Question: please help where there is a red X, the rest is correct Beale Management has a noncontributory, defined benefit pension plan. On December 31,2024 (the

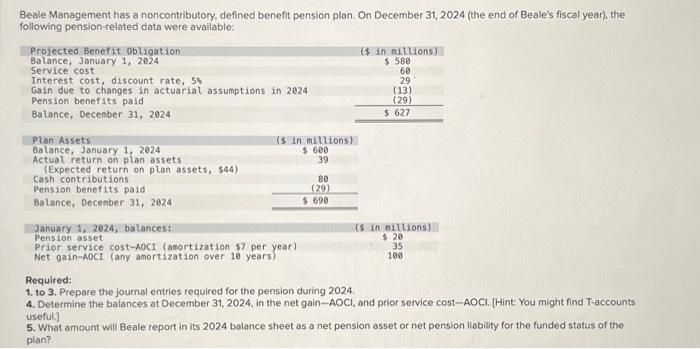

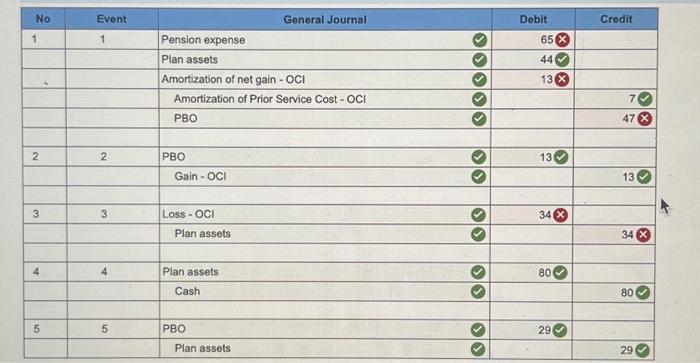

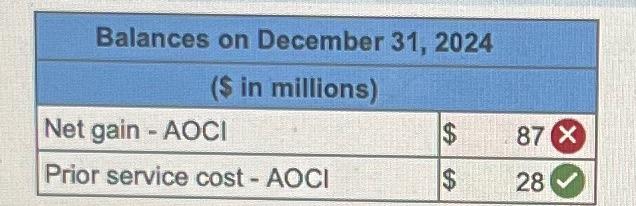

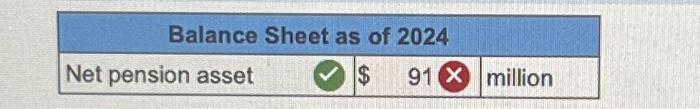

Beale Management has a noncontributory, defined benefit pension plan. On December 31,2024 (the end of Beale's fiscal year), the following pension-related data were available: Required: 1. to 3. Prepare the journal entries required for the pension during 2024. 4. Determine the balances at December 31,2024 , in the net gain-AOCI, and prior service cost-AOCl. [Hint: You might find T-accounts useful.] 5. What amount will Beale report in its 2024 balance sheet as a net pension asset or net pension liability for the funded status of the plan? \begin{tabular}{|l|ll|} \hline \multicolumn{3}{|c|}{ Balances on December 31,2024} \\ \hline \multicolumn{3}{|c|}{ (\$ in millions) } \\ \hline Net gain - AOCl & $ & 87 \\ \hline Prior service cost - AOCl & $ & 28 \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|} \hline \multicolumn{4}{|c|}{ Balance Sheet as of 2024} \\ \hline Net pension asset & $91 & million \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts