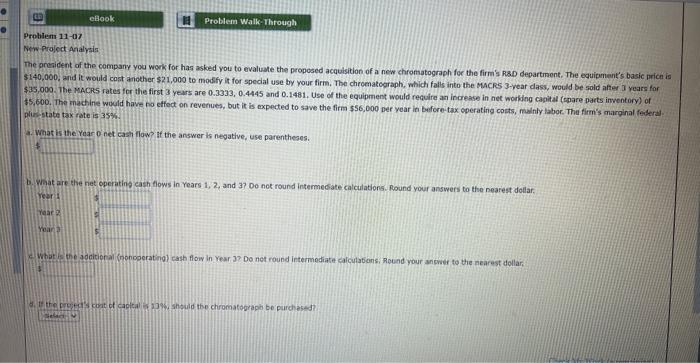

Question: Please help! Will upvote, thank you!! New Project Aralysis The preaident of the company you work for has asked you to evaluate the proposed acquisition

New Project Aralysis The preaident of the company you work for has asked you to evaluate the proposed acquisition of a new chromatograph for the firm's RaD departmont, The equipment's basic orice is \$140,000, and it would cost another $21,000 to modify it for special use by your firm. The chroenatograph, mhidh falls into the Macrs 3-wear dass, woeld be sold after 3 years for $35,000. The Macres rates for the first 3 years are 0.3333,0.4445 and 0.1481 . Use of the equipment would require an increase in net worklng capital (cpare parts inventory) of 5, 600. The machirie would have no effect on revenues, but it is expected to save the firm $56,000 per year in before-tax cperating costs, mulnly laboe. The firm's marginal federat. plisstate tak rate is 35% 1. What is the voar o' net cash flow? if the answer is negative, use parentheses. b. What are the net operating cash flows in Years 1, 2, and 3 ? Do not round intermedate calculations. Round your answers to the nearest dollar. Brear th Tear 7 Pris Yons 3 6. What is the additioral (nonoperating) eash flow in Year 3? Do net round intermediate calculabonsi gound your ancwer to the nearest dollar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts