Question: PLEASE HELP will leave a thumbs up 1. Jeff Falls, a heating system salesman, is single with 3 dependents. He earns $67,900 annually, and his

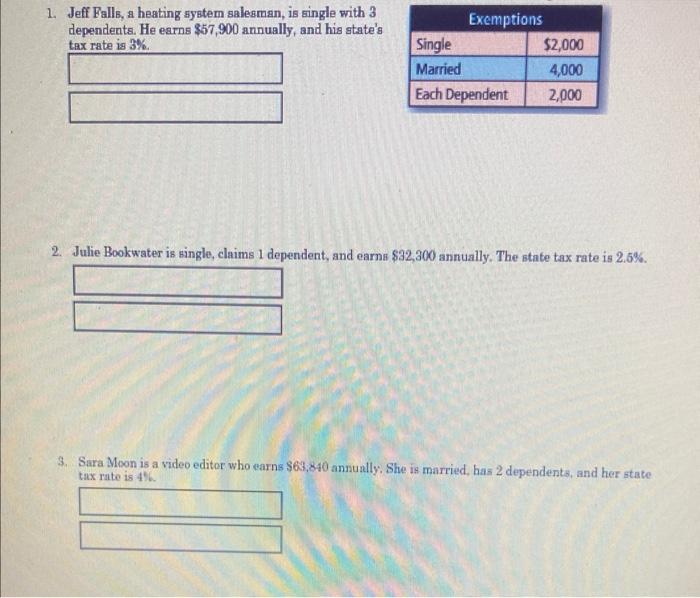

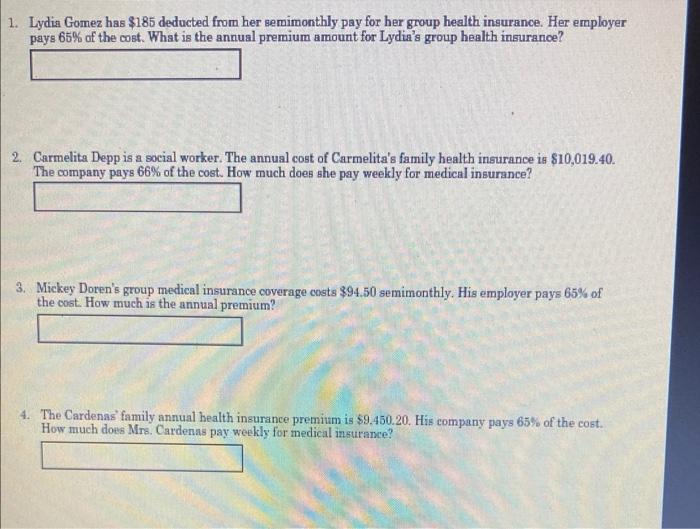

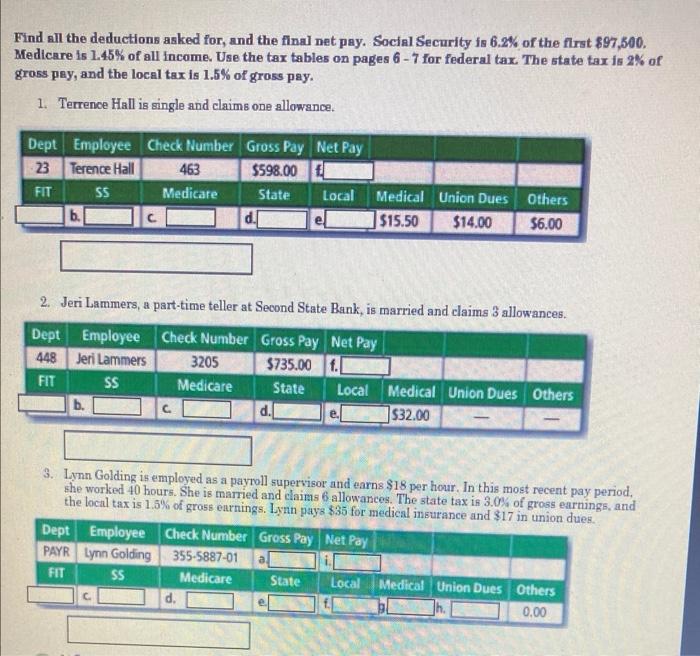

1. Jeff Falls, a heating system salesman, is single with 3 dependents. He earns $67,900 annually, and his state's tax rate is 3%. Exemptions Single $2,000 Married 4,000 Each Dependent 2,000 2. Julie Bookwater is single, claims 1 dependent, and earns $32,300 annually. The state tax rate is 2.6%. 3. Sara Moon is a video editor who earns $63,840 annually. She is married, has 2 dependents, and her state tax rate is 4% 1. Lydia Gomez has $185 deducted from her semimonthly pay for her group health insurance. Her employer pays 65% of the cost. What is the annual premium amount for Lydia's group health insurance? 2. Carmelita Depp is a social worker. The annual cost of Carmelita's family health insurance is $10,019.40. The company pays 66% of the cost. How much does she pay weekly for medical insurance? 3. Mickey Doren's group medical insurance coverage costs $94,50 semimonthly. His employer pays 65% of the cost. How much is the annual premium? 4. The Cardenas family annual health insurance premium is $9.450.20. His company pays 65% of the cost. How much does Mrs. Cardenas pay weekly for medical insurance? Find all the deductions asked for, and the final net pay. Social Security is 6.2% of the first $97,500. Medicare is 1.45% of all income. Use the tax tables on pages 6 - 7 for federal tax. The state tax is 2% of gross pay, and the local tax is 1.5% of gross pay. 1. Terrence Hall is single and claims one allowance. Dept Employee Check Number Gross Pay Net Pay 23 Terence Hall 463 $598.00 FIT SS Medicare State Local b. Medical Union Dues Others $15.50 $14.00 56.00 2. Jeri Lammers, a part-time teller at Second State Bank, is married and claims 3 allowances. Dept Employee Check Number Gross Pay Net Pay 448 Jeri Lammers 3205 $735.00 f. FIT SS Medicare State Local Medical Union Dues Others b. $32.00 C 3. Lynn Golding is employed as a payroll supervisor and earns $18 per hour. In this most recent pay period, she worked 40 hours. She is married and claims 6 allowances. The state tax is 3.0% of gross earnings, and the local tax is 1.5% of gross earnings. Lynn pays $35 for medical insurance and $17 in union dues. Dept Employee Check Number Gross Pay Net Pay PAYR Lynn Golding 355-5887-01 FIT SS Medicare State Local Medical Union Dues Others d. 0.00 C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts