Question: please help urgent! Answers to odd-numbered problems appear in Appendix A. Use the following income statements and balance sheets to calculate Garnet Inc.'s free cash

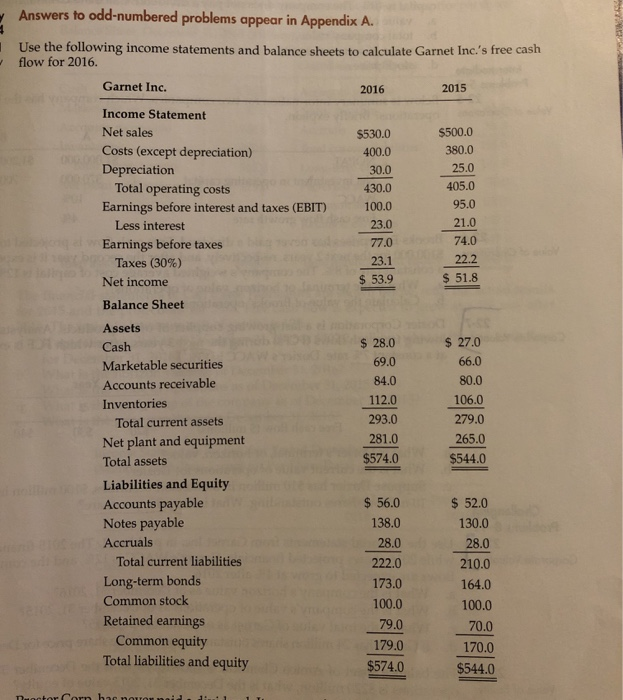

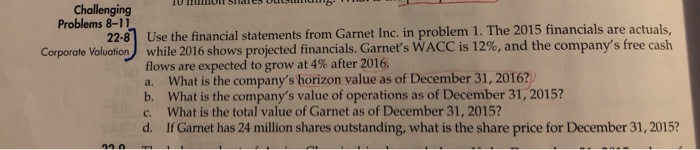

Answers to odd-numbered problems appear in Appendix A. Use the following income statements and balance sheets to calculate Garnet Inc.'s free cash flow for 2016. Garnet Inc. 2016 2015 Income Statement Net sales Costs (except depreciation) Depreciation Total operating costs Earnings before interest and taxes (EBIT) Less interest Earnings before taxes Taxes (30%) Net income $530.0 400.0 30.0 430.0 100.0 23.0 77.0 23.1 $ 53.9 $500.0 380.0 25.0 405.0 95.0 21.0 74.0 22.2 $ 51.8 Balance Sheet $ 28.0 69.0 84.0 112.0 293.0 281.0 $574.0 $ 27.0 66.0 80.0 106.0 279.0 265.0 $544.0 Assets Cash Marketable securities Accounts receivable Inventories Total current assets Net plant and equipment Total assets Liabilities and Equity Accounts payable Notes payable Accruals Total current liabilities Long-term bonds Common stock Retained earnings Common equity Total liabilities and equity $ 56.0 138.0 28.0 222.0 173.0 100.0 79.0 179.0 $574.0 $ 52.0 130.0 28.0 210.0 164.0 100.0 70.0 170.0 $544.0 Duter Comba Challenging Problems 8-11 22-8] Use the financial statements from Garnet Inc. in problem 1. The 2015 financials are actuals, Corporate Valuation while 2016 shows projected financials. Garnet's WACC is 12%, and the company's free cash flows are expected to grow at 4% after 2016 a. What is the company's horizon value as of December 31, 2016? b. What is the company's value of operations as of December 31, 2015? What is the total value of Garnet as of December 31, 2015? d. If Garnet has 24 million shares outstanding, what is the share price for December 31, 2015? c

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts