Question: Please help! Whoever the expert is please explain how you solved it! I would really appreciate it! Prepare consolidation spreadsheet for intercompany sale of equipment

Please help! Whoever the expert is please explain how you solved it! I would really appreciate it!

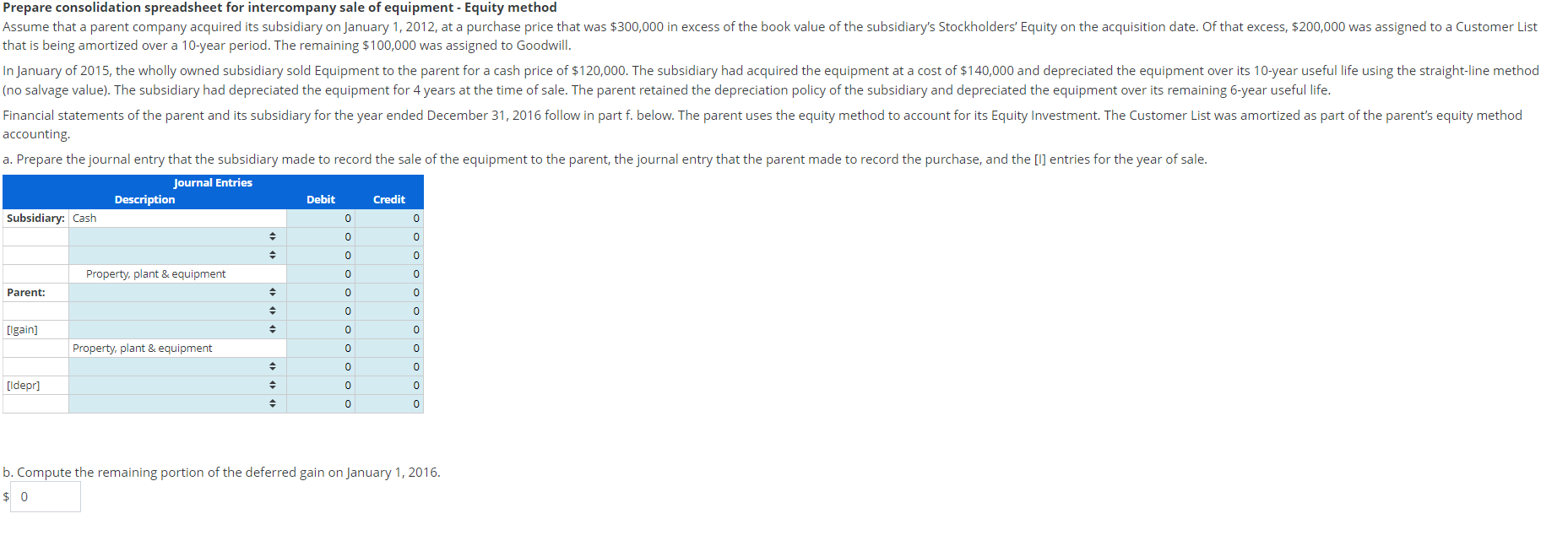

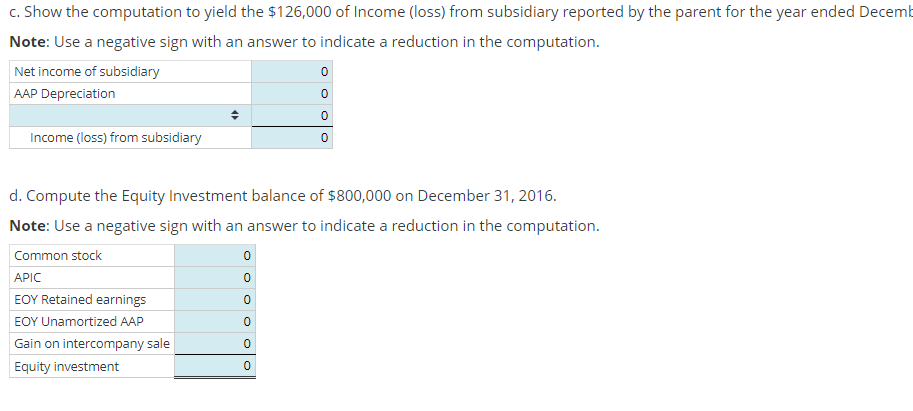

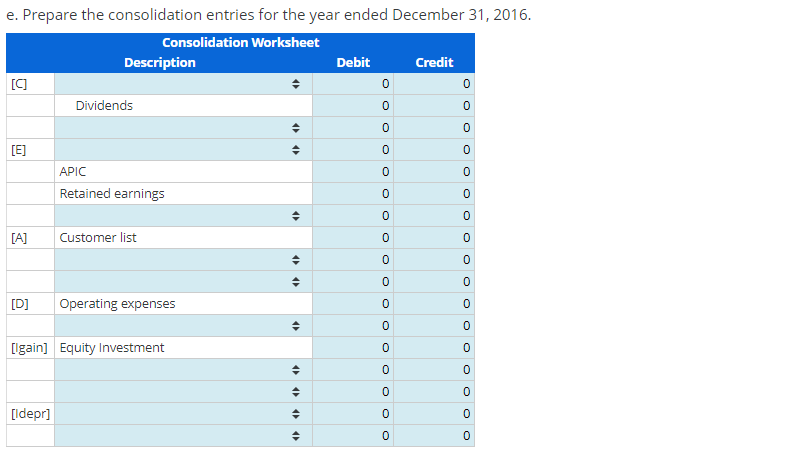

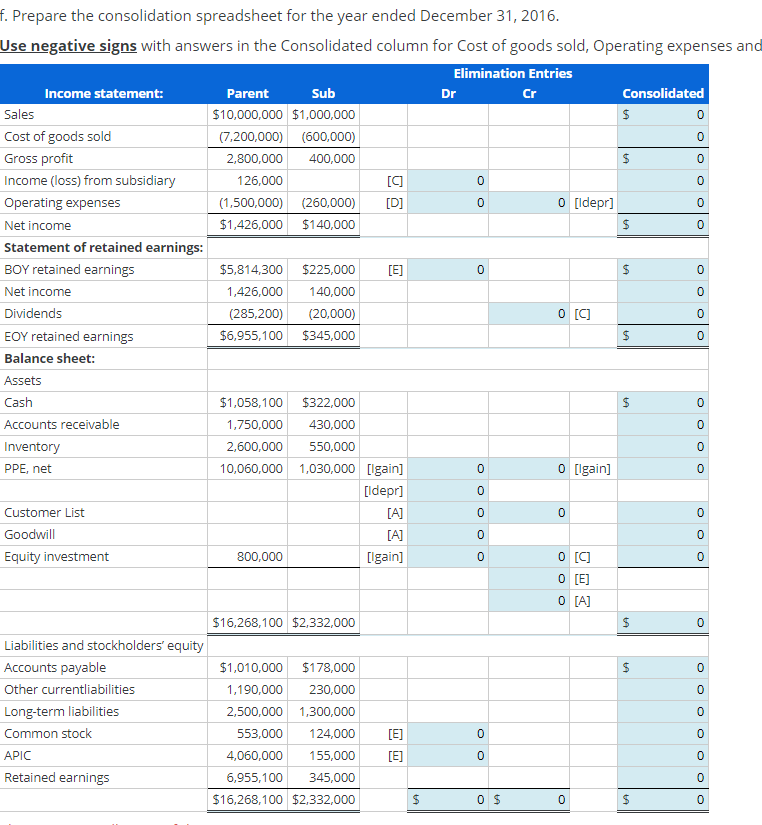

Prepare consolidation spreadsheet for intercompany sale of equipment - Equity method that is being amortized over a 10-year period. The remaining $100,000 was assigned to Goodwill. (no salvage value). The subsidiary had depreciated the equipment for 4 years at the time of sale. The parent retained the depreciation policy of the subsidiary and depreciated the equipment over its remaining 6 -year useful life. accounting. b. Compute the remaining portion of the deferred gain on January 1,2016. $0 c. Show the computation to yield the $126,000 of Income (loss) from subsidiary reported by the parent for the year ended Decemk Note: Use a negative sign with an answer to indicate a reduction in the computation. d. Compute the Equity Investment balance of $800,000 on December 31, 2016. Note: Use a negative sign with an answer to indicate a reduction in the computation. e. Prepare the consolidation entries for the year ended December 31, 2016. es

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts