Question: PLEASE HELP URGENT .. NO EXPLANATIONS NEEDED ONLY CORRECT ANSWER A company is evaluating a project that has an initial capital outlay of R12m and

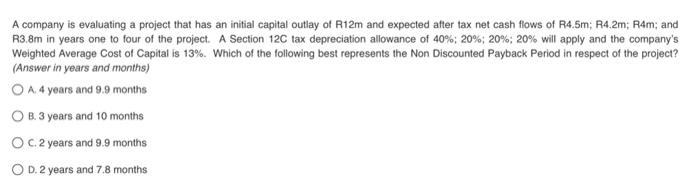

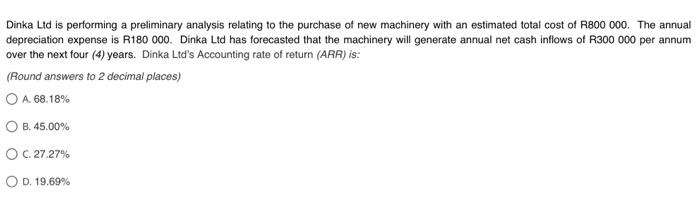

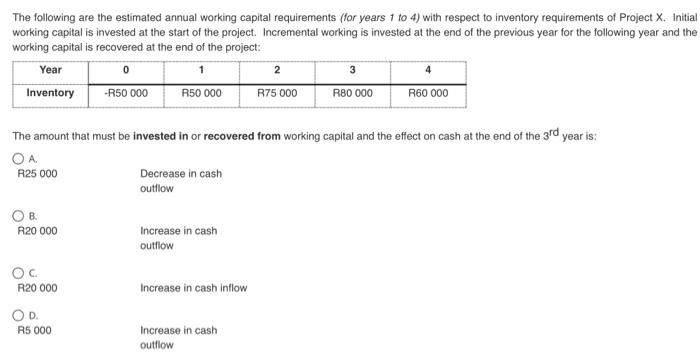

A company is evaluating a project that has an initial capital outlay of R12m and expected after tax net cash flows of R4.5m; R4.2m: R4m; and R3.8m in years one to four of the project. A Section 120 tax depreciation allowance of 40% 20% 20%; 20% will apply and the company's Weighted Average Cost of Capital is 13%. Which of the following best represents the Non Discounted Payback Period in respect of the project? (Answer in years and months) O A 4 years and 9.9 months OB. 3 years and 10 months O C 2 years and 9.9 months OD. 2 years and 7.8 months Dinka Ltd is performing a preliminary analysis relating to the purchase of new machinery with an estimated total cost of R800 000. The annual depreciation expense is R180 000. Dinka Ltd has forecasted that the machinery will generate annual net cash inflows of R300 000 per annum over the next four (4) years. Dinka Ltd's Accounting rate of return (ARR) is: (Round answers to 2 decimal places) O A. 68.18% OB. 45.00% OC.27.27% O D. 19.69% The following are the estimated annual working capital requirements (for years 1 to 4) with respect to inventory requirements of Project X. Initial working capital is invested at the start of the project. Incremental working is invested at the end of the previous year for the following year and the working capital is recovered at the end of the project: Year 1 3 Inventory - R50 000 R50 000 R75 000 R80 000 R60 000 0 2 4 The amount that must be invested in or recovered from working capital and the effect on cash at the end of the 3rd year is: OA R25 000 Decrease in cash outflow OB. R20 000 Increase in cash outflow . R20 000 Increase in cash inflow OD R5 000 Increase in cash outflow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts