Question: Please help! When George first pitched a new product idea to his manager, it was very well received because he did such a thorough job

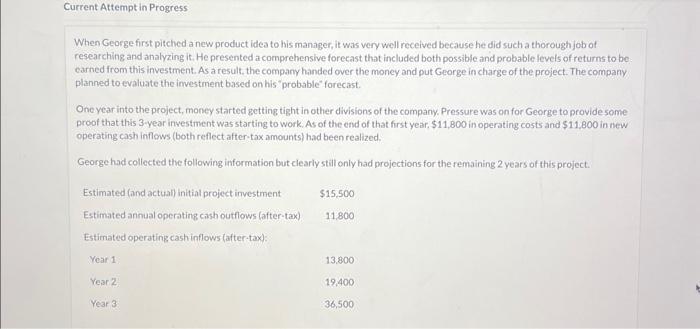

When George first pitched a new product idea to his manager, it was very well received because he did such a thorough job of researching and analyzing it. He presented a comprehensive forecast that included both possible and probable fevels of returns to be carned from this investment. As a result, the company handed over the money and put George in charge of the project. The company planned to evaluate the imvestment based on his "probable " forecast. One year into the project, money started getting tight in other divisions of the company. Pressure was on for George to provide some proof that this 3 year investment was starting to work. As of the end of that first year, $11,800 in operating costs and $11,800 in new operating cash inflows (both reflect after-tax amounts) had been realized. Georgehad collected the following information but elearly still only had projections for the remaining 2 years of this project. What was George'sinitial projection for the NPV of the cash flows at this probable level of activity, assuming an 9% discount rate? Tax effects, including any depreciation tax shield, have already been accounted for in the above amounts. (Round present value factor calculations to 5 decimal ploces, es. 1.25124 and final answer to 2 decimal places es. 5,125.36. Enter negative amounts using either a negative sign preceding the number eg. -45 or parentheses es. (45).)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts