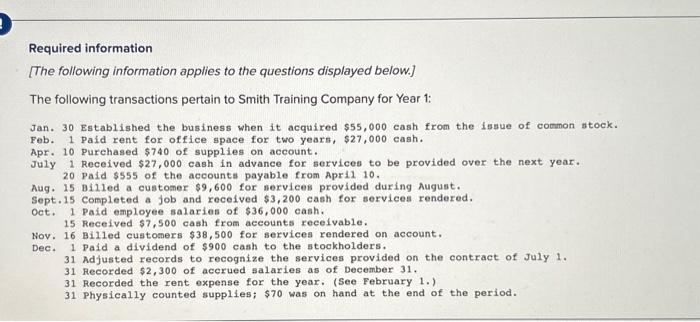

Question: Please help will thumbs up!! Please help 1 Established the business when it acquired $55,000 cash from the issue of common stock. 2 Paid rent

Please help will thumbs up!!

![information applies to the questions displayed below.] The following transactions pertain to](https://s3.amazonaws.com/si.experts.images/answers/2024/09/66e1967246dda_14566e19671d0b00.jpg)

Please help

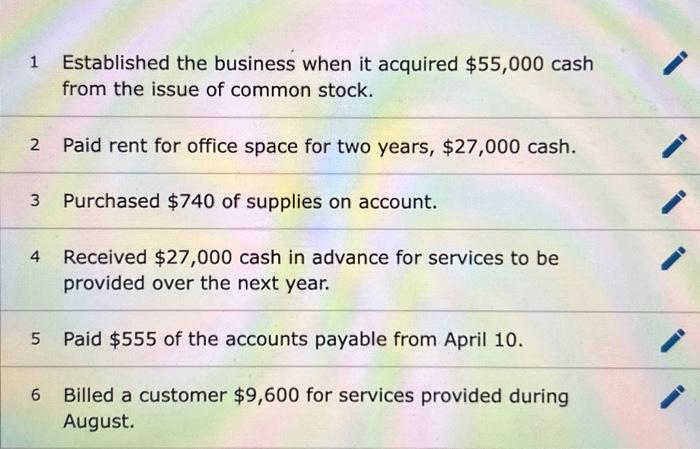

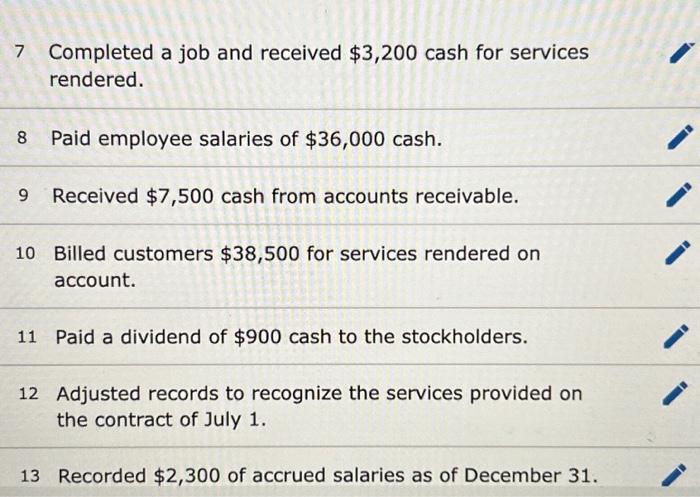

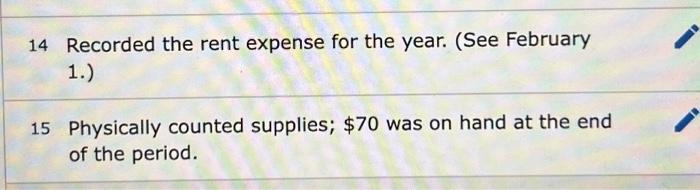

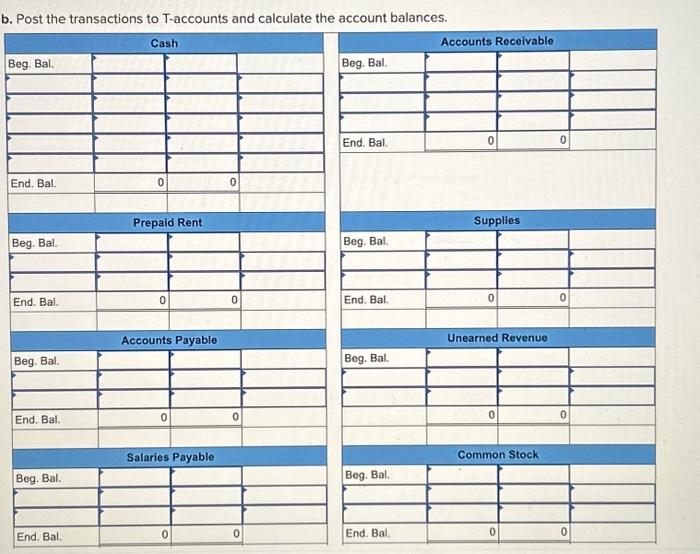

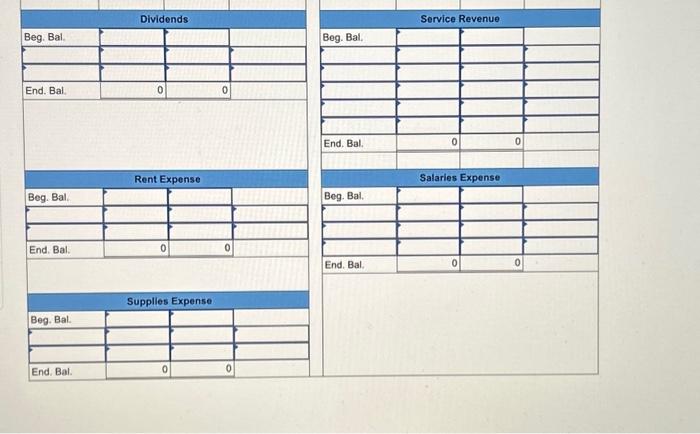

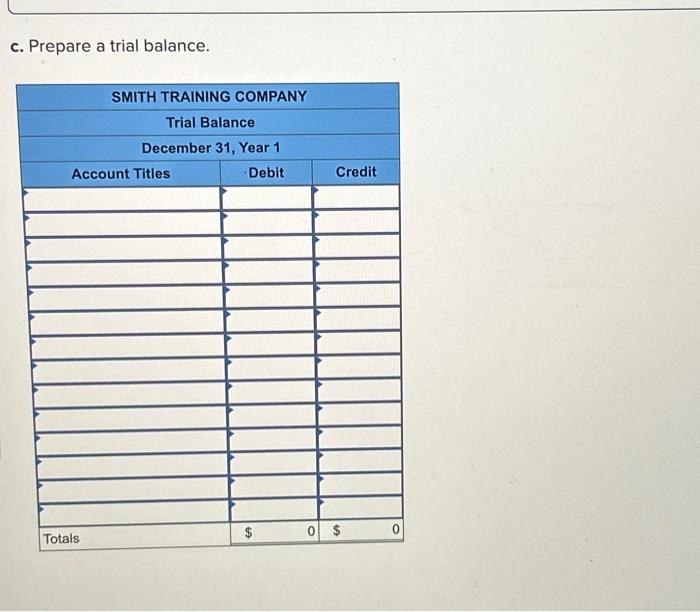

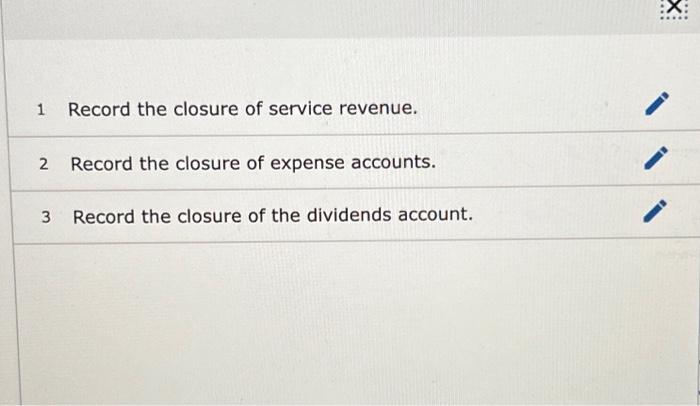

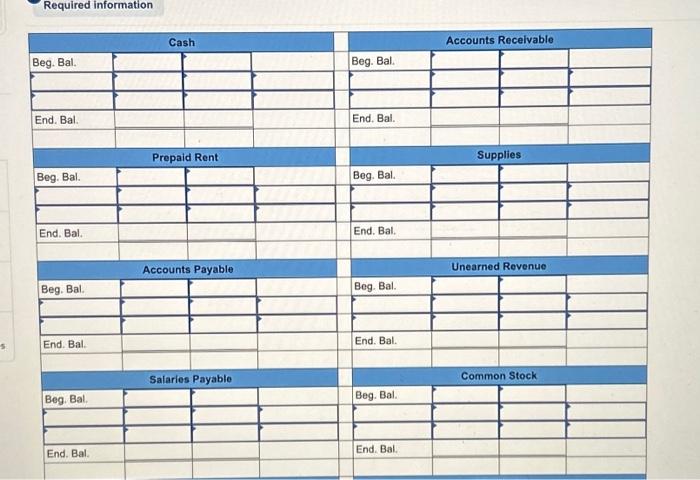

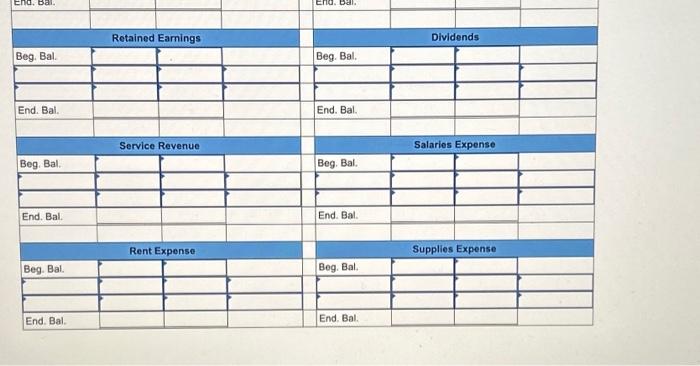

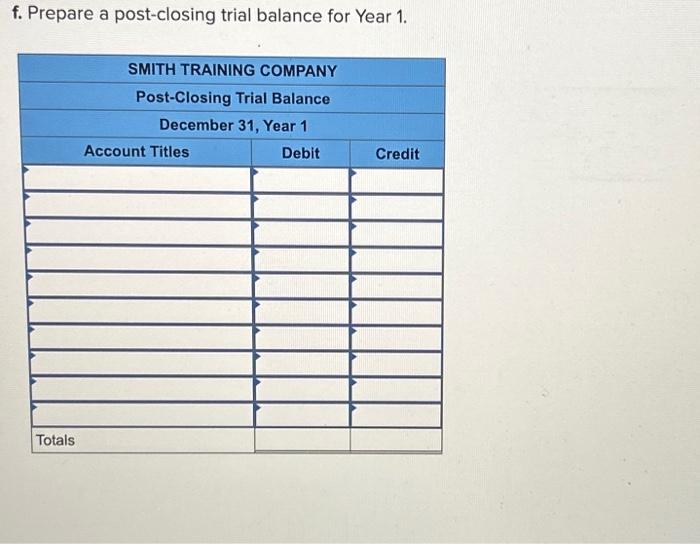

1 Established the business when it acquired $55,000 cash from the issue of common stock. 2 Paid rent for office space for two years, $27,000 cash. 3 Purchased $740 of supplies on account. 4 Received $27,000 cash in advance for services to be provided over the next year. 5 Paid $555 of the accounts payable from April 10. 6 Billed a customer $9,600 for services provided during August. c. Prepare a trial balance. Required information [The following information applies to the questions displayed below.] The following transactions pertain to Smith Training Company for Year 1: Jan. 30 Established the business when it acquired $55,000 cash from the issue of common stock. Feb. 1 paid rent for office space for two years, $27,000 cash. Apr. 10 Purchased $740 of supplies on account. July 1 Received $27,000 cash in advance for services to be provided over the next year. 20 Pald $555 of the accounts payable from Apri1 10. Aug. 15 Billed a customer $9,600 for nervices provided during August. Sept. 15 Completed a job and received $3,200 cash for services rendered. oct. I paid employee salaries of $36,000 eash. 15 Received $7,500 cash from accounts receivable. Nov. 16 Billed customers $38,500 for services rendered on account. Dec. 1 Paid a dividend of $900 cash to the stockholders. 31 Adjusted records to recognize the services provided on the contract of July 1. 31 Recorded $2,300 of accrued salaries as of December 31 . 31 Recorded the rent expense for the year. (See February 1.) 31 Physically counted supplies; $70 was on hand at the end of the period. 7 Completed a job and received $3,200 cash for services rendered. 8 Paid employee salaries of $36,000 cash. 9 Received $7,500 cash from accounts receivable. 10 Billed customers $38,500 for services rendered on account. 11 Paid a dividend of $900 cash to the stockholders. 12 Adjusted records to recognize the services provided on the contract of July 1 . 13 Recorded $2,300 of accrued salaries as of December 31 . \begin{tabular}{|l|l|l|l|l|l|l|l|} \hline & & & & & & & \\ \hline \end{tabular} Required information \begin{tabular}{|l|l|l|l|} \hline Beg. Bal. & & & \multicolumn{2}{|c|}{ Cash } \\ \hline & & & \\ \hline & & & \\ \hline End. Bal. & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|} \hline Beg. Bal. & & & \\ \hline & & & \\ \hline & & & \\ \hline End. Bal. & & & \\ \hline & & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|} \hline Beg. Bal. & & & \multicolumn{2}{|c|}{ Prepaid Rent } \\ \hline & & & \\ \hline & & & \\ \hline End. Bal. & & & \\ \hline & & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|} \hline Beg. Bal. & & \multicolumn{3}{|c|}{ Supplies } \\ \hline & & & \\ \hline & & & \\ \hline End. Bal. & & & \\ \hline & & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|} \hline Beg. Bal. & & \multicolumn{3}{|c|}{ Accounts Payable } \\ \hline & & & \\ \hline & & & \\ \hline End. Bal. & & & \\ \hline & & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|} \hline Beg. Bal. & & \multicolumn{3}{|c|}{ Unearned Revenue } \\ \hline & & & \\ \hline & & & \\ \hline End. Bal. & & & \\ \hline & & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|} \hline \multicolumn{3}{|c|}{ Salaries Payable } \\ \hline Beg. Bal. & & & \\ \hline & & & \\ \hline & & & \\ \hline End. Bal. & & & \\ \hline & & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|} \hline \multicolumn{3}{|c|}{ Common Stock } \\ \hline Beg. Bal. & & & \\ \hline & & & \\ \hline & & & \\ \hline End. Bal. & & & \\ \hline & & & \\ \hline \end{tabular} b. Post the transactions to T-accounts and calculate the account balances. d. Prepare the income statement, statement of changes in stockholders' equity, balance sheet, and statement of cash flows for Year (Statement of Cash Flows only, enter any decreases to account balances and cash outflows with a minus sign.) f. Prepare a post-closing trial balance for Year 1 . 1 Record the closure of service revenue. 2 Record the closure of expense accounts. 3 Record the closure of the dividends account

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts