Question: please help w case 1 a-e. harry is 28 yrs old & belinda is 27 yrs old. PINANCIAL PLANNING CASES CASE 1 Coverage paid-at- -at-65

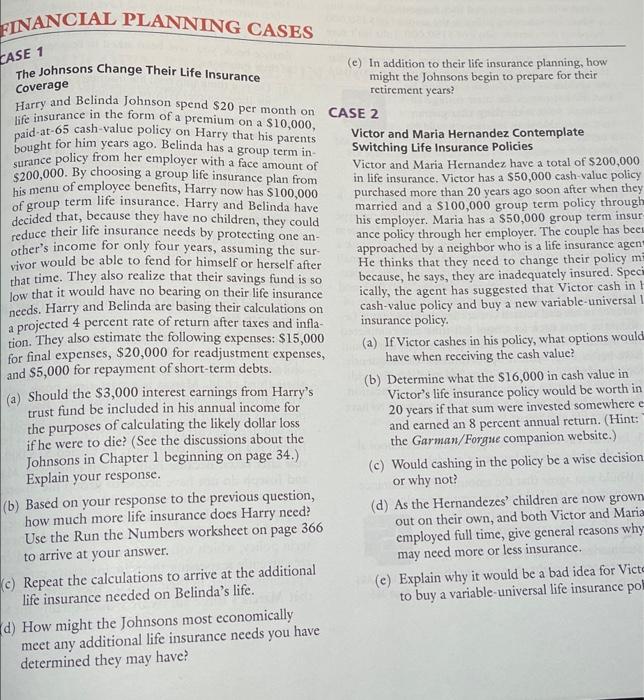

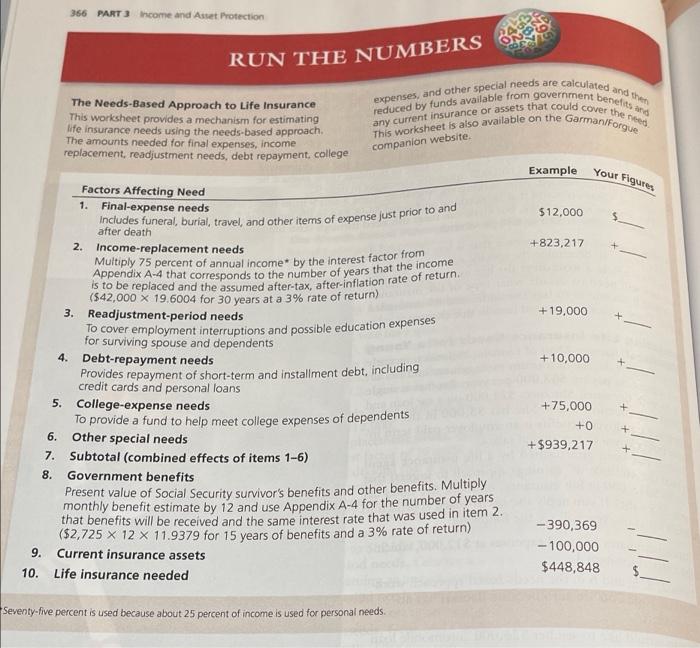

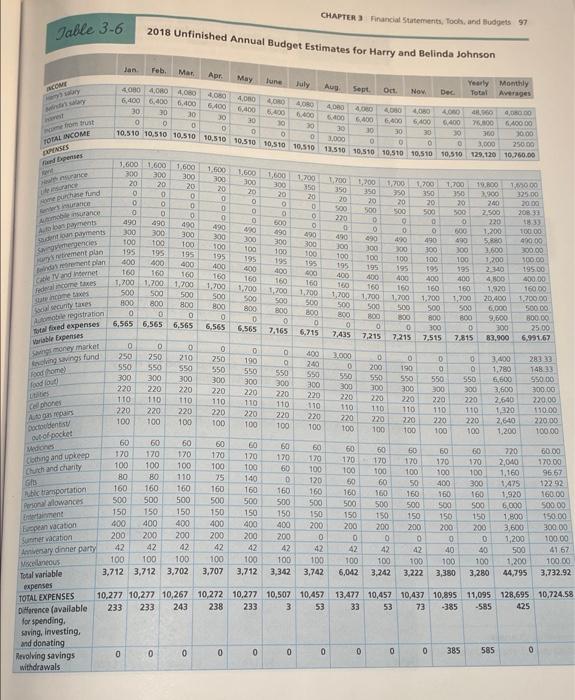

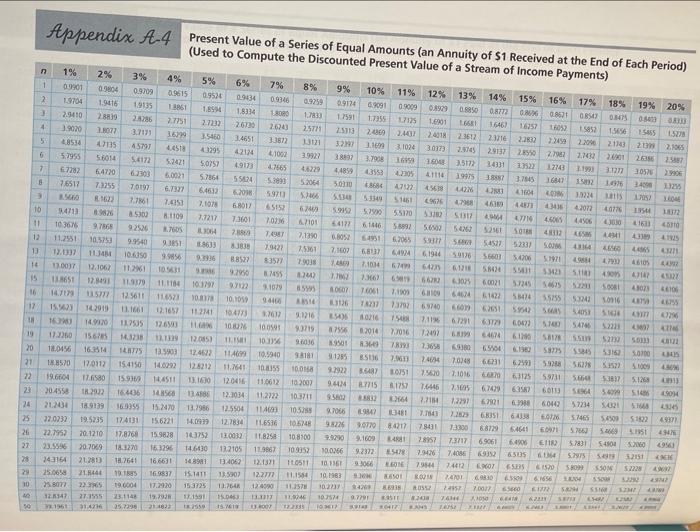

PINANCIAL PLANNING CASES CASE 1 Coverage paid-at- -at-65 cash-value policy on Harry that his parents The Johnsons Change Their Life Insurance (e) In addition to their life insurance planning, how might the Johnsons begin to prepare for their retirement years? life insurance in the form of a premium on a $10,000, CASE 2 bought for him years ago. Belinda has a group term in Victor and Maria Hernandez Contemplate surance policy from her employer with a face amount of Switching Life Insurance Policies $200,000. By choosing a group life insurance plan from Victor and Maria Hernandez have a total of $200,000 his menu of employee benefits, Harry now has $100,000 in life insurance, Victor has a $50,000 cash value policy of group term life insurance. Harry and Belinda have purchased more than 20 years ago soon after when they decided that, because they have no children, they could married and a $100,000 group term policy through reduce their life insurance needs by protecting one an- his employer. Maria has a $50,000 group term insur other's income for only four years, assuming the sur- ance policy through her employer. The couple has been approached by a neighbor who is a life insurance agen a vivor would be able to fend for himself or herself after that time. They also realize that their savings fund is so He thinks that they need to change their policy mi Jow that it would have no bearing on their life insurance because, he says, they are inadequately insured. Speci needs. Harry and Belinda are basing their calculations on ically, the agent has suggested that Victor cash in cash-value policy and buy a new variable-universal a projected 4 percent rate of return after taxes and infla- insurance policy. tion. They also estimate the following expenses: $15,000 for final expenses, $20,000 for readjustment expenses, (a) If Victor cashes in his policy, what options would have when receiving the cash value? and $5,000 for repayment of short-term debts. (b) Determine what the $16,000 in cash value in (a) Should the $3,000 interest earnings from Harry's Victor's life insurance policy would be worth in trust fund be included in his annual income for 20 years if that sum were invested somewhere e the purposes of calculating the likely dollar loss and earned an 8 percent annual return. (Hint: if he were to die? (See the discussions about the the Garman/Forgue companion website.) Johnsons in Chapter 1 beginning on page 34.) Explain your response. (c) Would cashing in the policy be a wise decision or why not? (b) Based on your response to the previous question, (d) As the Hernandezes' children are now grown how much more life insurance does Harry need? Use the Run the Numbers worksheet on page 366 out on their own, and both Victor and Maria employed full time, give general reasons why to arrive at your answer. may need more or less insurance. C) Repeat the calculations to arrive at the additional (e) Explain why it would be a bad idea for Victe life insurance needed on Belinda's life. to buy a variable-universal life insurance pol d) How might the Johnsons most economically meet any additional life insurance needs you have determined they may have? 0 366 PART 3 come and Asset Protection RUN THE NUMBERS calculated and then expenses, and other special needs are The Needs-Based Approach to Life Insurance This worksheet provides a mechanism for estimating life insurance needs using the needs-based approach. The amounts needed for final expenses, income replacement, readjustment needs, debt repayment, college reduced by funds available from government benefas and any current insurance or assets that could cover ved This worksheet is also available on the Garmanitorgue companion website. Example Your Figures $12,000 after death +823,217 +19,000 + +10,000 Factors Affecting Need 1. Final-expense needs Includes funeral, burial, travel, and other items of expense just prior to and 2. Income-replacement needs Multiply 75 percent of annual income by the interest factor from Appendix A-4 that corresponds to the number of years that the income (542,000 X 19.6004 for 30 years at a 3% rate of return) is to be replaced and the assumed after-tax, after-Inflation rate of return 3. Readjustment-period needs To cover employment interruptions and possible education expenses for surviving spouse and dependents 4. Debt-repayment needs Provides repayment of short-term and installment debt, including credit cards and personal loans 5. College-expense needs To provide a fund to help meet college expenses of dependents Other special needs 7. Subtotal (combined effects of items 1-6) Government benefits Present value of Social Security survivor's benefits and other benefits. Multiply monthly benefit estimate by 12 and use Appendix A-4 for the number of years that benefits will be received and the same interest rate that was used in item 2. (52,725 x 12 x 11.9379 for 15 years of benefits and a 3% rate of return) Current insurance assets Life insurance needed + +75,000 +0 +$939,217 6. 8. -390,369 -100,000 $448,848 9. / 10. Seventy-five percent is used because about 25 percent of income is used for personal needs. CHAPTER 3 Financial Statements, Tools, and Budget 97 Jable 3-6 2018 Unfinished Annual Budget Estimates for Harry and Belinda Johnson Mar Apr. May lune Aug wy bruar TOTAL INCOME EPINSES and penses 1.600 mance puse und insurance Anne Autobates un payments Sagencies obrement plan rement plan Vandiner de income taxes home Soowsentes mobile registration ble Expenses money marker ting wavings fund Boome 1,200 500 seal foed expenses 7,435 Jan Feb Yearly Monthly 4000 4,080 4080 Sept Oct. Now OBO Total Averages 400 6,400 6.400 0.400 RE 5.400 400 6.400 4.00 30 4,00 30 4680 5.400 5.400 4080 30 400 4,960 4,00.00 30 6400 0 5,400 30 6,400 10 5/100 G400 0 7.100 6,400.00 0 30 10.510 10.510 10,510 10,510 10,510 10,510 10,510 0 30 30 30 0 30 30 360 30.00 O 3.000 O 0 O 3,000 250.00 13.510 10,510 10,510 10,510 10,510 129,120 10.760.00 1.600 1.600 1.600 1.600 300 300 300 1.600 1700 300 20 1,700 1,200 1,700 300 20 300 1.700 1,700 20 19 DO 10.00 20 0 350 20 0 350 20 250 390 0 2.900 350 325.00 20 0 20 0 20 20 30 240 2000 0 O 500 O 500 0 500 500 0 500 0 2.500 0 208 33 490 220 0 0 500 0 220 490 1833 400 490 300 40 0 190 0 500 1.200 300 10000 300 300 490 300 190 490 90 490 300 50 100 400.00 100 100 100 300 300 100 300 300 195 100 300 300 3.000 195 195 100 195 100 195 100 195 100 100 400 100 1.200 100.00 600 400 400 195 400 195 195 195 195 195 23:00 195.00 160 400 160 160 160 160 400 400 400 400 500 4.800 160 1.200 1.700 400.00 1,200 1,700 160 1.700 160 160 160 160 160 1.920 16000 500 500 500 500 1,200 500 1,700 1.700 500 1.700 1.700 1,700 20.400 800 1,200.00 800 800 800 800 500 500 500 500 500 6,000 800 500.00 0 0 (200 0 0 800 800 0 800 800 800 9.600 800.00 6,565 6,565 6,565 6,565 0 6,565 0 0 300 D 7,165 300 25 00 6,715 7,215 7,215 7.515 7.815 83.900 6,991,67 0 0 0 0 O 250 400 250 210 250 3.000 0 190 0 0 0 3.400 28333 550 240 0 550 550 550 200 190 O a 550 1.780 148.23 550 300 300 550 300 300 550 300 550 550 550 6.600 550.00 300 300 220 220 220 300 300 220 300 300 300 3,600 300.00 220 220 220 110 110 220 220 220 110 110 220 2.600 220 220,00 110 110 110 220 220 110 110 110 220 220 110 110 1,320 110.00 220 100 100 220 220 220 220 220 2,640 220.00 100 100 100 100 100 100 100 100 100 100 1,200 100.00 60 60 60 60 60 60 60 60 60 220 170 60.00 170 60 170 170 120 170 170 120 170 170 170 170 2,040 170.00 100 100 100 100 100 60 100 100 100 100 100 100 1,160 96 67 80 BO 110 75 140 D 120 50 60 50 400 300 1475 12292 160 160 160 160 160 160 160 160 180 160 160 160 1.920 160.00 500 500 500 500 500 500 500 Sod SOO 6.000 500.00 150 150 150 150 159 150 150 150 150 150 1,800 150.00 400 400 400 400 400 400 200 200 200 200 200 200 3,600 pean vacation 300.00 200 200 200 200 200 200 0 0 0 0 0 0 1,200 100.00 Suomet vacation 42 42 42 42 42 42 42 42 42 42 40 40 500 41.67 Anniversary dinner party 100 100 100 100 100 100 100 100 100 100 100 100 1,200 100.00 Mellaneous 3,707 3,712 3.712 3,702 3,712 3,342 3,742 6,042 3.242 3.222 3,380 3.280 44,795 Total variable 3.732.92 expenses TOTAL EXPENSES 10,277 10,277 10,267 10,272 10,277 10,507 10,457 13,477 10,457 10,437 10,895 11,095 128,695 10,724.58 233 243 233 238 233 3 53 33 53 73 -385 425 -585 Diference (available for spending saving, investing and donating 0 0 0 0 0 585 0 0 0 0 385 Revolving savings withdrawals ww Ce phones At mars Dortet out of pocket Wednes Ching and upkeep Cuth and durity G hic transportation Personalowances 500 500 500 150 150 0 0 0 Appendix A-4 Present Value of a Series of Equal Amounts (an Annuity of $1 Received at the End of Each Period) (Used to compute the Discounted Present Value of a Stream of Income Payments) %E % % % 09534 09346 9% 09114 16060 6260 %% 0580 11991 CRONE MO ve LONE LIBRE 815 9 255 3054 WET OM ELE WE MET SET COES 97868 76895 CES 00095 URES WNIOS OSELY PER STEET CON WO SEBES 0995 10 ITS > 1% 2% 4% 5% 6% 1 7% 01 8% 09804 09709 10% 11% 09615 12% 13% 14% 09034 15% 16% 17% 18% 2 19704 0.925 1.9416 19% 0.9009 20% 1915 1951 1.894 08272 1.8314 0.3 0853 3 00 2.9410 1.7830 28819 17591 0.50 28286 2.7751 1.7355 17135 27232 16201 16257 2.6243 102 4 2.51 15852 15656 3.9020 2.513 1.59 2009 2.402 1555 16110 35460 2018 23612 34651 2 22832 2.2014 5 301 21100 48534 2 4115 2.1045 45792 J. 3.1024 30173 2.9745 43295 29132 42114 1000 2.7982 2.742 5.7955 39927 38097 5.6054 3.700 5.472 16 16 52421 25122 5,0757 2013 2.3522 4.9173 12743 41665 2.1991 3.1272 7 6.7282 4.229 4485 6.4770 2005 62301 4111 6.0021 19975 5.764 3887 3.7845 16847 55424 152 16 52064 76512 5010 24090 8684 7.3255 7.0197 6462 5678 LAM C 601 5.920 M 3.0224 2013 05 1.14 16 676 7.6151 7.1078 4600 6.8012 65152 4207 40776 10 59 5.2900 55170 1.1109 5130 UN 7.7217 4. 7.3601 20 4,4906 300 A101 6417 40 11 10367 92526 52561 1.760 7. 411 T. AN 12 1951 11.2551 6.2005 10.325 SO 9.9540 54527 -52331 93851 138633 SOM 411 16 79427 LES 2,5361 7.1600 6813 13 12.03 61914 11. 10.6350 59176 34706 9989 5.1971 49 . 8827 83577 7:08 7.14 67 16 100) 643 12.1067 5843 SH 40 9.2950 M55 17 10 7.366) 6620 15 11651 1075 12.31 11.9379 57245 11.1184 101197 6675 43073 8610 107 53 LOGO 76061 3.10 6424 16 1822 5 115777 35255 1001 5. 1167 116 4 10.109 9416 467 126 YAH 2392 69740 COM 15.923 17 59542 TO2910 11.1661 12.1657 Sce 11211 cm 16:41 2012 9.116 194) TO 1. 2.1 67201 6.0823 1 100 14.00 HEN 54740 126 ch 100M 1000 0219 2014 2.7016 1.2497 BUM GI SI . 19 17.220 156703 5.03 M.3238 111 12.0853 11 100% 9.6036 9501 7.839 7.3856 6130 587 20 18.0496 16514 1775 53152 0700 18.01 12.4622 11A 10.5940 SAINT 311285 SUS 7. 2.4056 70348 66231 6.2491 5928 1009 21 17.0112 15.4150 14.0292 12.8212 11.1641 10:55 100158 9.2922 BABY LOS 7.1016 co 6,3125 53731 5.560 187 5126 22 19.6604 12.6580 14,4511 1.100 12.0416 110612 10.2003 9.40 8.7715 1757 7.6445 2. 6352 60113 3.6079 5.14 23 204550 22 18406 560 13486 12.034 11.2722 10.3711 95802 164 2.711 1.2297 6.7921 6.90 60449 17234 11821 24 21.3 189139 169355 15.2470 13.7986 12.5504 114 105.88 87066 1947 2.1 68351 6433 COM 5.7465 Soo 51522 971 25 32.0232 19:5235 174131 15.6221 14.00 12.7834 11.6516 9.226 0710 8.4212 68729 54641 3.135 26 22.1952 201210 17.8768 159838 10752 120032 11.8258 1083 2.3290 9.1609 7317 6.9061 6.4906 ET 5.7831 54500 49 27 23.5596 30.709 18.1270 163296 14.6430 13.2105 11.9867 09352 30.0366 9.2372 35078 2.42 7.4036 5.95 52151

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts