Question: please help to put this information into a 1040 as well as any additional forms needed 1 2 16 Sean W. Wagner is married to

please help to put this information into a 1040 as well as any additional forms needed

please help to put this information into a 1040 as well as any additional forms needed

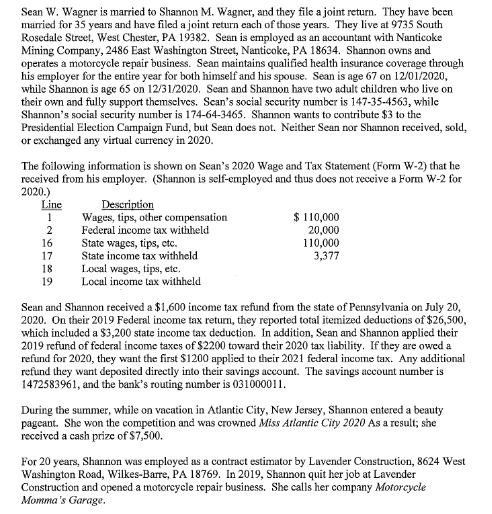

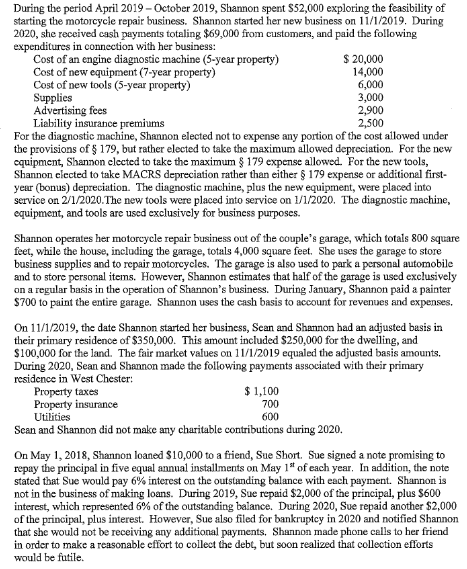

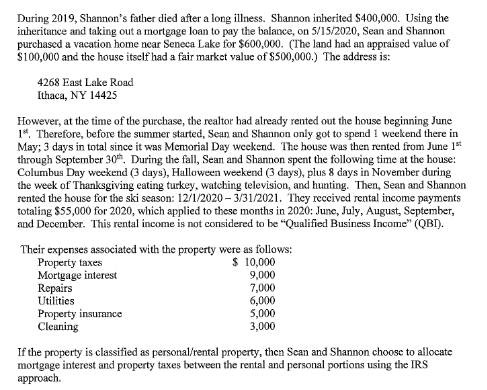

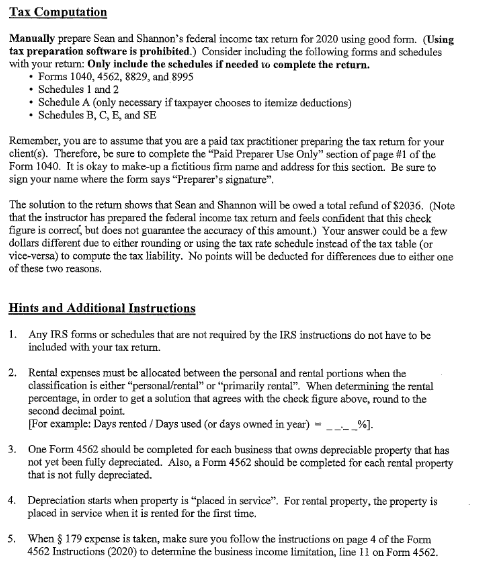

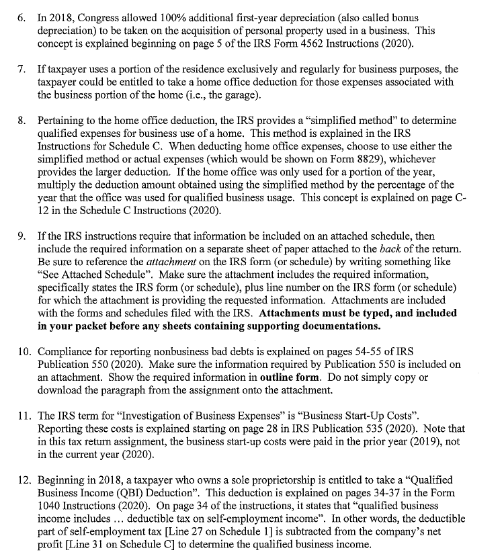

1 2 16 Sean W. Wagner is married to Shannon M. Wagner, and they file a joint return. They have been married for 35 years and have filed a joint return cach of those years. They live at 9735 South Rosedale Street, West Chester, PA 19382. Sean is employed as an accountant with Nanticoke Mining Company, 2486 East Washington Street, Nanticoke, PA 18634. Shannon owns and operates a motorcycle repair business. Sean maintains qualified health insurance coverage through his employer for the entire year for both himself and his spouse. Sean is age 67 on 12/01/2020, while Shannon is age 65 on 12/31/2020. Sean and Shannon have two adult children who live on their own and fully support themselves. Sean's social security number is 147-35-4563, while Shannon's social security number is 174-64-3465. Shannon wants to contribute $3 to the Presidential Election Campaign Fund, but Sean does not. Neither Sean nor Shannon received, sold, or exchanged any virtual currency in 2020. The following information is shown on Sean's 2020 Wage and Tax Statement (Form W-2) that he received from his employer. (Shannon is self-employed and thus does not receive a Form W-2 for 2020.) Line Description Wages, tips, other compensation $ 110,000 Federal income tax withheld 20,000 State wages, tips, etc. 110,000 17 State income tax withheld 3,377 18 Local wages, tips, etc. 19 Local income tax withheld Sean and Shannon received a $1,600 income tax refund from the state of Pennsylvania on July 20, 2020. On their 2019 Federal income tax return, they reported total itemized deductions of $26,500, which included a $3,200 state income tax deduction. In addition, Sean and Shannon applied their 2019 refund of federal income taxes of $2200 toward their 2020 tax liability. If they are owed a refund for 2020, they want the first $1200 applied to their 2021 federal income tax. Any additional refund they want deposited directly into their savings account. The savings account number is 1472583961, and the bank's routing number is 031000011. During the summer, while on vacation in Atlantic City, New Jersey, Shannon entered a beauty pageant. She won the competition and was crowned Miss Atlantic City 2020 As a result; she received a cash prize of $7,500. For 20 years, Shannon was employed as a contract estimator by Lavender Construction, 8624 West Washington Road, Wilkes-Barre, PA 18769. In 2019, Shannon quit her job at Lavender Construction and opened a motorcycle repair business. She calls her company Motorcycle Momma's Garage During the period April 2019-October 2019, Shannon spent $52,000 exploring the feasibility of starting the motorcycle repair business. Shannon started her new business on 11/1/2019. During 2020, she received cash payments totaling $69,000 from customers, and paid the following expenditures in connection with her business: Cost of an engine diagnostic machine (5-year property) $ 20,000 Cost of new equipment (7-year property) 14,000 Cost of new tools (5-year property) 6,000 Supplies 3,000 Advertising fees 2,900 Liability insurance premiums 2,500 For the diagnostic machine, Shannon elected not to expense any portion of the cost allowed under the provisions of g 179, but rather elected to take the maximum allowed depreciation. For the new equipment, Shannon elected to take the maximum $ 179 expense allowed. For the new tools, Shannon elected to take MACRS depreciation rather than either $ 179 expense or additional first- year (bonus) depreciation. The diagnostic machine, plus the new equipment, were placed into service on 2/1/2020. The new tools were placed into service on 1/1/2020. The diagnostic machine, equipment, and tools are used exclusively for business purposes. Shannon operates her motorcycle repair business out of the couple's garage, which totals 800 square feet, while the house, including the garage, totals 4,000 square feet. She uses the garage to store business supplies and to repair motorcycles. The garage is also used to park a personal automobile and to store personal items. However, Shannon estimates that half of the garage is used exclusively on a regular basis in the operation of Shannon's business. During January, Shannon paid a painter $700 to paint the entire garage. Shannon uses the cash basis to account for revenues and expenses. On 11/1/2019, the date Shannon started her business, Sean and Shannon had an adjusted basis in their primary residence of $350,000. This amount included $250,000 for the dwelling, and $100,000 for the land. The fair market values on 11/1/2019 equaled the adjusted basis amounts. During 2020, Sean and Shannon made the following payments associated with their primary residence in West Chester: Property taxes $ 1,100 Property insurance Utilities Sean and Shannon did not make any charitable contributions during 2020. On May 1, 2018, Shannon loaned $10,000 to a friend, Sue Short. Sue signed a note promising to repay the principal in five equal annual installments on May 1st of each year. In addition, the note stated that Sue would pay 6% interest on the outstanding balance with each payment. Shannon is not in the business of making loans. During 2019, Sue repaid $2,000 of the principal, plus $600 interest, which represented 5% of the outstanding balance. During 2020, Sue repaid another $2,000 of the principal, plus interest. However, Sue also filed for bankruptcy in 2020 and notified Shannon that she would not be receiving any additional payments. Shannon made phone calls to her friend in order to make a reasonable effort to collect the debt, but soon realized that collection efforts would be futile. 700 600 During 2019, Shannon's father died after a long illness. Shannon inherited $400,000. Using the inheritance and taking out a mortgage loan to pay the balance, on 5/15/2020, Sean and Shannon purchased a vacation home near Seneca Lake for $600,000. (The land had an appraised value of $100,000 and the house itself had a fair market value of $500,000.) The address is: 4268 East Lake Road Ithaca, NY 14425 However, at the time of the purchase, the realtor had already rented out the house beginning June 19. Therefore, before the summer started, Sean and Shannon only got to spend 1 weekend there in May, 3 days in total since it was Menorial Day weekend. The house was then rented from June 15 through September 30. During the fall, Sean and Shannon spent the following time at the house: Columbus Day weekend (3 days), Halloween weekend (3 days), plus 8 days in November during the week of Thanksgiving eating turkey, watching television, and hunting. Then, Sean and Shannon rented the house for the ski season: 12/1/2020 - 3/31/2021. They received rental income payments totaling $55,000 for 2020, which applied to these months in 2020: June July August, September, and December. This rental income is not considered to be "Qualified Business Income" (QBI). Their expenses associated with the property were as follows: Property taxes $ 10,000 Mortgage interest 9,000 Repairs 7,000 Utilities 6,000 Property insurance 5,000 Cleaning 3,000 If the property is classified as personal/rental property, then Scan and Shannon choose to allocate mortgage interest and property taxes between the rental and personal portions using the IRS approach. Tax Computation Manually prepare Sean and Shannon's federal income tax return for 2020 using good form. (Using tax preparation software is prohibited.) Consider including the following forms and schedules with your return: Only include the schedules if needed to complete the return. Forms 1040, 4562, 8829, and 8995 Schedules 1 and 2 Schedule A (only necessary if taxpayer chooses to itemize deductions) Schedules B, C, E, and SE Remember, you are to assume that you are a paid tax practitioner preparing the tax retum for your client(s). Therefore, be sure to complete the "Paid Preparer Use Only" section of page #1 of the Form 1040. It is okay to make-up a fictitious firm name and address for this section. Be sure to sign your name where the form says Preparer's signature". The solution to the return shows that Sean and Shannon will be owed a total refund of $2036 (Note that the instructor has prepared the federal income tax retum and feels confident that this check figure is correct, but does not guarantee the accuracy of this amount.) Your could be a few dollars different due to either rounding or using the tax rate schedule instead of the tax table (or vice-versa) to compute the tax liability. No points will be deducted for differences due to either one of these two reasons. Hints and Additional Instructions 1. Any IRS forms or schedules that are not required by the IRS instructions do not have to be included with your tax return. 2. Rental expenses must be allocated between the personal and rental portions when the classification is either personal/rental" or "primarily rental". When determining the rental percentage, in order to get a solution that agrees with the check figure above, round to the second decimal point. For example: Days rented / Days used (or days owned in year) - _%). 3. One Form 4562 should be completed for each business that owns depreciable property that has not yet been fully depreciated. Also, a Form 4562 should be completed for cach rental property that is not fully depreciated. 4. Depreciation starts when property is placed in service". For rental property, the property is placed in service when it is rented for the first time. 5. When $ 179 expense is taken, make sure you follow the instructions on page 4 of the Form 4562 Instructions (2020) to deternine the business income limitation, line 11 on Form 4562. 6. In 2018, Congress allowed 100% additional first-year depreciation (also called bonus depreciation) to be taken on the acquisition of personal property used in a business. This concept is explained beginning on page 5 of the IRS Form 4562 Instructions (2020). 7. If taxpayer uses a portion of the residence exclusively and regularly for business purposes, the taxpayer could be entitled to take a home office deduction for those expenses associated with the business portion of the home (i.c., the garage). 8. Pertaining to the home office deduction, the IRS provides a "simplified method" to determine qualified expenses for business use of a home. This method is explained in the IRS Instructions for Schedule C. When deducting home office expenses, choose to use either the simplified method or actual expenses (which would be shown on Form 8829), whichever provides the larger deduction. If the home office was only used for a portion of the year, multiply the deduction amount obtained using the simplified method by the percentage of the year that the office was used for qualified business usage. This concept is explained on page C- 12 in the Schedule C Instructions (2020). 9. If the IRS instructions require that information be included on an attached schedule, then include the required information on a separate sheet of paper attached to the back of the return. Be sure to reference the attachment on the IRS form (or schedule) by writing something like "See Attached Schedule". Make sure the attachment includes the required information, specifically states the IRS form (or schedule), plus line number on the IRS form (or schedule) for which the attachment is providing the requested information. Attachments are included with the forms and schedules filed with the IRS. Attachments must be typed, and included in your packet before any sheets containing supporting documentations. 10. Compliance for reporting nonbusiness bad debts is explained on pages 54-55 of IRS Publication 550 (2020). Make sure the information required by Publication 550 is included on an attachment. Show the required information in outline form. Do not simply copy or download the paragraph from the assignment onto the attachment. 11. The IRS term for "Investigation of Business Expenses" is Business Start-Up Costs". Reporting these costs is explained starting on page 28 in IRS Publication 535 (2020). Note that in this tax return assignment, the business start-up costs were paid in the prior year (2019), not in the current year (2020). 12. Beginning in 2018, a taxpayer who owns a sole proprictorship is entitled to take a "Qualified Business Income (QBI) Deduction. This deduction is explained on pages 34-37 in the Form 1040 Instructions (2020). On page 34 of the instructions, it states that "qualified business income includes ... deductible tax on self-employment income". In other words, the deductible part of self-employment tax [Line 27 on Schedule 1] is subtracted from the company's net profit [Line 31 on Schedule C] to determine the qualified business income. 1 2 16 Sean W. Wagner is married to Shannon M. Wagner, and they file a joint return. They have been married for 35 years and have filed a joint return cach of those years. They live at 9735 South Rosedale Street, West Chester, PA 19382. Sean is employed as an accountant with Nanticoke Mining Company, 2486 East Washington Street, Nanticoke, PA 18634. Shannon owns and operates a motorcycle repair business. Sean maintains qualified health insurance coverage through his employer for the entire year for both himself and his spouse. Sean is age 67 on 12/01/2020, while Shannon is age 65 on 12/31/2020. Sean and Shannon have two adult children who live on their own and fully support themselves. Sean's social security number is 147-35-4563, while Shannon's social security number is 174-64-3465. Shannon wants to contribute $3 to the Presidential Election Campaign Fund, but Sean does not. Neither Sean nor Shannon received, sold, or exchanged any virtual currency in 2020. The following information is shown on Sean's 2020 Wage and Tax Statement (Form W-2) that he received from his employer. (Shannon is self-employed and thus does not receive a Form W-2 for 2020.) Line Description Wages, tips, other compensation $ 110,000 Federal income tax withheld 20,000 State wages, tips, etc. 110,000 17 State income tax withheld 3,377 18 Local wages, tips, etc. 19 Local income tax withheld Sean and Shannon received a $1,600 income tax refund from the state of Pennsylvania on July 20, 2020. On their 2019 Federal income tax return, they reported total itemized deductions of $26,500, which included a $3,200 state income tax deduction. In addition, Sean and Shannon applied their 2019 refund of federal income taxes of $2200 toward their 2020 tax liability. If they are owed a refund for 2020, they want the first $1200 applied to their 2021 federal income tax. Any additional refund they want deposited directly into their savings account. The savings account number is 1472583961, and the bank's routing number is 031000011. During the summer, while on vacation in Atlantic City, New Jersey, Shannon entered a beauty pageant. She won the competition and was crowned Miss Atlantic City 2020 As a result; she received a cash prize of $7,500. For 20 years, Shannon was employed as a contract estimator by Lavender Construction, 8624 West Washington Road, Wilkes-Barre, PA 18769. In 2019, Shannon quit her job at Lavender Construction and opened a motorcycle repair business. She calls her company Motorcycle Momma's Garage During the period April 2019-October 2019, Shannon spent $52,000 exploring the feasibility of starting the motorcycle repair business. Shannon started her new business on 11/1/2019. During 2020, she received cash payments totaling $69,000 from customers, and paid the following expenditures in connection with her business: Cost of an engine diagnostic machine (5-year property) $ 20,000 Cost of new equipment (7-year property) 14,000 Cost of new tools (5-year property) 6,000 Supplies 3,000 Advertising fees 2,900 Liability insurance premiums 2,500 For the diagnostic machine, Shannon elected not to expense any portion of the cost allowed under the provisions of g 179, but rather elected to take the maximum allowed depreciation. For the new equipment, Shannon elected to take the maximum $ 179 expense allowed. For the new tools, Shannon elected to take MACRS depreciation rather than either $ 179 expense or additional first- year (bonus) depreciation. The diagnostic machine, plus the new equipment, were placed into service on 2/1/2020. The new tools were placed into service on 1/1/2020. The diagnostic machine, equipment, and tools are used exclusively for business purposes. Shannon operates her motorcycle repair business out of the couple's garage, which totals 800 square feet, while the house, including the garage, totals 4,000 square feet. She uses the garage to store business supplies and to repair motorcycles. The garage is also used to park a personal automobile and to store personal items. However, Shannon estimates that half of the garage is used exclusively on a regular basis in the operation of Shannon's business. During January, Shannon paid a painter $700 to paint the entire garage. Shannon uses the cash basis to account for revenues and expenses. On 11/1/2019, the date Shannon started her business, Sean and Shannon had an adjusted basis in their primary residence of $350,000. This amount included $250,000 for the dwelling, and $100,000 for the land. The fair market values on 11/1/2019 equaled the adjusted basis amounts. During 2020, Sean and Shannon made the following payments associated with their primary residence in West Chester: Property taxes $ 1,100 Property insurance Utilities Sean and Shannon did not make any charitable contributions during 2020. On May 1, 2018, Shannon loaned $10,000 to a friend, Sue Short. Sue signed a note promising to repay the principal in five equal annual installments on May 1st of each year. In addition, the note stated that Sue would pay 6% interest on the outstanding balance with each payment. Shannon is not in the business of making loans. During 2019, Sue repaid $2,000 of the principal, plus $600 interest, which represented 5% of the outstanding balance. During 2020, Sue repaid another $2,000 of the principal, plus interest. However, Sue also filed for bankruptcy in 2020 and notified Shannon that she would not be receiving any additional payments. Shannon made phone calls to her friend in order to make a reasonable effort to collect the debt, but soon realized that collection efforts would be futile. 700 600 During 2019, Shannon's father died after a long illness. Shannon inherited $400,000. Using the inheritance and taking out a mortgage loan to pay the balance, on 5/15/2020, Sean and Shannon purchased a vacation home near Seneca Lake for $600,000. (The land had an appraised value of $100,000 and the house itself had a fair market value of $500,000.) The address is: 4268 East Lake Road Ithaca, NY 14425 However, at the time of the purchase, the realtor had already rented out the house beginning June 19. Therefore, before the summer started, Sean and Shannon only got to spend 1 weekend there in May, 3 days in total since it was Menorial Day weekend. The house was then rented from June 15 through September 30. During the fall, Sean and Shannon spent the following time at the house: Columbus Day weekend (3 days), Halloween weekend (3 days), plus 8 days in November during the week of Thanksgiving eating turkey, watching television, and hunting. Then, Sean and Shannon rented the house for the ski season: 12/1/2020 - 3/31/2021. They received rental income payments totaling $55,000 for 2020, which applied to these months in 2020: June July August, September, and December. This rental income is not considered to be "Qualified Business Income" (QBI). Their expenses associated with the property were as follows: Property taxes $ 10,000 Mortgage interest 9,000 Repairs 7,000 Utilities 6,000 Property insurance 5,000 Cleaning 3,000 If the property is classified as personal/rental property, then Scan and Shannon choose to allocate mortgage interest and property taxes between the rental and personal portions using the IRS approach. Tax Computation Manually prepare Sean and Shannon's federal income tax return for 2020 using good form. (Using tax preparation software is prohibited.) Consider including the following forms and schedules with your return: Only include the schedules if needed to complete the return. Forms 1040, 4562, 8829, and 8995 Schedules 1 and 2 Schedule A (only necessary if taxpayer chooses to itemize deductions) Schedules B, C, E, and SE Remember, you are to assume that you are a paid tax practitioner preparing the tax retum for your client(s). Therefore, be sure to complete the "Paid Preparer Use Only" section of page #1 of the Form 1040. It is okay to make-up a fictitious firm name and address for this section. Be sure to sign your name where the form says Preparer's signature". The solution to the return shows that Sean and Shannon will be owed a total refund of $2036 (Note that the instructor has prepared the federal income tax retum and feels confident that this check figure is correct, but does not guarantee the accuracy of this amount.) Your could be a few dollars different due to either rounding or using the tax rate schedule instead of the tax table (or vice-versa) to compute the tax liability. No points will be deducted for differences due to either one of these two reasons. Hints and Additional Instructions 1. Any IRS forms or schedules that are not required by the IRS instructions do not have to be included with your tax return. 2. Rental expenses must be allocated between the personal and rental portions when the classification is either personal/rental" or "primarily rental". When determining the rental percentage, in order to get a solution that agrees with the check figure above, round to the second decimal point. For example: Days rented / Days used (or days owned in year) - _%). 3. One Form 4562 should be completed for each business that owns depreciable property that has not yet been fully depreciated. Also, a Form 4562 should be completed for cach rental property that is not fully depreciated. 4. Depreciation starts when property is placed in service". For rental property, the property is placed in service when it is rented for the first time. 5. When $ 179 expense is taken, make sure you follow the instructions on page 4 of the Form 4562 Instructions (2020) to deternine the business income limitation, line 11 on Form 4562. 6. In 2018, Congress allowed 100% additional first-year depreciation (also called bonus depreciation) to be taken on the acquisition of personal property used in a business. This concept is explained beginning on page 5 of the IRS Form 4562 Instructions (2020). 7. If taxpayer uses a portion of the residence exclusively and regularly for business purposes, the taxpayer could be entitled to take a home office deduction for those expenses associated with the business portion of the home (i.c., the garage). 8. Pertaining to the home office deduction, the IRS provides a "simplified method" to determine qualified expenses for business use of a home. This method is explained in the IRS Instructions for Schedule C. When deducting home office expenses, choose to use either the simplified method or actual expenses (which would be shown on Form 8829), whichever provides the larger deduction. If the home office was only used for a portion of the year, multiply the deduction amount obtained using the simplified method by the percentage of the year that the office was used for qualified business usage. This concept is explained on page C- 12 in the Schedule C Instructions (2020). 9. If the IRS instructions require that information be included on an attached schedule, then include the required information on a separate sheet of paper attached to the back of the return. Be sure to reference the attachment on the IRS form (or schedule) by writing something like "See Attached Schedule". Make sure the attachment includes the required information, specifically states the IRS form (or schedule), plus line number on the IRS form (or schedule) for which the attachment is providing the requested information. Attachments are included with the forms and schedules filed with the IRS. Attachments must be typed, and included in your packet before any sheets containing supporting documentations. 10. Compliance for reporting nonbusiness bad debts is explained on pages 54-55 of IRS Publication 550 (2020). Make sure the information required by Publication 550 is included on an attachment. Show the required information in outline form. Do not simply copy or download the paragraph from the assignment onto the attachment. 11. The IRS term for "Investigation of Business Expenses" is Business Start-Up Costs". Reporting these costs is explained starting on page 28 in IRS Publication 535 (2020). Note that in this tax return assignment, the business start-up costs were paid in the prior year (2019), not in the current year (2020). 12. Beginning in 2018, a taxpayer who owns a sole proprictorship is entitled to take a "Qualified Business Income (QBI) Deduction. This deduction is explained on pages 34-37 in the Form 1040 Instructions (2020). On page 34 of the instructions, it states that "qualified business income includes ... deductible tax on self-employment income". In other words, the deductible part of self-employment tax [Line 27 on Schedule 1] is subtracted from the company's net profit [Line 31 on Schedule C] to determine the qualified business income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts