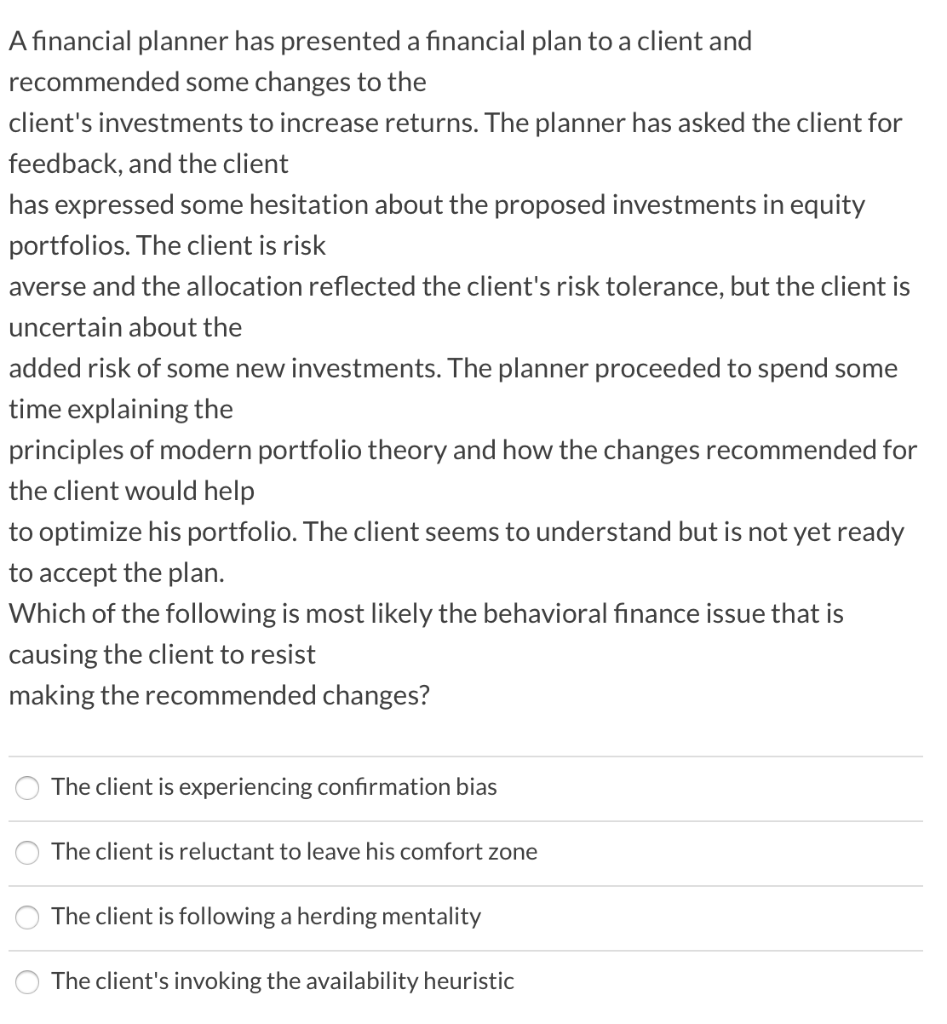

A financial planner has presented a financial plan to a client and recommended some changes to the client's investments to increase returns. The planner has asked the client for feedback, and the client has expressed some hesitation about the proposed investments in equity portfolios. The client is risk averse and the allocation reflected the client's risk tolerance, but the client is uncertain about the added risk of some new investments. The planner proceeded to spend some time explaining the principles of modern portfolio theory and how the changes recommended for the client would help to optimize his portfolio. The client seems to understand but is not yet ready to accept the plan. Which of the following is most likely the behavioral finance issue that is causing the client to resist making the recommended changes? The client is experiencing confirmation bias The client is reluctant to leave his comfort zone The client is following a herding mentality The client's invoking the availability heuristic

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts