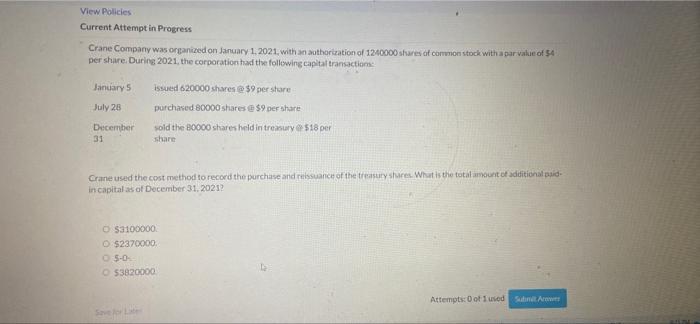

Question: please help View Policies Current Attempt in Progress Crane Company was organized on January 1, 2021. with an authorization of 1200000 shares of common stock

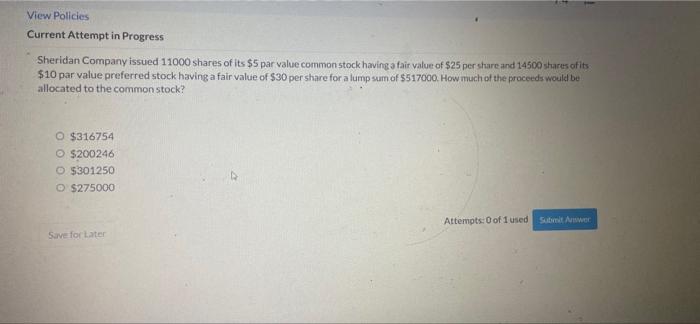

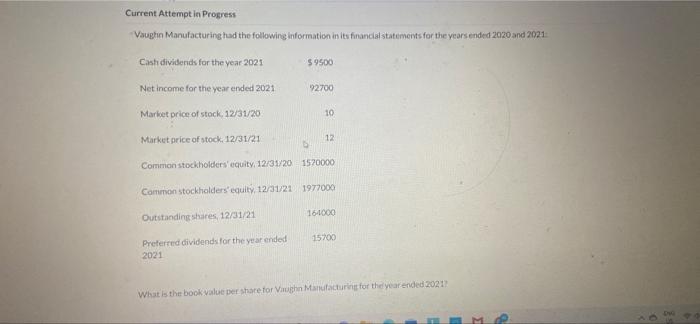

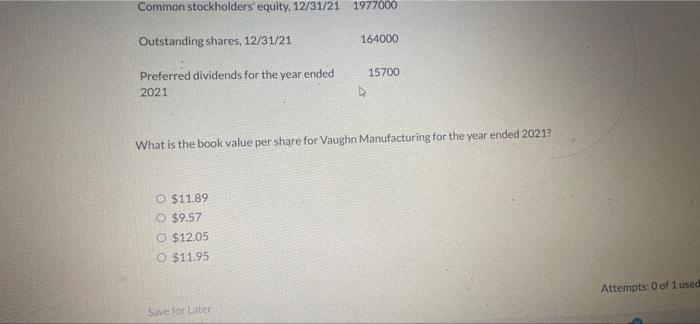

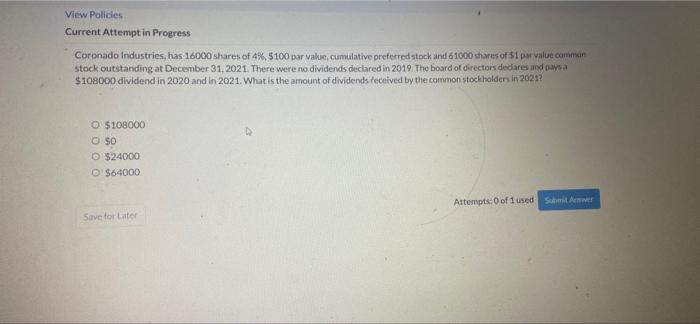

View Policies Current Attempt in Progress Crane Company was organized on January 1, 2021. with an authorization of 1200000 shares of common stock with a par value of 54 per share. During 2021, the corporation had the following capital transactions January 5 July 28 Issued 620000 shares @ $9 per stare purchased 80000 shares e 59 per share sold the 80000 shares held in treasury 518 per share December 31 Crane used the cost method to record the purchase and issuance of the treasury sure. What is the total amount of additional paid in capitalas of December 31, 2021 53100000 O $2370000 5-0 $3820000 Attempts of used Are View Policies Current Attempt in Progress Sheridan Company issued 11000 shares of its $5 par value common stock having a fair value of $25 per share and 14500 shares of its $10 par value preferred stock having a fair value of $30 per share for a lump sum of $517000. How much of the proceeds would be allocated to the common stock? O $316754 O $200246 O $301250 O $275000 Attempts: 0 of 1 used SWE Save for later Current Attempt in Progress Vaughn Manufacturing had tho following information in its financial statements for the years ended 2020 and 2021 Cash dividends for the year 2021 $ 9500 Net Income for the year ended 2021 92700 Market price of stock, 12/31/20 10 Market price of stock, 12/31/21 12 Common stockholders equity, 12/31/20 1570000 Common stockholders' equity, 12/31/21 1977000 Outstanding shares 12/31/21 164000 15700 Preferred dividends for the year ended 2021 What is the book value per share for Vaughn Manufacturing for the year ended 2021 e 3 Common stockholders' equity, 12/31/21 1977000 Outstanding shares, 12/31/21 164000 15700 Preferred dividends for the year ended 2021 What is the book value per share for Vaughn Manufacturing for the year ended 2021? O $11.89 $9.57 O $12.05 O $11.95 Attempts: 0 of 1 used Suve for later View Policies Current Attempt in Progress Coronado Industries, has 16000 shares of 4% 5100 par value, cumulative preferred stock and 61000 shares of $1 par value common stock outstanding at December 31, 2021. There were no dividends declared in 2019. The board of directors dedares and paysa $108000 dividend in 2020 and in 2021. What is the amount of dividends received by the common stockholders in 2017 D O $108000 O $0 O $24000 O $64000 Attempts:0 of 1 used SA Sove for Later

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts