Question: please help will rate!!! Question 28 1 pts The following information applies to the next two questions (28-29) Assume the annual T-bill rates in the

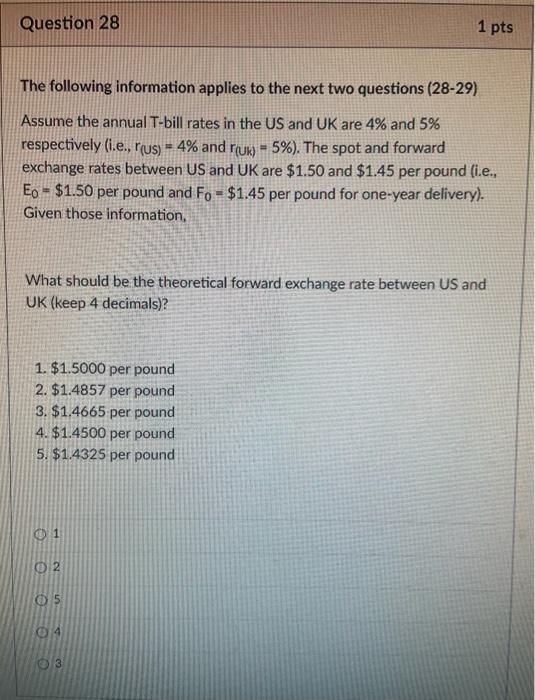

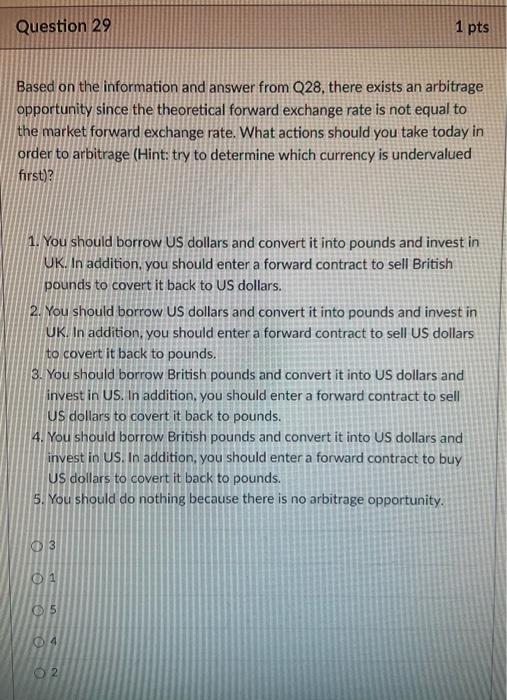

Question 28 1 pts The following information applies to the next two questions (28-29) Assume the annual T-bill rates in the US and UK are 4% and 5% respectively (i.e., rus) = 4% and r(uk) - 5%). The spot and forward exchange rates between US and UK are $1.50 and $1.45 per pound (i.e.. Eo - $1.50 per pound and Fo - $1.45 per pound for one-year delivery). Given those information, What should be the theoretical forward exchange rate between US and UK (keep 4 decimals)? 1. $1.5000 per pound 2. $1.4857 per pound 3. $1.4665 per pound 4. $1.4500 per pound 5. $1.4325 per pound 1 2 05 04 Question 29 1 pts Based on the information and answer from Q28, there exists an arbitrage opportunity since the theoretical forward exchange rate is not equal to the market forward exchange rate. What actions should you take today in order to arbitrage (Hint: try to determine which currency is undervalued first)? 1. You should borrow US dollars and convert it into pounds and invest in UK. In addition, you should enter a forward contract to sell British pounds to covert it back to US dollars. 2. You should borrow US dollars and convert it into pounds and invest in UK. In addition, you should enter a forward contract to sell US dollars to covert it back to pounds. 3. You should borrow British pounds and convert it into US dollars and invest in US. In addition, you should enter a forward contract to sell US dollars to covert it back to pounds. 4. You should borro British pounds and convert it into US dollars and invest in US. In addition, you should enter a forward contract to buy US dollars to covert it back to pounds. 5. You should do nothing because there is no arbitrage opportunity. 03 0 1 5 04 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts