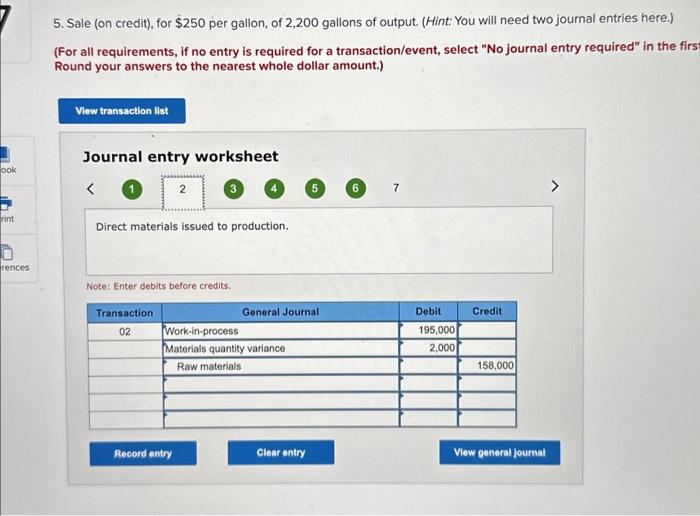

Question: please help was answered but wrong Journal entry worksheet Note: Enter debits before credits. 5. Sale (on credit), for $250 per gallon, of 2,200 gallons

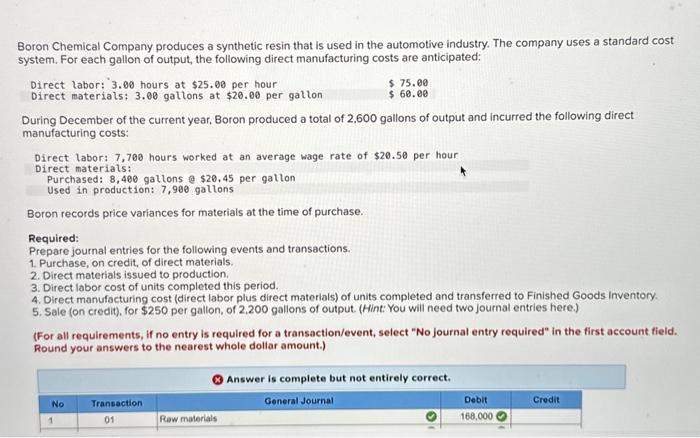

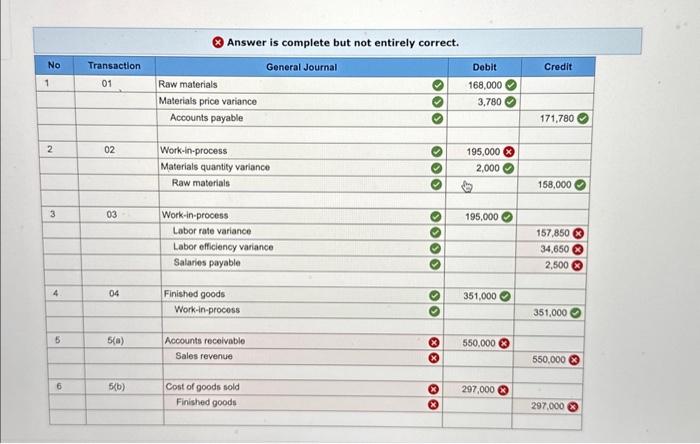

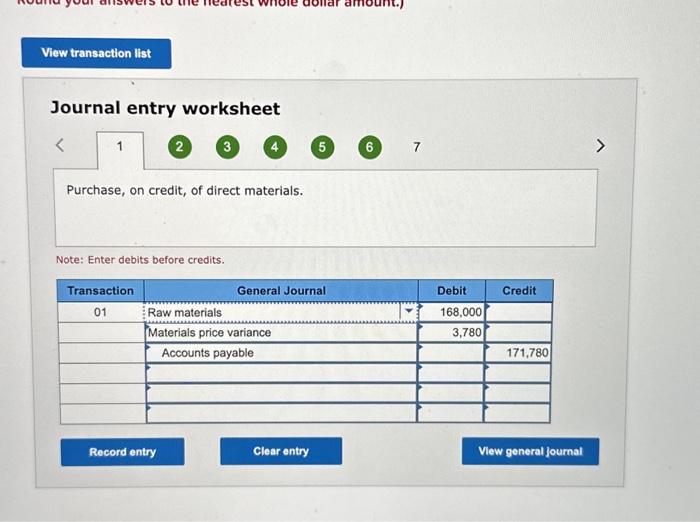

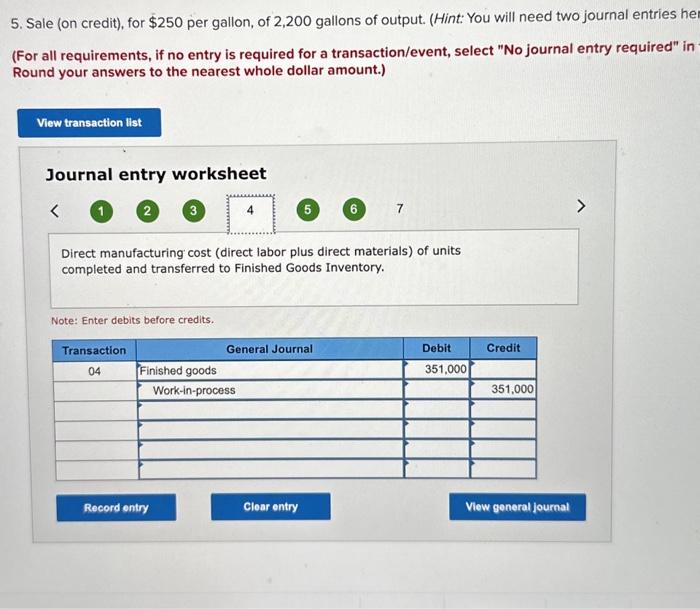

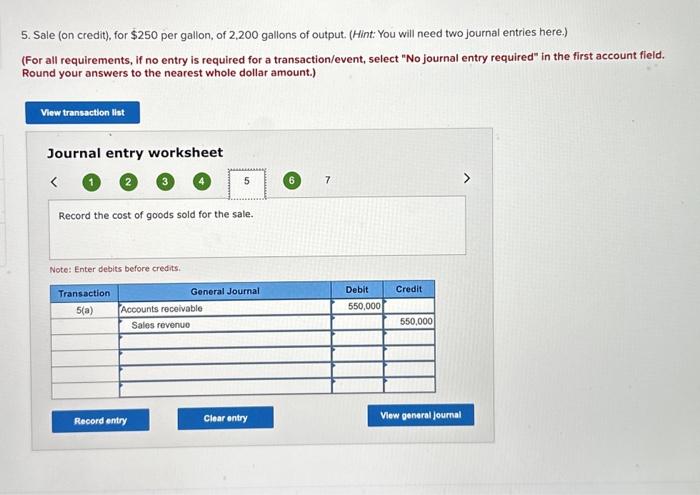

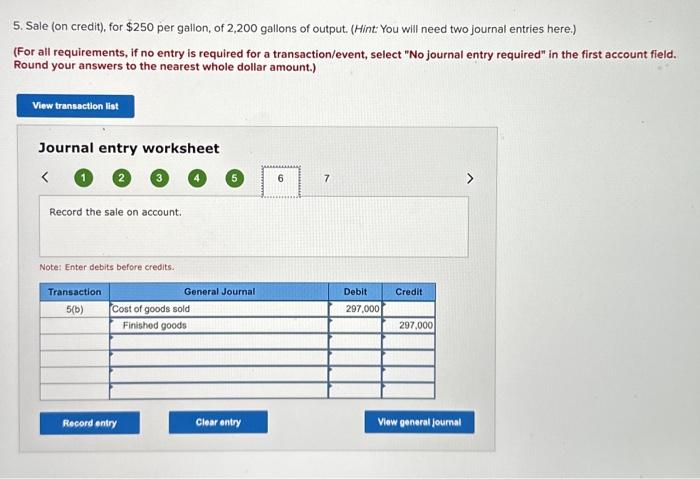

Journal entry worksheet Note: Enter debits before credits. 5. Sale (on credit), for $250 per gallon, of 2,200 gallons of output. (Hint: You will need two journal entries here.) (For all requirements, if no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your answers to the nearest whole dollar amount.) Journal entrv workchaet 5. Sale (on credit), for $250 per gallon, of 2,200 gallons of output. (Hint: You will need two journal entries he (For all requirements, if no entry is required for a transaction/event, select "No journal entry required" in Round your answers to the nearest whole dollar amount.) Journal entry worksheet Note: Enter debits before credits. 5. Sale (on credit), for $250 per gallon, of 2,200 gallons of output. (Hint: You will need two journal entries here.) (For all requirements, if no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your answers to the nearest whole dollar amount.) Note: b nter getars perore erears. 5. Sale (on credit), for $250 per gallon, of 2,200 gallons of output. (Hint: You will need two journal entries here.) (For all requirements, if no entry is required for a transaction/event, select "No journal entry required" in the first account fleld. Round your answers to the nearest whole dollar amount.) Journal entry worksheet (1) 2 7 Record the cost of goods sold for the sale. Note: Enter debits before credits. 5. Sale (on credit), for $250 per gallon, of 2,200 gallons of output. (Hint: You will need two journal entries here.) (For all requirements, if no entry is required for a transaction/event, select "No journal entry required" in the firs Round your answers to the nearest whole dollar amount.) Journal entry worksheet Note: Enter debits before credits. Boron Chemical Company produces a synthetic resin that is used in the automotive industry. The company uses a standard cost system. For each gallon of output, the following direct manufacturing costs are anticipated: Direct labor: 3.00 hours at $25.00 per hour Direct materials: 3.00 gallons at $20.00 per gallon $75.00$60.00 During December of the current year, Boron produced a total of 2,600 gallons of output and incurred the following direct manufacturing costs: Direct labor: 7,700 hours worked at an average wage rate of $20.50 per hour Direct materiats: Purchased: 8,400 gatlons a $20.45 per gatlon Used in production: 7,900 gallons Boron records price variances for materials at the time of purchase. Required: Prepare journal entries for the following events and transactions. 1. Purchase, on credit, of direct materials. 2. Direct materials issued to production. 3. Direct labor cost of units completed this period. 4. Direct manufocturing cost (direct labor plus direct materials) of units completed and transferred to Finished Goods inventory. 5 . Sale (on credit), for $250 per gallon, of 2,200 gallons of output. (Hint: You will need two journal entries here.) (For all requirements, if no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your answers to the nearest whole dollar amount.) (8 Answer is complete but not entirely correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts