Question: please help!! will thunbs up!!! Rapido, LLC uses machine hours as the activity base for its manufacturing overhead. The estimate of annual overhead costs for

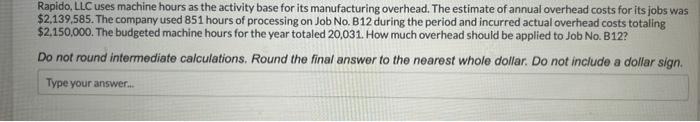

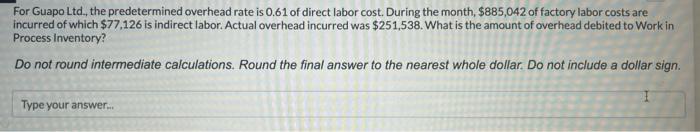

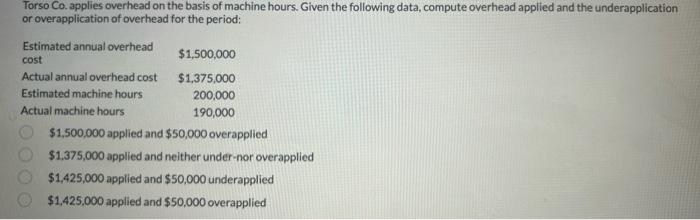

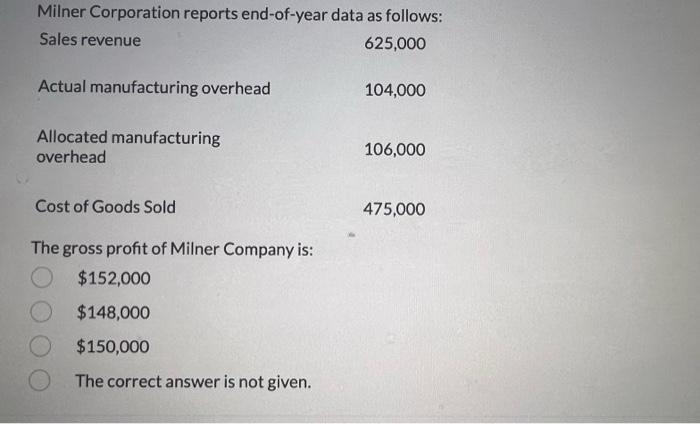

Rapido, LLC uses machine hours as the activity base for its manufacturing overhead. The estimate of annual overhead costs for its jobs was $2,139,585. The company used 851 hours of processing on Job No. B12 during the period and incurred actual overhead costs totaling $2,150,000. The budgeted machine hours for the year totaled 20,031. How much overhead should be applied to Job No. B12? Do not round intermediate calculations. Round the final answer to the nearest whole dollar. Do not include a dollar sign. Typeyour answer... For Guapo Ltd., the predetermined overhead rate is 0.61 of direct labor cost. During the month, $885,042 of factory labor costs are incurred of which $77,126 is indirect labor. Actual overhead incurred was $251,538. What is the amount of overhead debited to Work in Process inventory? Do not round intermediate calculations. Round the final answer to the nearest whole dollar. Do not include a dollar sign. Torso Co. applies overhead on the basis of machine hours. Given the following data, compute overhead applied and the underapplication or overapplication of overhead for the period: $1,500,000 applied and $50,000 overapplied $1,375,000 applied and neither under-nor overapplied $1,425,000 applied and $50,000 underapplied $1,425,000 applied and $50,000 overapplied The gross profit of Milner Company is: $152,000 $148,000 $150,000 The correct answer is not given

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts