Question: Please help to get 100% to this my assignment with out of 45points, this is for our CHAPTER 7 TOPIC CONTAINS WITH 9QUESTION. So 1

Please help to get 100% to this my assignment with out of 45points, this is for our CHAPTER 7 TOPIC CONTAINS WITH 9QUESTION. So 1 question per 1 photo out of 9photos.

This photo is arrange from Chapter 7 Question 1 to 9 Thank you so much in advance

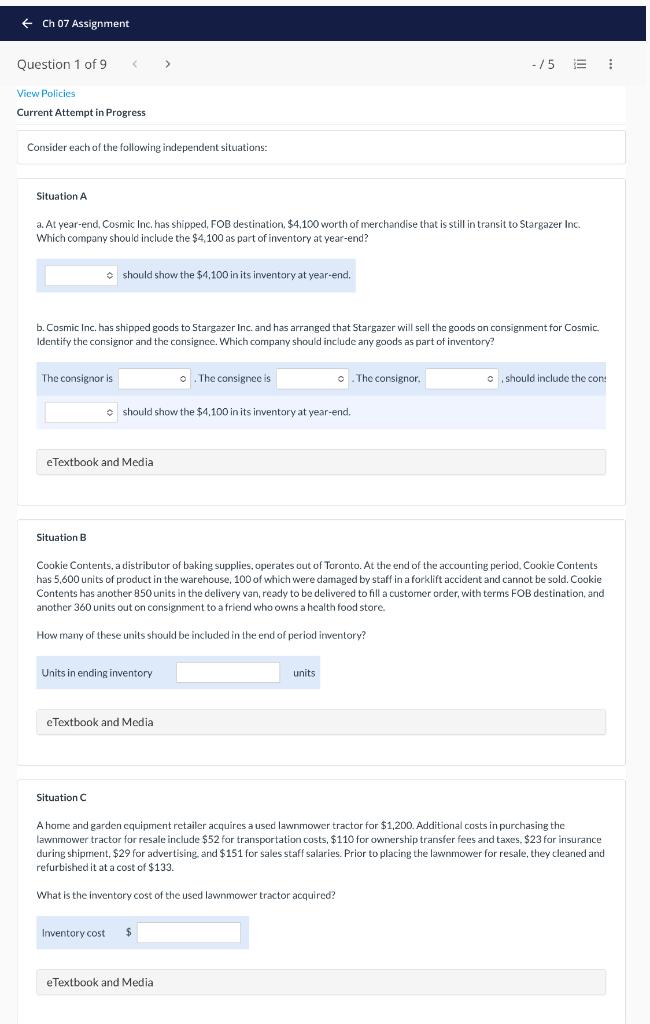

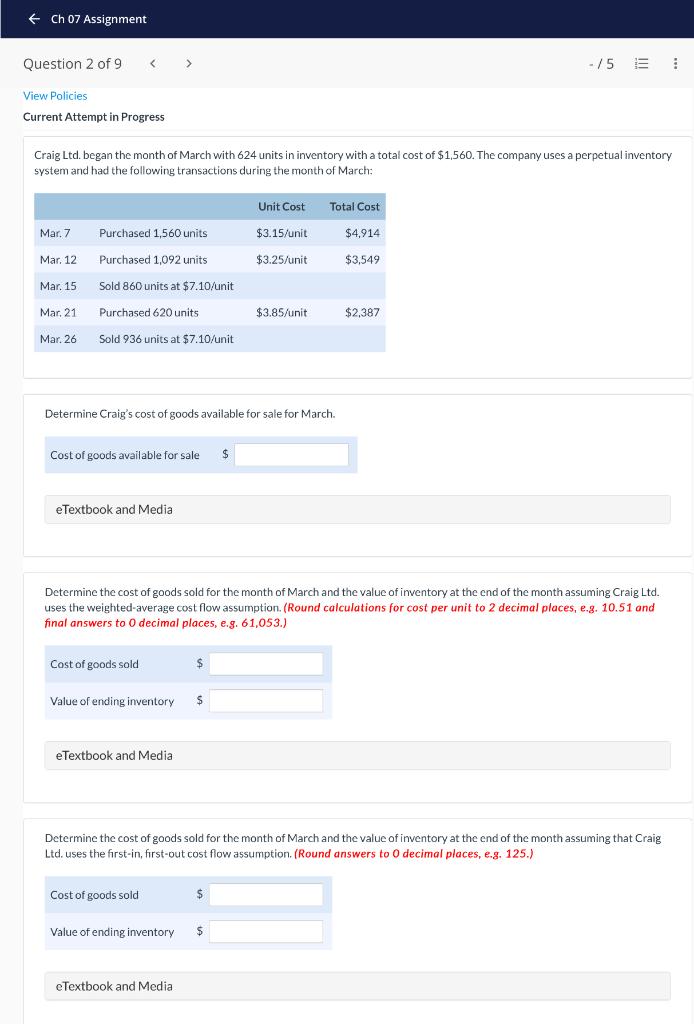

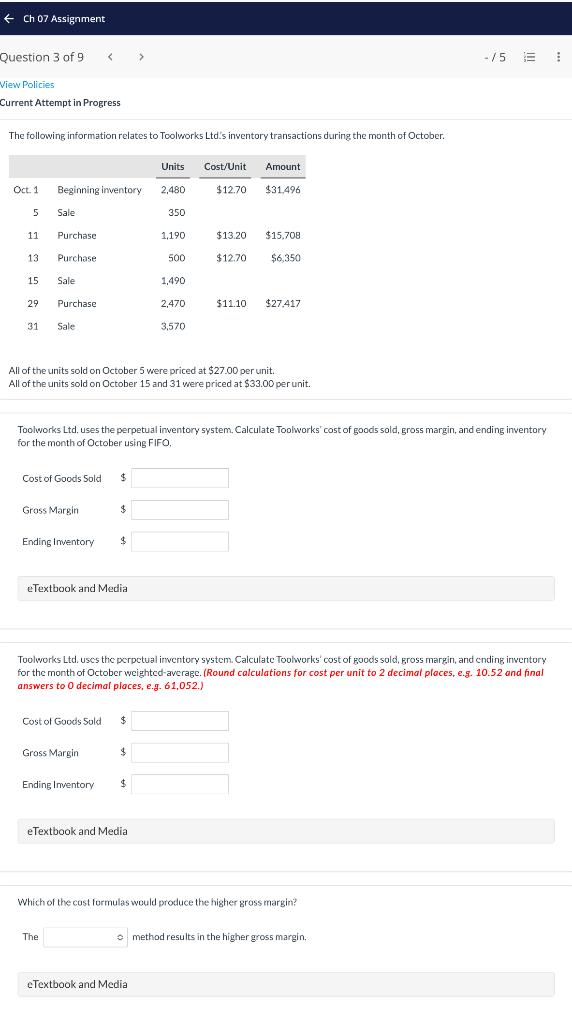

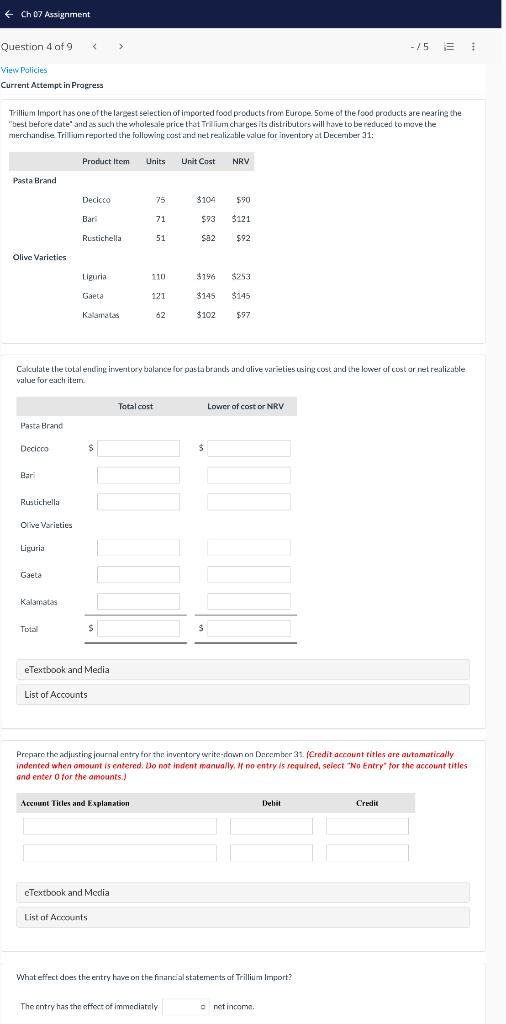

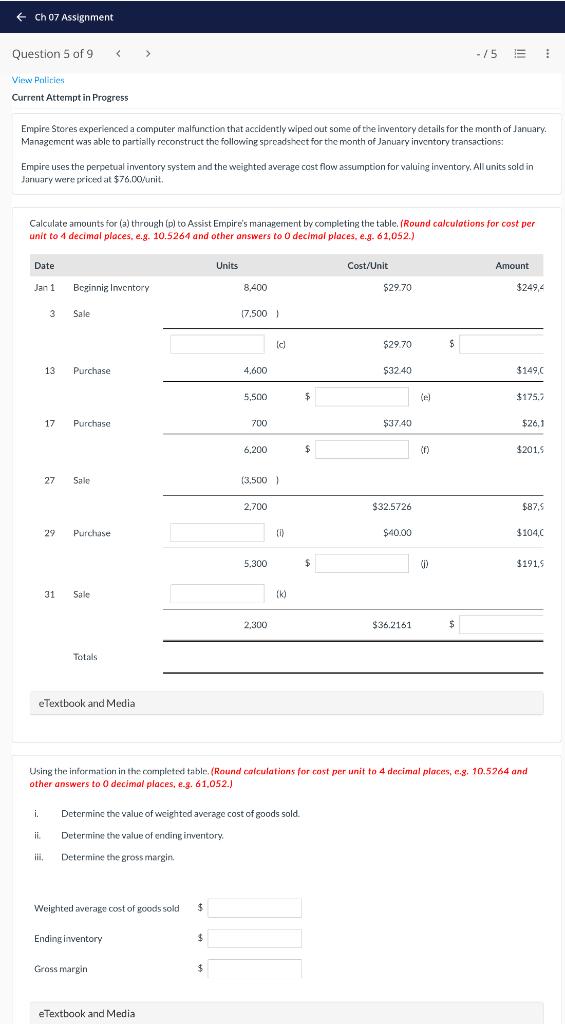

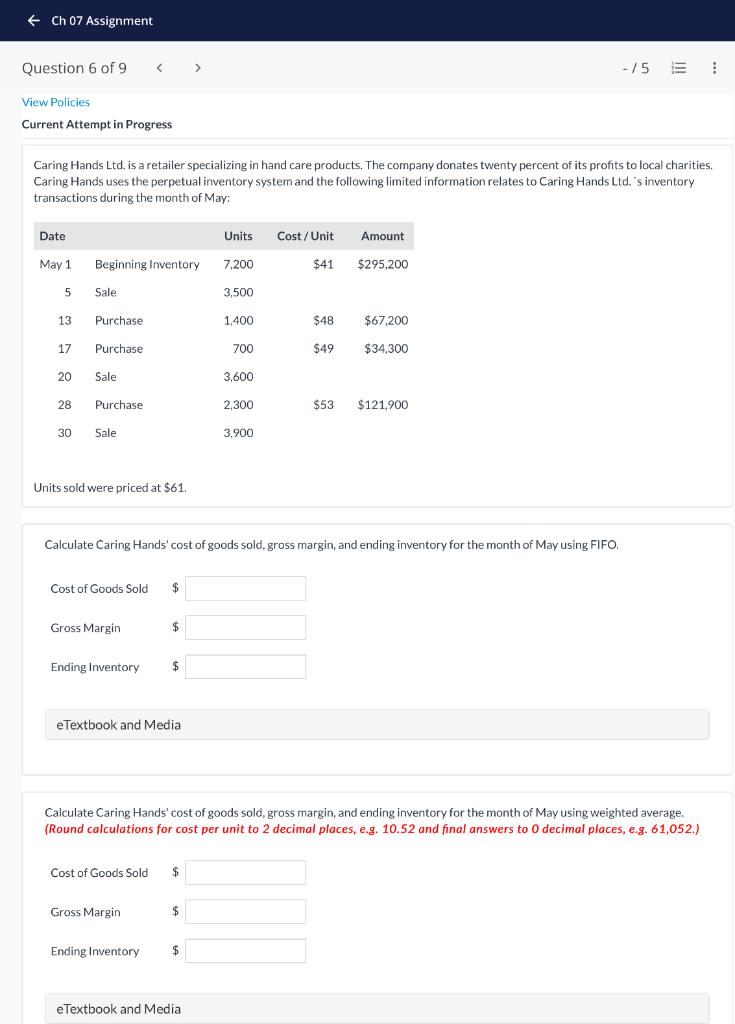

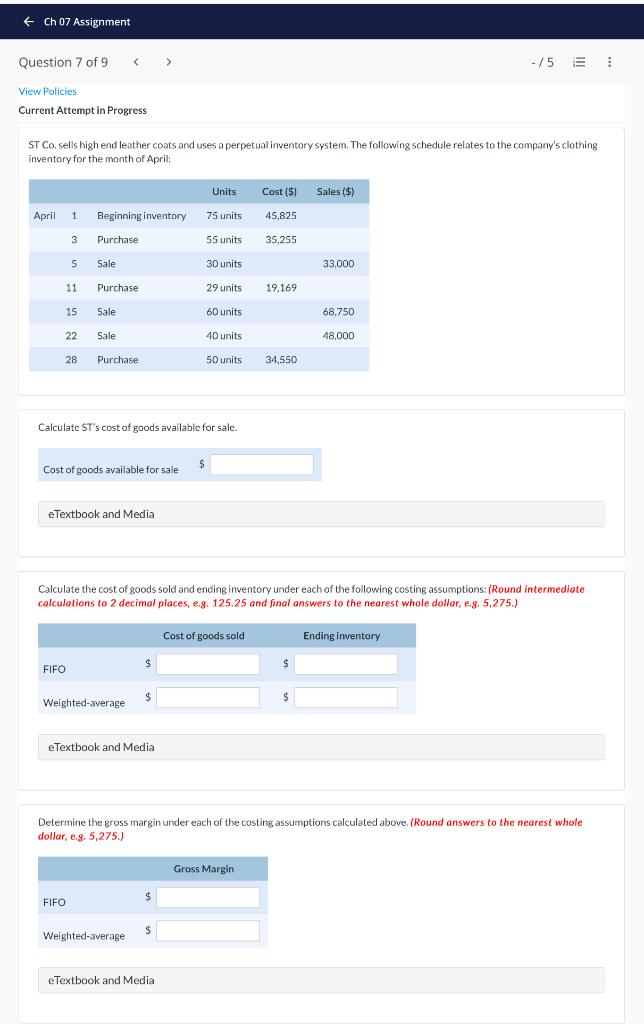

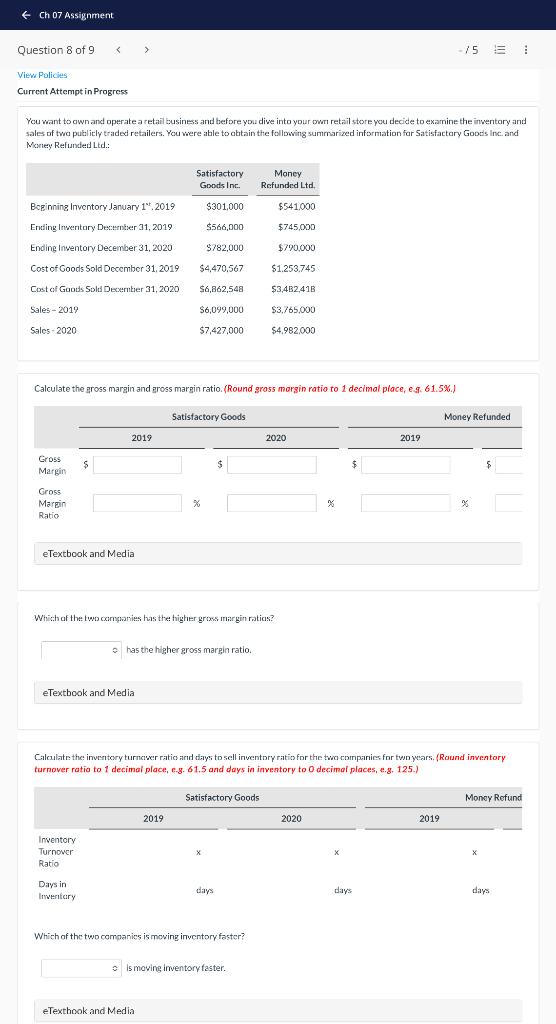

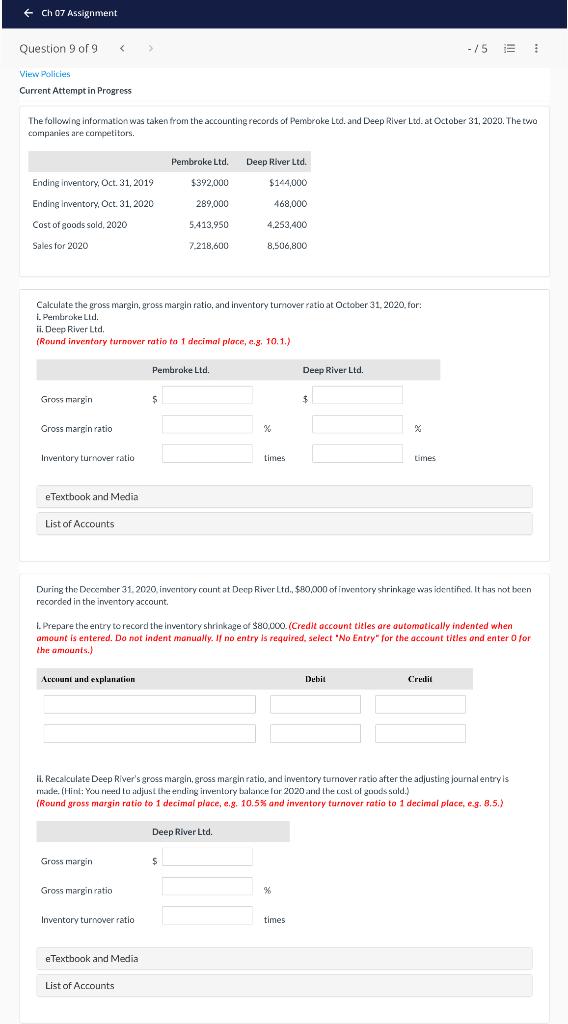

Ch 07 Assignment Question 1 of 9 -/5 View Policies Current Attempt in Progress Consider each of the following independent situations: Situation A a. At year-end, Cosmic Inc. has shipped, FOB destination, $4,100 worth of merchandise that is still in transit to Stargazer Inc. Which company should include the $4,100 as part of inventory at year-end? should show the $4,100 in its inventory at year-end. b. Cosmic Inc. has shipped goods to Stargazer Inc. and has arranged that Stargazer will sell the goods on consignment for Cosmic. Identify the consignor and the consignee. Which company should include any goods as part of inventory? The consignor is The consignee is The consignor. should include the cons should show the $4,100 in its inventory at year-end. eTextbook and Media Situation B Cookie Contents, a distributor of baking supplies, operates out of Toronto. At the end of the accounting period. Cookie Contents has 5,600 units of product in the warehouse, 100 of which were damaged by staff in a forklift accident and cannot be sold. Cookie Contents has another 850 units in the delivery van, ready to be delivered to fill a customer order, with terms FOB destination, and another 360 units out on consignment to a friend who owns a health food store. How many of these units should be included in the end of period inventory? Units in ending inventory units eTextbook and Media Situation C A home and garden equipment retailer acquires a used lawnmower tractor for $1,200. Additional costs in purchasing the lawnmower tractor for resale include $52 for transportation costs, $110 for ownership transfer fees and taxes. $23 for insurance during shipment, $29 for advertising, and $151 for sales staff salaries. Prior to placing the lawnmower for resale, they cleaned and refurbished it at a cost of $133. What is the inventory cost of the used lawnmower tractor acquired? Inventory cost $ eTextbook and Media Ch 07 Assignment Question 2 of 9 -/5 View Policies Current Attempt in Progress Craig Ltd. began the month of March with 624 units in inventory with a total cost of $1,560. The company uses a perpetual inventory system and had the following transactions during the month of March: Unit Cost Total Cost Mar. 7 Purchased 1,560 units $3.15/unit $4,914 Mar. 12 Purchased 1,092 units $3.25/unit $3,549 Mar. 15. Sold 860 units at $7.10/unit Mar. 21 Purchased 620 units $3.85/unit $2,387 Mar. 26 Sold 936 units at $7.10/unit Determine Craig's cost of goods available for sale for March. Cost of goods available for sale $ eTextbook and Media Determine the cost of goods sold for the month of March and the value of inventory at the end of the month assuming Craig Ltd. uses the weighted-average cost flow assumption. (Round calculations for cost per unit to 2 decimal places, e.g. 10.51 and final answers to 0 decimal places, e.g. 61,053.) Cost of goods sold $ Value of ending inventory eTextbook and Media Determine the cost of goods sold for the month of March and the value of inventory at the end of the month assuming that Craig Ltd. uses the first-in, first-out cost flow assumption. (Round answers to 0 decimal places, e.g. 125.) Cost of goods sold $ Value of ending inventory. $ eTextbook and Medial > Ch 07 Assignment Question 3 of 9 -/5 13 I Ch 07 Assignment Question 4 of 9 -/5 = 1 E View Policies Current Attempt in Progress Trillium Import has one of the largest selection of imported food products from Europe. Some of the food products are nearing the "best before date and as such the wholesale price that Trillium charges its distributors will have to be reduced to move the merchandise Trillium reported the following cost and net realizable value for inventory at December 31: Product Item Units Unit Cost NRV Pasta Brand Decicco 75 $104 $90 Bari 71 $93 $121 Rustichella 51 $82 $92 Olive Varieties Liguria 110 $196 $253 Gaeta 121 $145 $145 Kalamatas 62 $102 $97 Calculate the total ending inventory balance for pasta brands and alive varieties using cost and the lower of cost or net realizable value for each item Total cost Lower of cost or NRV Pasta Brand Decicco Bari Rustichella Olive Varieties Liguria Gaeta Kalamatas Total $ $ eTextbook and Medial List of Accounts Prepare the adjusting journal entry for the inventory write-down on December 31. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Credit 36 eTextbook and Medial List of Accounts What effect does the entry have on the financial statements of Trillium Import? The entry has the effect of immediately onet income. $ Ch 07 Assignment Question 5 of 9 (c) (1) (k) $ $ $ (f) (0) $ $249,4 $149,0 $175.7 $26,1 $201.5 $87,5 $104,0 $191,5 Ch 07 Assignment Question 6 of 9 -15 View Policies Current Attempt in Progress Caring Hands Ltd. is a retailer specializing in hand care products. The company donates twenty percent of its profits to local charities. Caring Hands uses the perpetual inventory system and the following limited information relates to Caring Hands Ltd. 's inventory transactions during the month of May: Date Units Cost/Unit Amount May 1 Beginning Inventory 7,200 $41 $295,200 5 Sale 3,500 13 Purchase 1,400 $48 $67,200 17 Purchase 700 $49 $34,300 20 Sale 3,600 28 Purchase 2,300 $53 $121,900 30 Sale 3,900 Units sold were priced at $61. Calculate Caring Hands' cost of goods sold, gross margin, and ending inventory for the month of May using FIFO. Cost of Goods Sold $ Gross Margin $ Ending Inventory $ eTextbook and Media Calculate Caring Hands' cost of goods sold, gross margin, and ending inventory for the month of May using weighted average. (Round calculations for cost per unit to 2 decimal places, e.g. 10.52 and final answers to 0 decimal places, e.g. 61,052.) Cost of Goods Sold $ Gross Margin $ Ending Inventory $ eTextbook and Media Ch 07 Assignment Question 7 of 9 Ch 07 Assignment Question 8 of 9 % days Ch 07 Assignment Question 9 of 9

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts