Question: Please help us to get the amount for entries. This is ASPE question(Canadian private company standards). On January 1, 2020. Sandhill Corporation issued 11% bonds

Please help us to get the amount for entries. This is ASPE question(Canadian private company standards).

Please help us to get the amount for entries. This is ASPE question(Canadian private company standards).

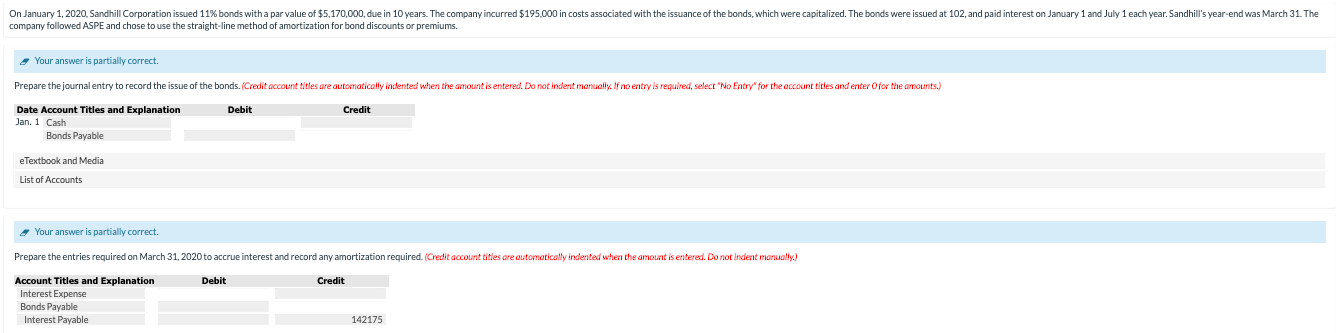

On January 1, 2020. Sandhill Corporation issued 11% bonds with a par value of $5,170,000, due in 10 years. The company incurred $195,000 in costs associated with the issuance of the bonds, which were capitalized. The bonds were issued at 102, and paid interest on January 1 and July 1 each year. Sandhill's year-end was March 31. The company followed ASPE and chose to use the straight-line method of amortization for bond discounts or premiums. Your answer is partially correct. Prepare the journal entry to record the issue of the bonds. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts.) Debit Credit Date Account Titles and Explanation Jan. 1 Cash Bonds Payable eTextbook and Media List of Accounts Your answer is partially correct. Prepare the entries required on March 31, 2020 to accrue interest and record any amortization required. (Credit account titles are automatically indented when the amount is entered. Do not Indent manually.) Debit Credit Account Titles and Explanation Interest Expense Bonds Payable Interest Payable 142175

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts