Question: PLEASE HELP!!! URGENCY NEEDED :) THANKS IN ADVANCE!!!!! Required: 1. Prepare operating income statements for Chataqua Can Company for its first three years of operations

PLEASE HELP!!! URGENCY NEEDED :) THANKS IN ADVANCE!!!!!

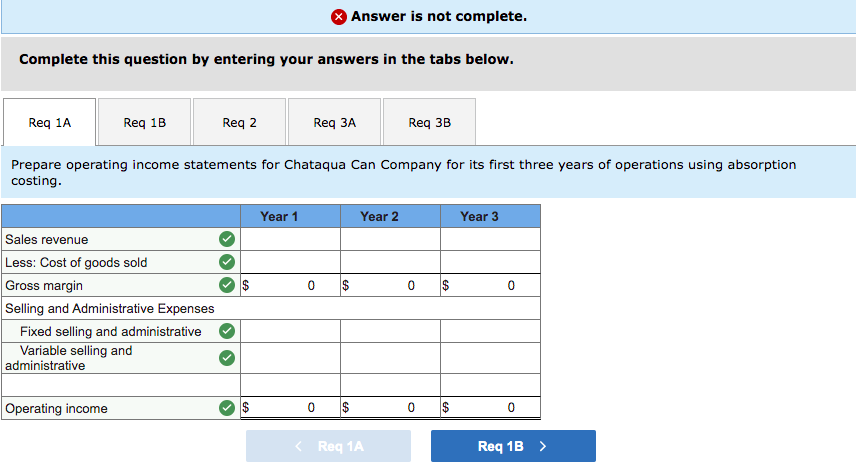

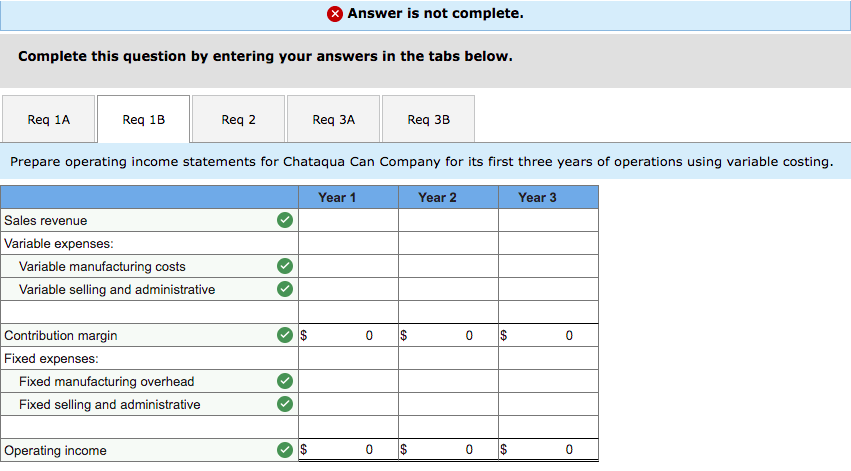

Required: 1. Prepare operating income statements for Chataqua Can Company for its first three years of operations using: a. Absorption costing. b. Variable costing.

Question 1A: Absorption costing: Please place answers exactly where they belong within the table below :)

Question 1B: Variable costing: Please place answers exactly where they belong within the table below :)

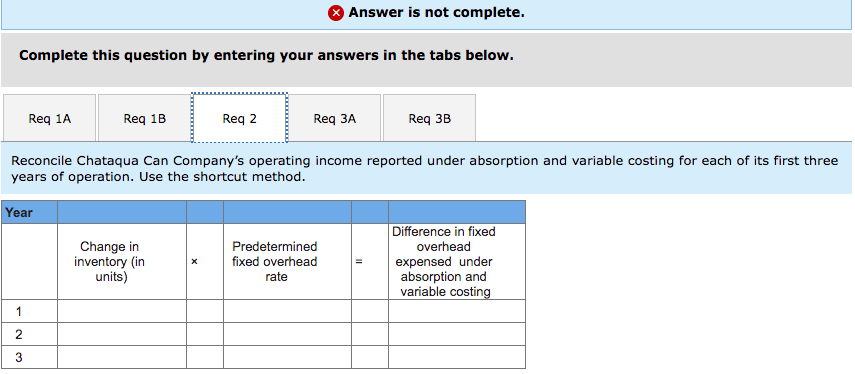

2. Reconcile Chataqua Can Companys operating income reported under absorption and variable costing for each of its first three years of operation. Use the shortcut method.

Question 2: Reconciliation: Please place answers exactly where they belong within the table below :)

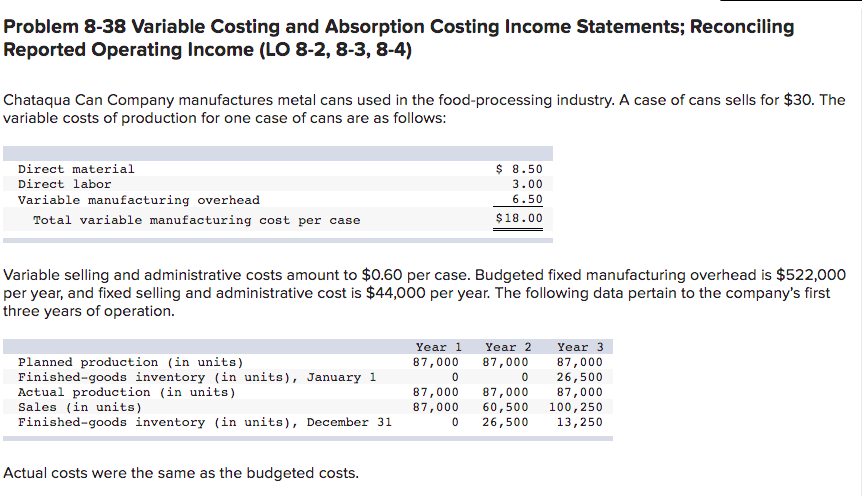

Problem 8-38 Variable Costing and Absorption Costing Income Statements; Reconciling Reported Operating Income (LO 8-2, 8-3, 8-4) Chataqua Can Company manufactures metal cans used in the food processing industry. A case of cans sells for $30. The variable costs of production for one case of cans are as follows: Direct material Direct labor Variable manufacturing overhead Total variable manufacturing cost per case $ 8.50 3.00 6.50 $18.00 Variable selling and administrative costs amount to $0.60 per case. Budgeted fixed manufacturing overhead is $522,000 per year, and fixed selling and administrative cost is $44,000 per year. The following data pertain to the company's first three years of operation. Planned production (in units) Finished-goods inventory (in units), January 1 Actual production (in units) Sales (in units) Finished-goods inventory (in units), December 31 Year 1 87,000 0 87,000 87,000 0 Year 2 87,000 0 87,000 60,500 26,500 Year 3 87,000 26,500 87,000 100,250 13,250 Actual costs were the same as the budgeted costs. Answer is not complete. Complete this question by entering your answers in the tabs below. Req 1A Req 1B Req 2 Req Reg 3 Prepare operating income statements for Chataqua Can Company for its first three years of operations using absorption costing. Year 1 Year 2 Year 3 0 $ 0 $ 0 Sales revenue Less: Cost of goods sold Gross margin Selling and Administrative Expenses Fixed selling and administrative Variable selling and administrative Operating income 0 $ 0 $ 0 Answer is not complete. Complete this question by entering your answers in the tabs below. Req 1A Reg 1B Req 2 Req 3A Req 3B Prepare operating income statements for Chataqua Can Company for its first three years of operations using variable costing. Year 1 Year 2 Year 3 Sales revenue Variable expenses: Variable manufacturing costs Variable selling and administrative $ 0 $ 0 $ 0 Contribution margin Fixed expenses: Fixed manufacturing overhead Fixed selling and administrative Operating income 0 $ 0 $ 0 Answer is not complete. Complete this question by entering your answers in the tabs below. Req 1A Req 1B Reg 2 Req 3A Req 3B Reconcile Chataqua Can Company's operating income reported under absorption and variable costing for each of its first three years of operation. Use the shortcut method. Year Change in inventory (in units) Predetermined fixed overhead rate Difference in fixed overhead expensed under absorption and variable costing 1 N 2 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts