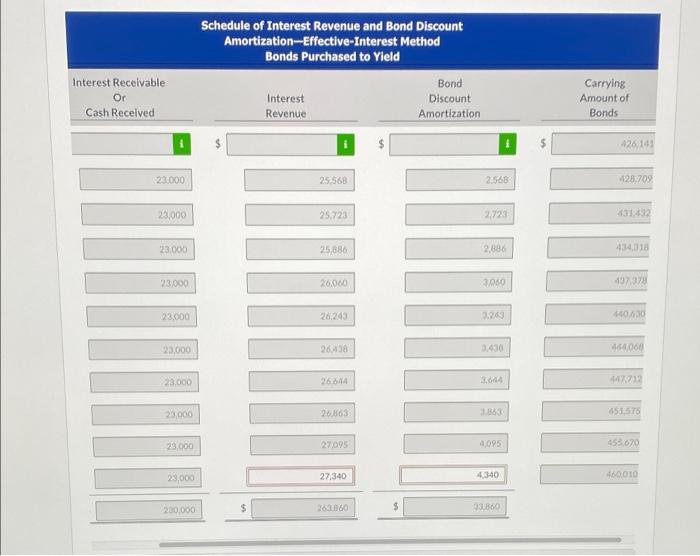

Question: Please help why am I getting wrong numbers on the last row of the amortization? Schedule of Interest Revenue and Bond Discount Amortization-Effective Interest Method

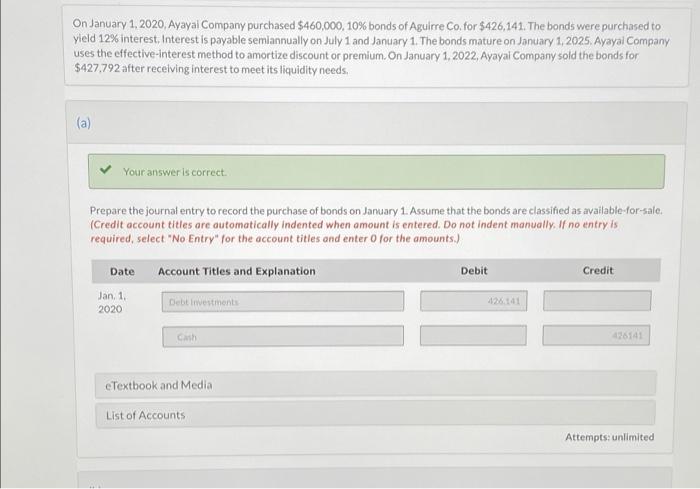

Schedule of Interest Revenue and Bond Discount Amortization-Effective Interest Method Bonds Purchased to Yield Bond Interest Discount Revenue Amortization Interest Receivable Or Carrying Amount of Bonds Cash Received 426 141 20.000 25.568 2.568 128.709 23,000 25.723 2.723 -431432 23.000 25,886 2,886 4:14,318 23.000 20,000 3.060 4979 23.000 26,243 3.249 106.30 23.000 26.438 0.430 46406 23,000 26644 3,604 447732 23.000 26863 1.863 4502575 23.000 27.095 4,095 455.670 23,000 27,340 4340 160010 200,000 $ 0860 $ 33.800 On January 1, 2020, Ayayal Company purchased $460,000, 10% bonds of Aguirre Co. for $426,141. The bonds were purchased to yield 12% interest, Interest is payable semiannually on July 1 and January 1. The bonds mature on January 1, 2025. Ayayal Company uses the effective-Interest method to amortize discount or premium On January 1, 2022, Ayayal Company sold the bonds for $427,792 after receiving interest to meet its liquidity needs, (a) Your answer is correct Prepare the journal entry to record the purchase of bonds on January 1. Assume that the bonds are classifed as available-for-sale. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) Date Account Titles and explanation Debit Credit Jan. 1 2020 Debit inestimenti Cash 496141 cTextbook and Media List of Accounts Attempts: unlimited

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts