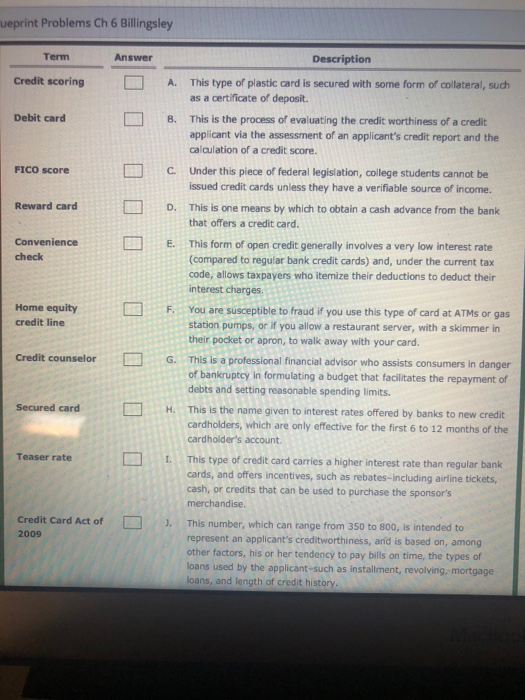

Question: please help ueprint Problems Ch 6 Billingsley Term Answer Description Credit scoring A. This type of plastic card is secured with some form of collateral,

ueprint Problems Ch 6 Billingsley Term Answer Description Credit scoring A. This type of plastic card is secured with some form of collateral, such B. This is the process of evaluating the credit worthiness of a credit C. Under this piece of federal legislation, college students cannot be as a certificate of deposit. Debit card applicant via the assessment of an applicant's credit report and the calculation of a credit score. FICO Score issued credit cards unless they have a verifiable source of income. Reward card D. This is one means by which to obtain a cash advance from the bank that offers a credit card ConvenienceEThis form of open credit generally involves a very low interest rate check (compared to regular bank credit cards) and, under the current tax code, allows taxpayers who itemize their deductions to deduct their interest charges Home equity credit line You are susceptible to fraud if you use this type of card at ATMs or gas station pumps, or if you allow a restaurant server, with a skimmer in their pocket or apron, to walk away with your card. Credit counselorG. This is a professional financial advisor who assists consumers in of bankruptcy in formulating a budget that facitates the repayment of debts and setting reasonable spending limits. Secured cardH. This is the name given to interest rates offered by banks to new credit cardholders, which are only effective for the first 6 to 12 months of the cardholder's account Teaser rate This type of credit card carries a higher interest rate than regular bank cards, and offers incentives, such as rebates-including airline tickets, cash, or credits that can be used to purchase the sponsor's merchandise Credit Card Act ofJ. This number, which can range from 350 to 800, is intended to 2009 represent an applicant's creditworthiness, and is based on, am other factors, his or her tendency to pay bills on time, the types of loans used by the applicant-such as installment, revolving, mortgage loans, and length of credit history ong

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts