Question: PLEASE HELP Twin Pines Internet Caf (TPIC) was established and incorporated on January 1, 2020, by Marie Mundle and has just completed its third year

PLEASE HELP

Twin Pines Internet Caf (TPIC) was established and incorporated on January 1, 2020, by Marie Mundle and has just completed its third year of operations with a year-end of December 31. Marie was born in the Kingston area and after completing her university degree in Commerce, she decided to move North of Kingston to set up her own business. After months of research, Marie decided to open her business in the North Frontenac region. Her research showed that there was tremendous potential in that area, especially during the summer tourist season, for a small caf with Internet service. Local cottagers and campers without service suggested that they would find it appealing to check their email while shopping in the trendy area.

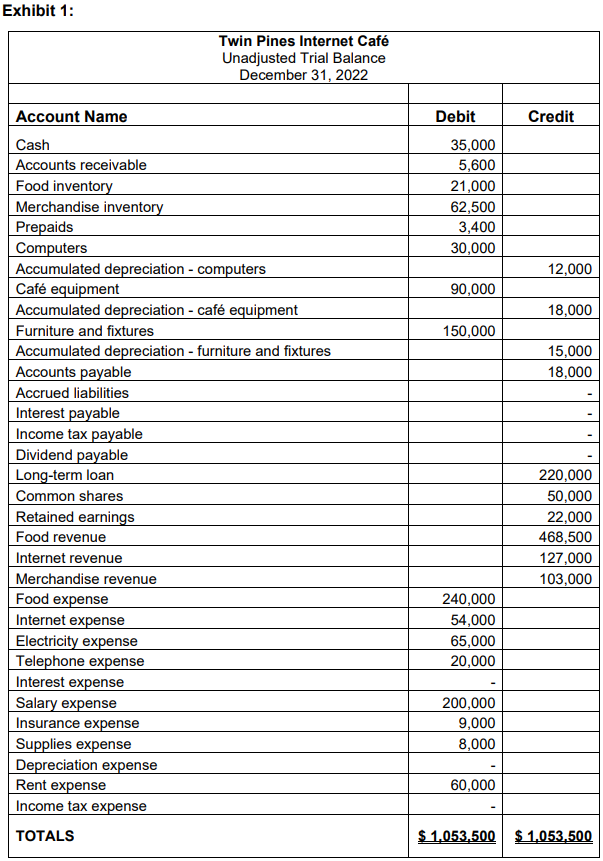

TPIC runs out of 90 square meters (1,000 square feet) of space. It has one entrance into the caf and patio doors leading out to a deck that overlooks the water. TPIC pays $5,000 per month for the rental of the space. Marie was able to negotiate with the landlord and was not required to pay the first months rent in advance. All of her rental payments are current and up to date. For the last two years, TPIC has had a very reliable accountant prepare its year-end financial statements and everything has been correct. This year, TPICs accountant retired, and Marie did the best she could with recording her financial information. For the information she was not sure about, she kept all of the required supporting documentation. Marie hired your accounting firm to prepare her financial statements for the year and you were assigned to the job. Marie supplied you with her unadjusted trial balance and the information in Exhibit I (unadjusted Trial Balance) to assist you.

Additional information:

-The amount currently sitting in prepaid expenses arose due to the December 31, 2021, adjusting entry made by her previous accountant. Marie didnt know how or what to do with it, so she left it. This years insurance policy was purchased on November 1, 2022, for $9,000. The policy runs from November 1 to October 31 of each year.

-Marie has a note that she owed $900 in wages to her employees for the period ending December 31, 2022.

-The loan was incurred when the caf was opened. The loan carries an interest rate of 8%. The interest is payable two months after year-end and the principal is due in 2025.

-TPIC will sometimes book special events with small organizations that are allowed to pay after the event has taken place. On December 29, 2022, a small company had a gathering at the caf. The company was billed $1,089 and has 30 days to pay it. Marie has not yet recorded this in her financial records.

-TPIC declared a dividend of $5,000 on December 30, 2022.

-Marie didnt know how to record depreciation for the year and so left it for you to record. There were no capital asset additions or disposals during 2022. Depreciation for all assets is charged per the depreciation methods described below (based on the notes left by her previous accountant):

Computers: 5 years straight-line method, no salvage value

Caf equipment: declining balance method @ 8%

Furniture and fixtures: 20 years straight-line method, no salvage value

-The information shows that TPIC owes $400 for a telephone bill and $300 for electricity for December. Those amounts have not been recorded yet.

-The corporate income tax rate is 25%

Based on the information you have been given:

1. Prepare the year-end adjusting journal entries (except for the adjusting entry to record income tax expense).

2. Calculate the net income then prepare the entry to record the income tax expense as part of your final submission.

3. Complete a partial worksheet using Excel. Complete the worksheet columns (with column totals):

-Trial Balance (unadjusted add totals)

-Adjusting Entries

-Adjusted Trial Balance

4. Make necessary corrections to adjusting entries and complete the adjusting entry for income tax expense.

5. Complete the worksheet, making any corrections needed to the columns noted above, and adding the following columns (with appropriate column totals):

-Income Statement

-Balance Sheet and Statement of Retained Earnings

6. Prepare in good form the income statement, statement of financial position (classified balance sheet), and statement of retained earnings.

Net income after tax should be $6,922.

7. After you have completed the financial statements in good form, prepare the closing journal entries and the post-closing trial balance. Ensure you show all of your work and prepare proper journal entries and properly formatted financial statements (you do not need to complete account sub-ledgers).

Exhibit 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts