Question: please help !! will give thumbs up divisions are considered separate components as defined by generally accepted accounting principles. The farm equipment component had been

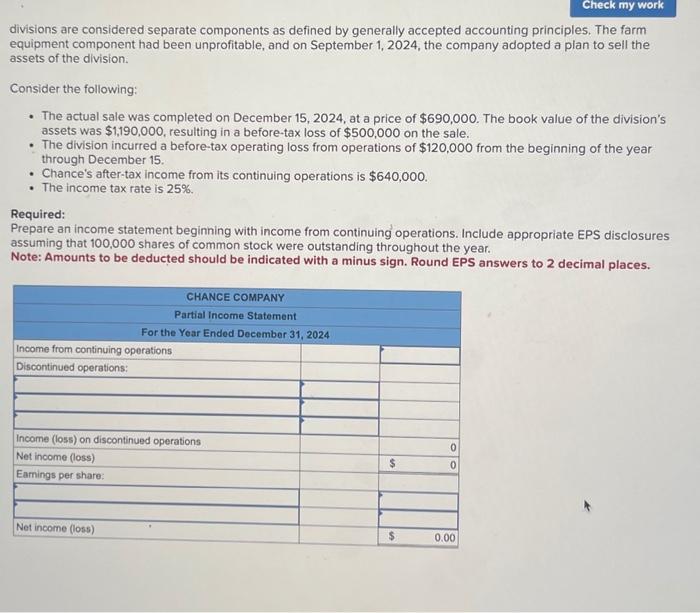

divisions are considered separate components as defined by generally accepted accounting principles. The farm equipment component had been unprofitable, and on September 1, 2024, the company adopted a plan to sell the assets of the division. Consider the following: - The actual sale was completed on December 15,2024 , at a price of $690,000. The book value of the division's assets was $1,190,000, resulting in a before-tax loss of $500,000 on the sale. - The division incurred a before-tax operating loss from operations of $120,000 from the beginning of the year through December 15. - Chance's after-tax income from its continuing operations is $640,000. - The income tax rate is 25%. Required: Prepare an income statement beginning with income from continuing operations. Include appropriate EPS disclosures assuming that 100,000 shares of common stock were outstanding throughout the year. Note: Amounts to be deducted should be indicated with a minus sign. Round EPS answers to 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts