Question: please help to solve question e and f. 1. Simple, long-only, bond strategies. The following exercise gets you to consider some simple, and indeed popular,

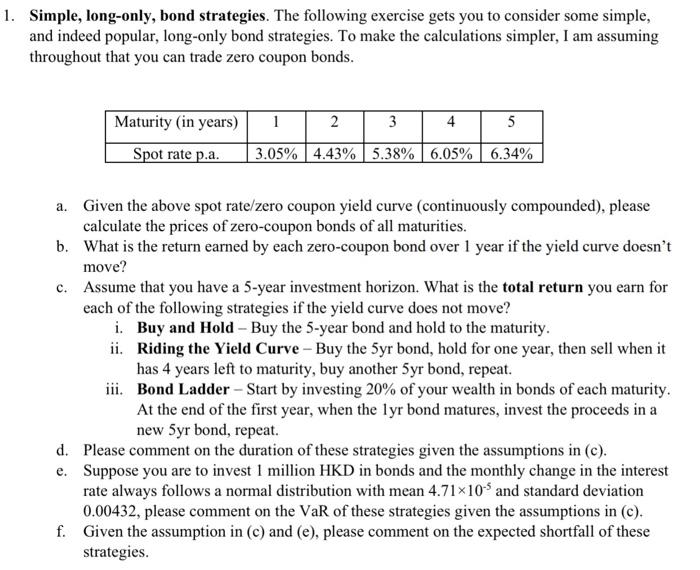

1. Simple, long-only, bond strategies. The following exercise gets you to consider some simple, and indeed popular, long-only bond strategies. To make the calculations simpler, I am assuming throughout that you can trade zero coupon bonds. 1 2 3 4 5 Maturity (in years) Spot rate p.a. 3.05% 4.43% 5.38% 6.05% 6.34% a. Given the above spot rate/zero coupon yield curve (continuously compounded), please calculate the prices of zero-coupon bonds of all maturities. b. What is the return earned by each zero-coupon bond over 1 year if the yield curve doesn't move? c. Assume that you have a 5-year investment horizon. What is the total return you earn for each of the following strategies if the yield curve does not move? i. Buy and Hold - Buy the 5-year bond and hold to the maturity. ii. Riding the Yield Curve - Buy the 5yr bond, hold for one year, then sell when it has 4 years left to maturity, buy another 5yr bond, repeat. iii. Bond Ladder - Start by investing 20% of your wealth in bonds of each maturity. At the end of the first year, when the lyr bond matures, invest the proceeds in a new 5yr bond, repeat. d. Please comment on the duration of these strategies given the assumptions in (c). e. Suppose you are to invest 1 million HKD in bonds and the monthly change in the interest rate always follows a normal distribution with mean 4.71*10% and standard deviation 0.00432, please comment on the VaR of these strategies given the assumptions in (c). f. Given the assumption in (c) and (e), please comment on the expected shortfall of these strategies. 1. Simple, long-only, bond strategies. The following exercise gets you to consider some simple, and indeed popular, long-only bond strategies. To make the calculations simpler, I am assuming throughout that you can trade zero coupon bonds. 1 2 3 4 5 Maturity (in years) Spot rate p.a. 3.05% 4.43% 5.38% 6.05% 6.34% a. Given the above spot rate/zero coupon yield curve (continuously compounded), please calculate the prices of zero-coupon bonds of all maturities. b. What is the return earned by each zero-coupon bond over 1 year if the yield curve doesn't move? c. Assume that you have a 5-year investment horizon. What is the total return you earn for each of the following strategies if the yield curve does not move? i. Buy and Hold - Buy the 5-year bond and hold to the maturity. ii. Riding the Yield Curve - Buy the 5yr bond, hold for one year, then sell when it has 4 years left to maturity, buy another 5yr bond, repeat. iii. Bond Ladder - Start by investing 20% of your wealth in bonds of each maturity. At the end of the first year, when the lyr bond matures, invest the proceeds in a new 5yr bond, repeat. d. Please comment on the duration of these strategies given the assumptions in (c). e. Suppose you are to invest 1 million HKD in bonds and the monthly change in the interest rate always follows a normal distribution with mean 4.71*10% and standard deviation 0.00432, please comment on the VaR of these strategies given the assumptions in (c). f. Given the assumption in (c) and (e), please comment on the expected shortfall of these strategies

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts