Question: Please help, why is this answer not correct! Exercise 1537 (Static) Segment Reporting (LO 15-5) Perth Corporation has two operating divisions, a casino and a

Please help, why is this answer not correct!

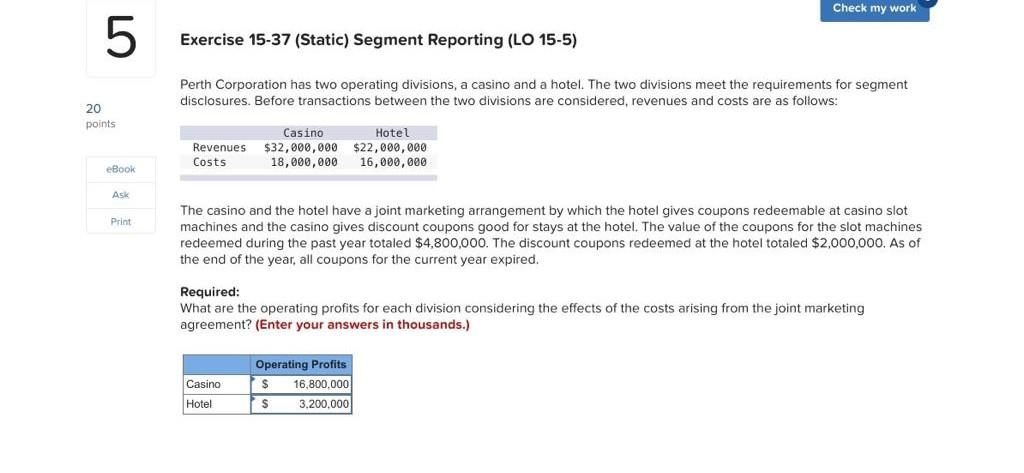

Exercise 1537 (Static) Segment Reporting (LO 15-5) Perth Corporation has two operating divisions, a casino and a hotel. The two divisions meet the requirements for segment disclosures. Before transactions between the two divisions are considered, revenues and costs are as follows: The casino and the hotel have a joint marketing arrangement by which the hotel gives coupons redeemable at casino slot machines and the casino gives discount coupons good for stays at the hotel. The value of the coupons for the slot machines redeemed during the past year totaled $4,800,000. The discount coupons redeemed at the hotel totaled $2,000,000. As of the end of the year, all coupons for the current year expired. Required: What are the operating profits for each division considering the effects of the costs arising from the joint marketing agreement? (Enter your answers in thousands.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts