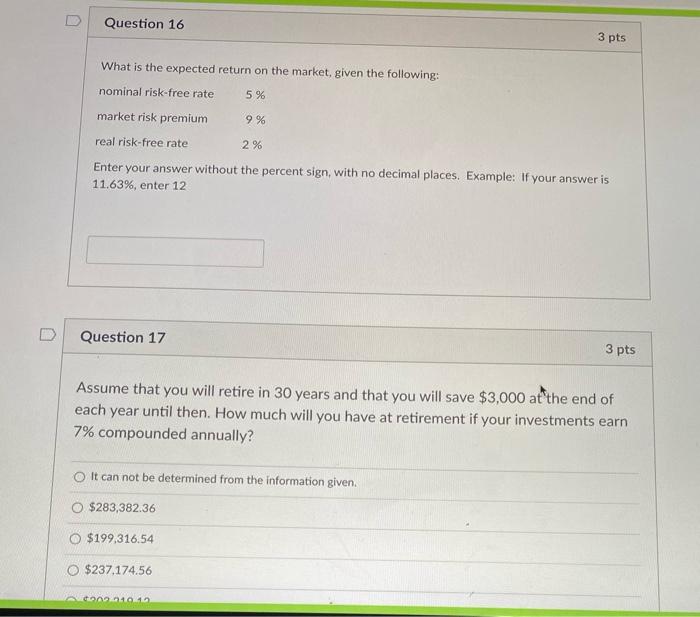

Question: please help U Question 16 3 pts What is the expected return on the market, given the following: nominal risk-free rate 5 % market risk

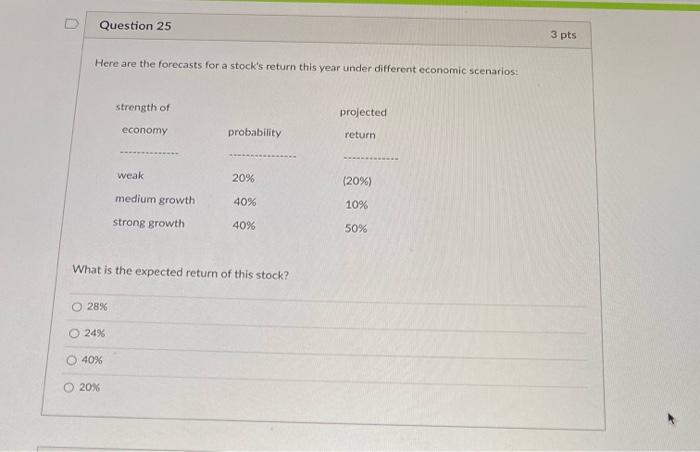

U Question 16 3 pts What is the expected return on the market, given the following: nominal risk-free rate 5 % market risk premium 9 % real risk-free rate 2 % Enter your answer without the percent sign, with no decimal places. Example: If your answer is 11.63%, enter 12 Question 17 3 pts Assume that you will retire in 30 years and that you will save $3,000 at the end of each year until then. How much will you have at retirement if your investments earn 7% compounded annually? It can not be determined from the information given. $283,382.36 O $199.316.54 $237.174.56 10.10 Question 25 3 pts Here are the forecasts for a stock's return this year under different economic scenarios: strength of projected economy probability return weak 20% (20%) medium growth 40% 10% strong growth 4096 50% What is the expected return of this stock? O 28% 2496 O 40% 0 20% Question 18 3 pts The common stock of Nicholls, Inc. has a bota of 0.90. Inflation is expected to be 3% over the next year. The T-bil rate is 4%. The market risk premium is 7%. Use the capital asset pricing model to determine the required return on Nicholls common stock. 0 739 4.6% 13.3% 10.3% Question 19 1 pts You wish to put some money in a bank account today in order to have $1,000 3 years from now. If the bank compounds semi-annually, you would have to start with more money in the account than if compounding occurs quarterly. false true

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts