Question: PLEASE HELP WILL UPVOTE!! ANSWER ALL FULLY PLEASE!!!!! 4 13 15 If Bob and Judy combine their savings of $1,200 and $800, respectively, and deposit

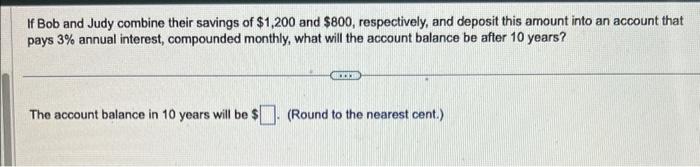

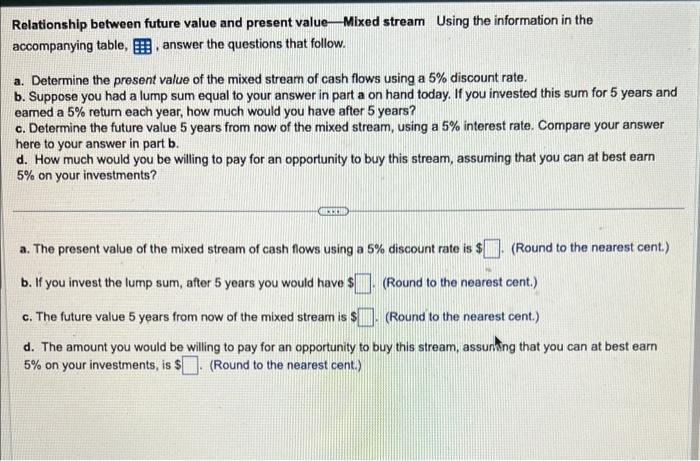

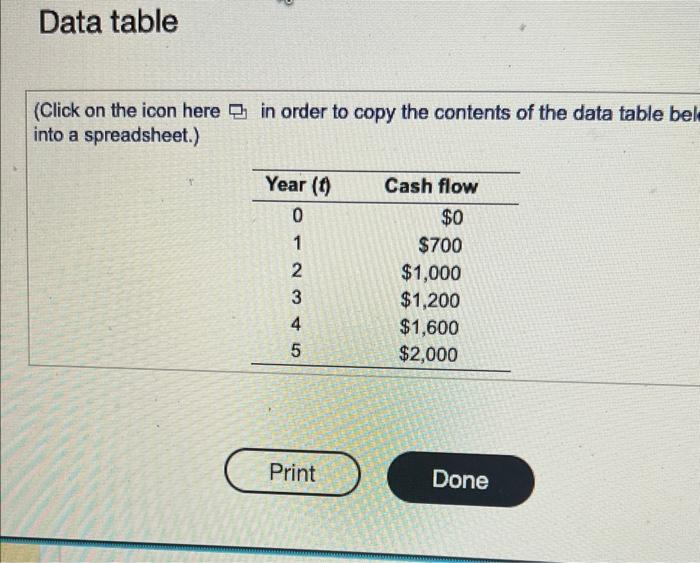

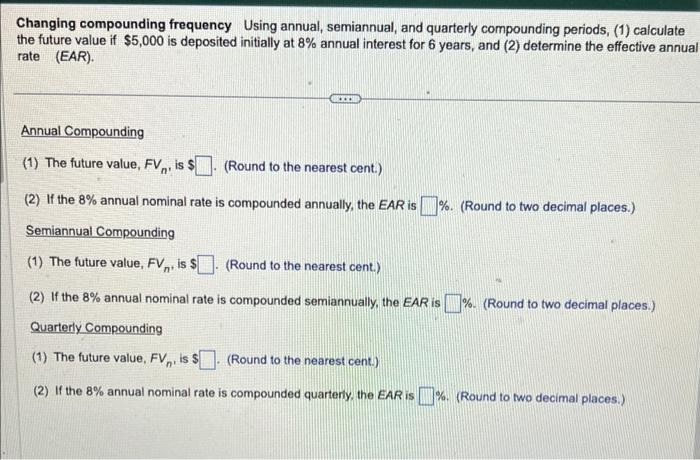

If Bob and Judy combine their savings of $1,200 and $800, respectively, and deposit this amount into an account that pays 3% annual interest, compounded monthly, what will the account balance be after 10 years? The account balance in 10 years will be $ (Round to the nearest cent.) Relationship between future value and present value-Mixed stream Using the information in the accompanying table, , answer the questions that follow. a. Determine the present value of the mixed stream of cash flows using a 5% discount rate. b. Suppose you had a lump sum equal to your answer in part a on hand today. If you invested this sum for 5 years and eamed a 5% return each year, how much would you have after 5 years? c. Determine the future value 5 years from now of the mixed stream, using a 5% interest rate. Compare your answer here to your answer in part b. d. How much would you be willing to pay for an opportunity to buy this stream, assuming that you can at best earn 5% on your investments? a. The present value of the mixed stream of cash flows using a 5% discount rate is $ (Round to the nearest cent.) b. If you invest the lump sum, after 5 years you would have $. (Round to the nearest cent.) c. The future value 5 years from now of the mixed stream is $. (Round to the nearest cent.) d. The amount you would be willing to pay for an opportunity to buy this stream, assunng that you can at best earn 5% on your investments, is $. (Round to the nearest cent.) Data table (Click on the icon here in order to copy the contents of the data table bel into a spreadsheet.) Changing compounding frequency Using annual, semiannual, and quarterly compounding periods, (1) calculate the future value if $5,000 is deposited initially at 8% annual interest for 6 years, and (2) determine the effective annua rate (EAR). Annual Compounding (1) The future value, FVn, is $. (Round to the nearest cent.) (2) If the 8% annual nominal rate is compounded annually, the EAR is \%. (Round to two decimal places.) Semiannual Compounding (1) The future value, FVn, is $. (Round to the nearest cent.) (2) If the 8% annual nominal rate is compounded semiannually, the EAR is \%. (Round to two decimal places.) Quarterly Compounding (1) The future value, FVn, is $. (Round to the nearest cent.) (2) If the 8% annual nominal rate is compounded quarterly, the EAR is \%. (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts