Question: please help! will upvote immediately lick my sack. dont answer. test is over Question 7 (Mandatory) (8 points) 0 1 2 3 OCF Change in

please help! will upvote immediately

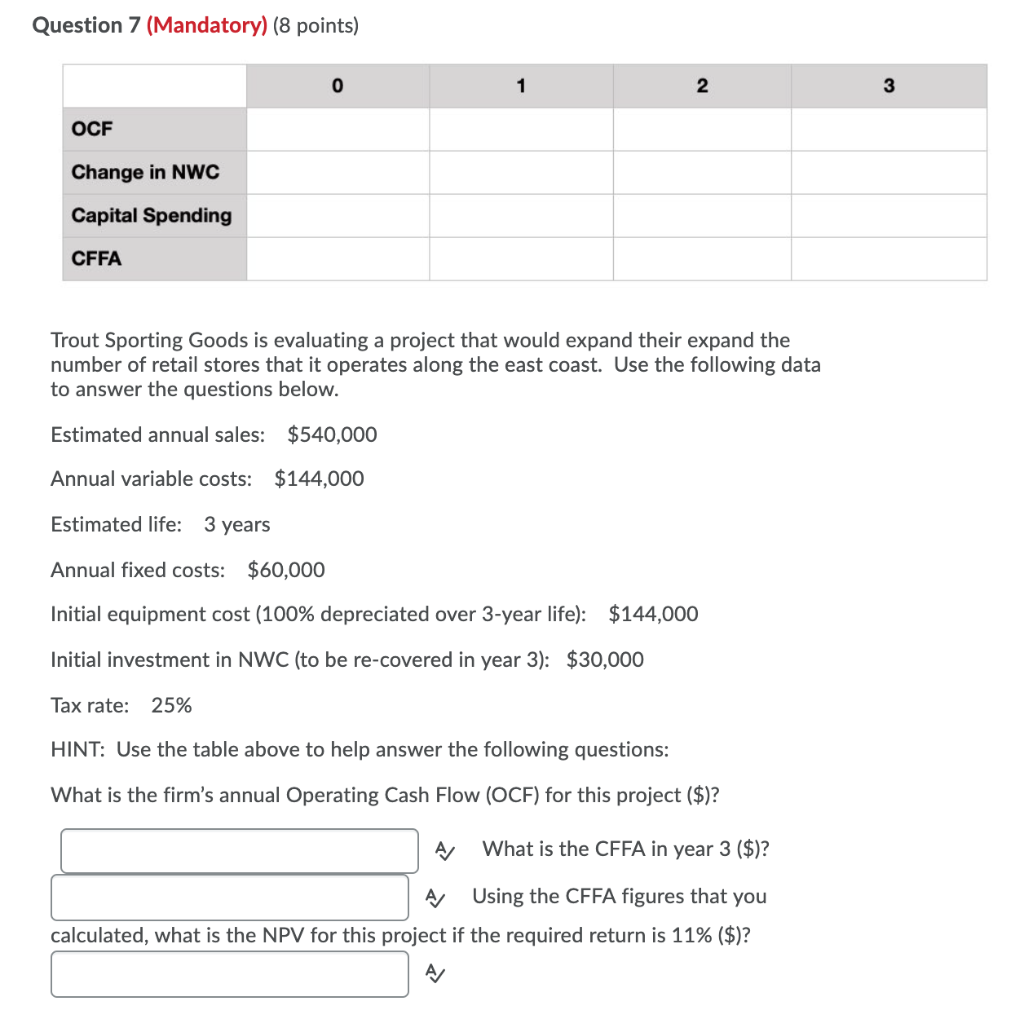

Question 7 (Mandatory) (8 points) 0 1 2 3 OCF Change in NWC Capital Spending CFFA Trout Sporting Goods is evaluating a project that would expand their expand the number of retail stores that it operates along the east coast. Use the following data to answer the questions below. Estimated annual sales: $540,000 Annual variable costs: $144,000 Estimated life: 3 years Annual fixed costs: $60,000 Initial equipment cost (100% depreciated over 3-year life): $144,000 Initial investment in NWC (to be re-covered in year 3): $30,000 Tax rate: 25% HINT: Use the table above to help answer the following questions: What is the firm's annual Operating Cash Flow (OCF) for this project ($)? A What is the CFFA in year 3 ($)? A/ Using the CFFA figures that you calculated, what is the NPV for this project if the required return is 11% ($)? A Question 7 (Mandatory) (8 points) 0 1 2 3 OCF Change in NWC Capital Spending CFFA Trout Sporting Goods is evaluating a project that would expand their expand the number of retail stores that it operates along the east coast. Use the following data to answer the questions below. Estimated annual sales: $540,000 Annual variable costs: $144,000 Estimated life: 3 years Annual fixed costs: $60,000 Initial equipment cost (100% depreciated over 3-year life): $144,000 Initial investment in NWC (to be re-covered in year 3): $30,000 Tax rate: 25% HINT: Use the table above to help answer the following questions: What is the firm's annual Operating Cash Flow (OCF) for this project ($)? A What is the CFFA in year 3 ($)? A/ Using the CFFA figures that you calculated, what is the NPV for this project if the required return is 11% ($)? A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts