Question: please help to solve letter A . I have posted this question more than 3 times, all I received wrong answers. please help to solve

please help to solve letter A . I have posted this question more than 3 times, all I received wrong answers. please help to solve with the correct answer . Thanks!

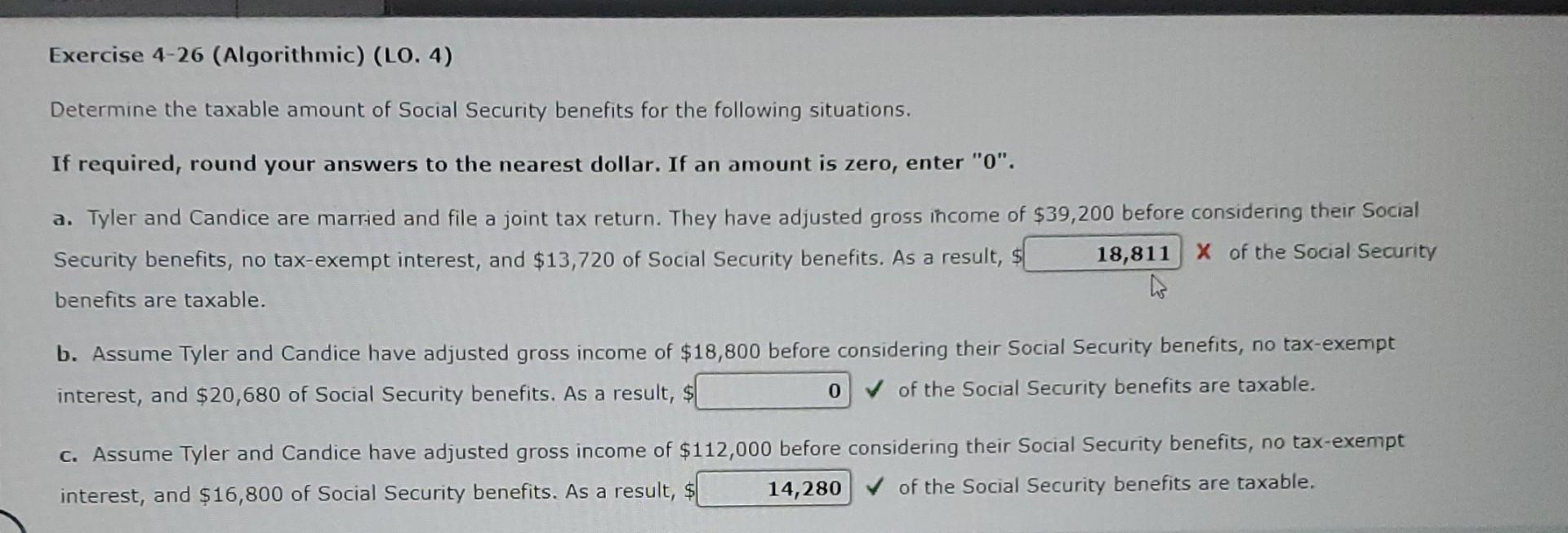

Exercise 4-26 (Algorithmic) (LO. 4) Determine the taxable amount of Social Security benefits for the following situations. If required, round your answers to the nearest dollar. If an amount is zero, enter " 0 ". a. Tyler and Candice are married and file a joint tax return. They have adjusted gross income of $39,200 before considering their Social Security benefits, no tax-exempt interest, and $13,720 of Social Security benefits. As a result, $ x of the Social Security benefits are taxable. b. Assume Tyler and Candice have adjusted gross income of $18,800 before considering their Social Security benefits, no tax-exempt interest, and $20,680 of Social Security benefits. As a result, $ of the Social Security benefits are taxable. c. Assume Tyler and Candice have adjusted gross income of $112,000 before considering their Social Security benefits, no tax-exempt interest, and $16,800 of Social Security benefits. As a result, $ of the Social Security benefits are taxable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts