Question: please help, urgent needed View Policies Current Attempt in Progress Crane Company purchased $3550000 of 8%, 5-year bonds from Novak, Inc. on January 1, 2021,

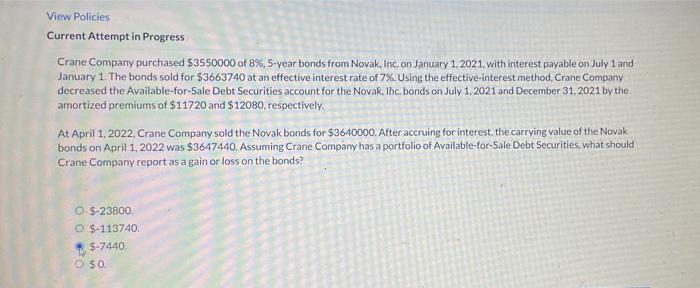

View Policies Current Attempt in Progress Crane Company purchased $3550000 of 8%, 5-year bonds from Novak, Inc. on January 1, 2021, with interest payable on July 1 and January 1. The bonds sold for $3663740 at an effective interest rate of 7%. Using the effective-interest method, Crane Company decreased the Available-for-Sale Debt Securities account for the Novak, Ihc bonds on July 1, 2021 and December 31, 2021 by the amortized premiums of $11720 and $12080, respectively. At April 1, 2022, Crane Company sold the Novak bonds for $3640000. After accruing for interest the carrying value of the Novak bonds on April 1, 2022 was $3647440. Assuming Crane Company has a portfolio of Available-for-Sale Debt Securities. what should Crane Company report as a gain or loss on the bonds? O $-23800 O $-113740. $-7440 SO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts