Question: please help! will thumbs up! Problem 1. (30 Points) On March 30, 2023, the euro's spot exchange rate and its 3-month forward exchange rate are

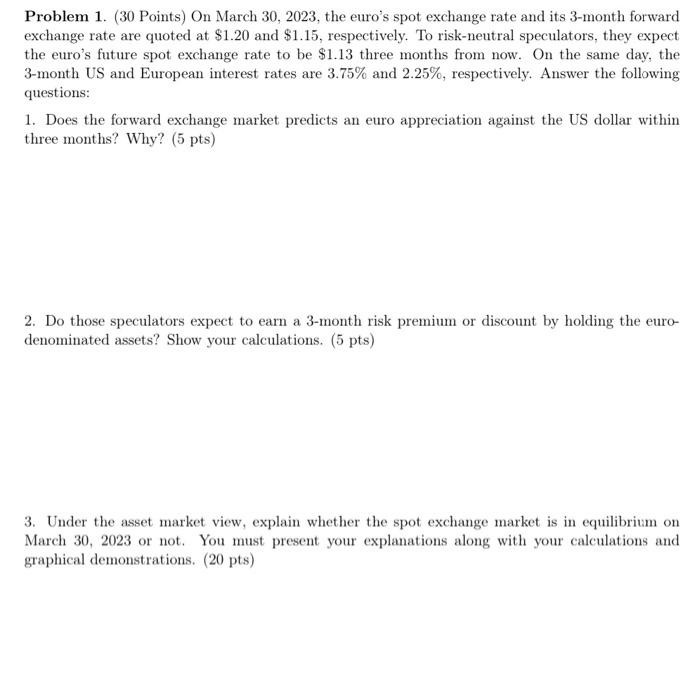

Problem 1. (30 Points) On March 30, 2023, the euro's spot exchange rate and its 3-month forward exchange rate are quoted at $1.20 and $1.15, respectively. To risk-neutral speculators, they expect the euro's future spot exchange rate to be $1.13 three months from now. On the same day, the 3-month US and European interest rates are 3.75% and 2.25%, respectively. Answer the following questions: 1. Does the forward exchange market predicts an euro appreciation against the US dollar within three months? Why? (5 pts) 2. Do those speculators expect to earn a 3-month risk premium or discount by holding the eurodenominated assets? Show your calculations. (5 pts) 3. Under the asset market view, explain whether the spot exchange market is in equilibritum on March 30, 2023 or not. You must present your explanations along with your calculations and graphical demonstrations. (20 pts)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts