Question: Please help to solve this question, thank you. Question 1 An entrepreneur wants to raise outside financing to undertake an investment. The investment costs $80m

Please help to solve this question, thank you.

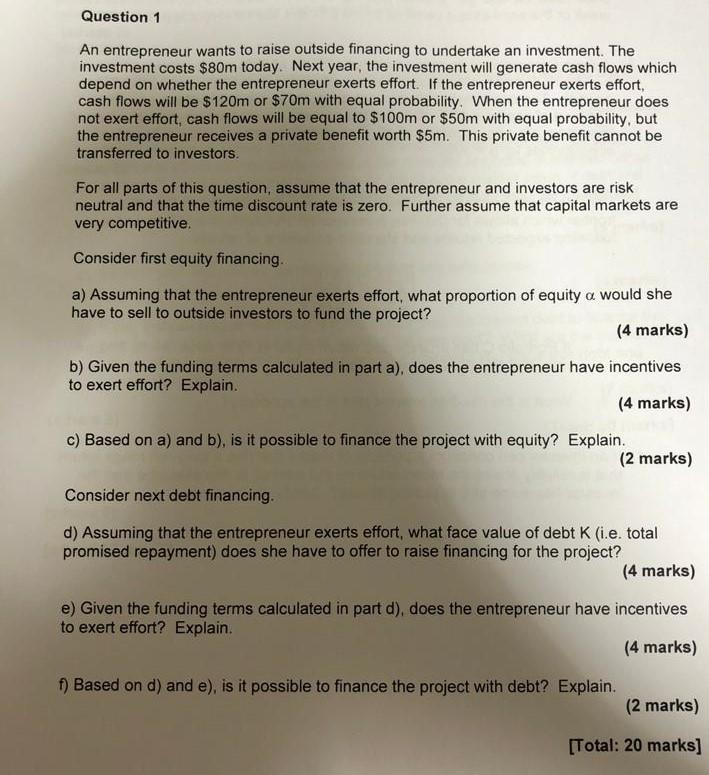

Question 1 An entrepreneur wants to raise outside financing to undertake an investment. The investment costs $80m today. Next year, the investment will generate cash flows which depend on whether the entrepreneur exerts effort. If the entrepreneur exerts effort, cash flows will be $120m or $70m with equal probability. When the entrepreneur does not exert effort, cash flows will be equal to $100m or $50m with equal probability, but the entrepreneur receives a private benefit worth $5m. This private benefit cannot be transferred to investors. For all parts of this question, assume that the entrepreneur and investors are risk neutral and that the time discount rate is zero. Further assume that capital markets are very competitive. Consider first equity financing. a) Assuming that the entrepreneur exerts effort, what proportion of equity a would she have to sell to outside investors to fund the project? (4 marks) b) Given the funding terms calculated in part a), does the entrepreneur have incentives to exert effort? Explain. (4 marks) c) Based on a) and b), is it possible to finance the project with equity? Explain. (2 marks) Consider next debt financing. d) Assuming that the entrepreneur exerts effort, what face value of debt K (i.e. total promised repayment) does she have to offer to raise financing for the project? (4 marks) e) Given the funding terms calculated in part d), does the entrepreneur have incentives to exert effort? Explain. (4 marks) f) Based on d) and e), is it possible to finance the project with debt? Explain. (2 marks) [Total: 20 marks] Question 1 An entrepreneur wants to raise outside financing to undertake an investment. The investment costs $80m today. Next year, the investment will generate cash flows which depend on whether the entrepreneur exerts effort. If the entrepreneur exerts effort, cash flows will be $120m or $70m with equal probability. When the entrepreneur does not exert effort, cash flows will be equal to $100m or $50m with equal probability, but the entrepreneur receives a private benefit worth $5m. This private benefit cannot be transferred to investors. For all parts of this question, assume that the entrepreneur and investors are risk neutral and that the time discount rate is zero. Further assume that capital markets are very competitive. Consider first equity financing. a) Assuming that the entrepreneur exerts effort, what proportion of equity a would she have to sell to outside investors to fund the project? (4 marks) b) Given the funding terms calculated in part a), does the entrepreneur have incentives to exert effort? Explain. (4 marks) c) Based on a) and b), is it possible to finance the project with equity? Explain. (2 marks) Consider next debt financing. d) Assuming that the entrepreneur exerts effort, what face value of debt K (i.e. total promised repayment) does she have to offer to raise financing for the project? (4 marks) e) Given the funding terms calculated in part d), does the entrepreneur have incentives to exert effort? Explain. (4 marks) f) Based on d) and e), is it possible to finance the project with debt? Explain. (2 marks) [Total: 20 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts