Question: Please HELP!!! Williams Tax Service The Mid-Term Problem covers a monthly accounting cycle for Williams Tax Service, a sole proprietorship which is owned by John

Please HELP!!!

Please HELP!!!

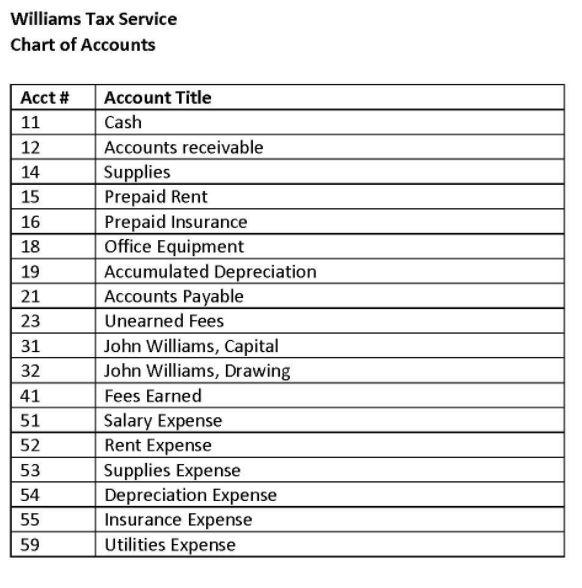

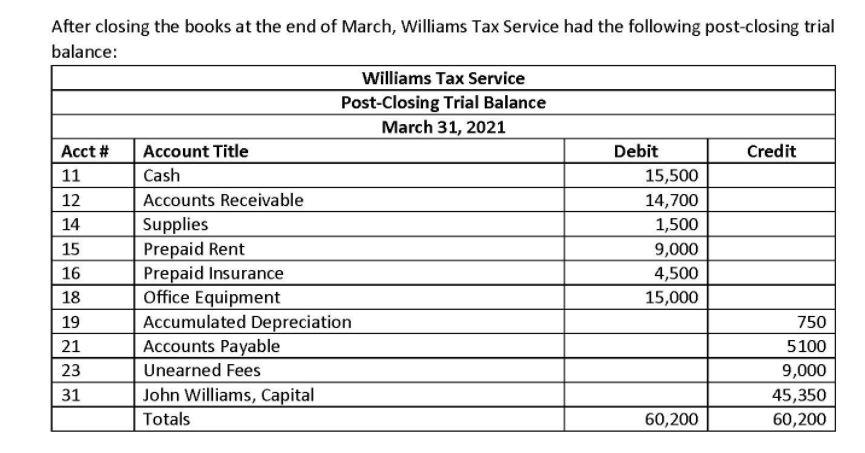

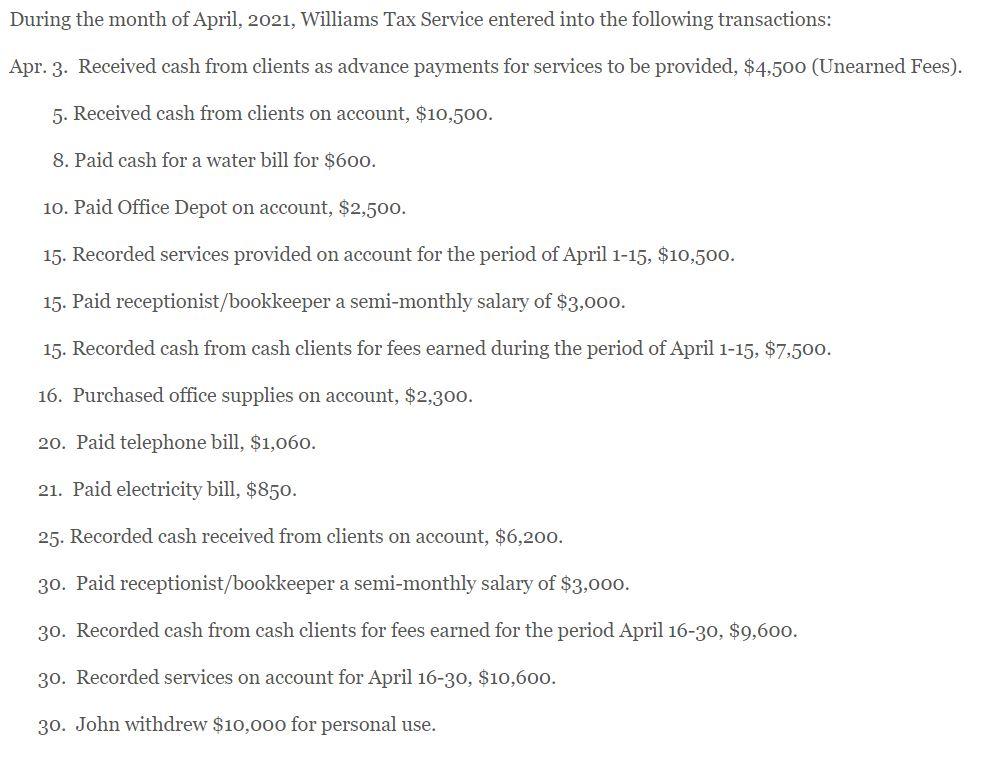

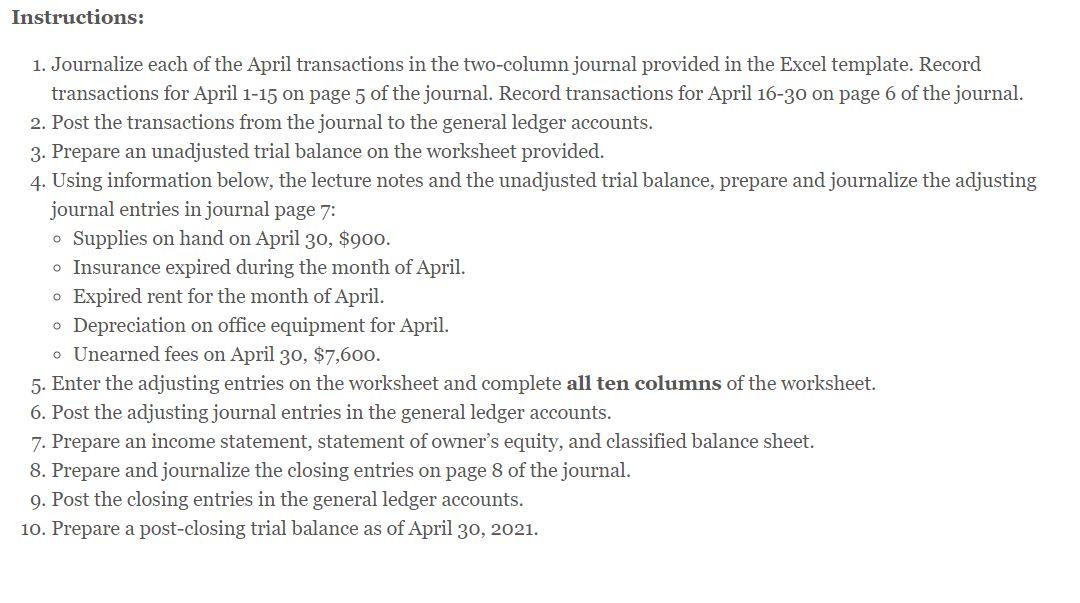

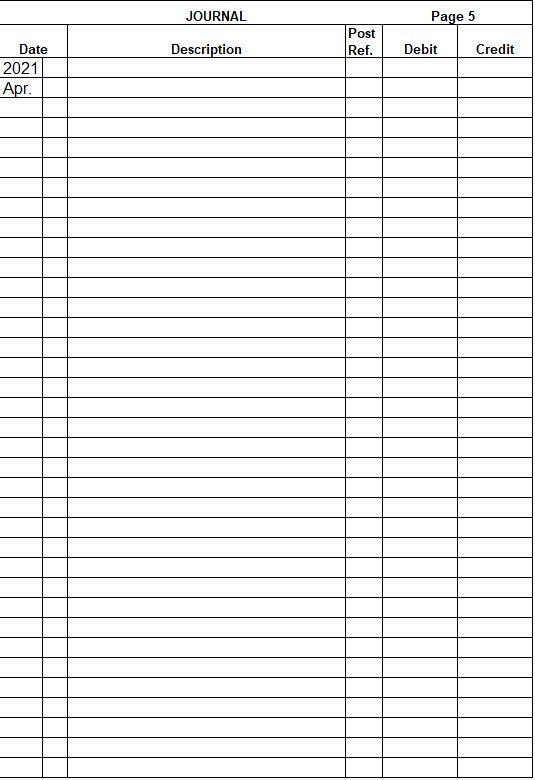

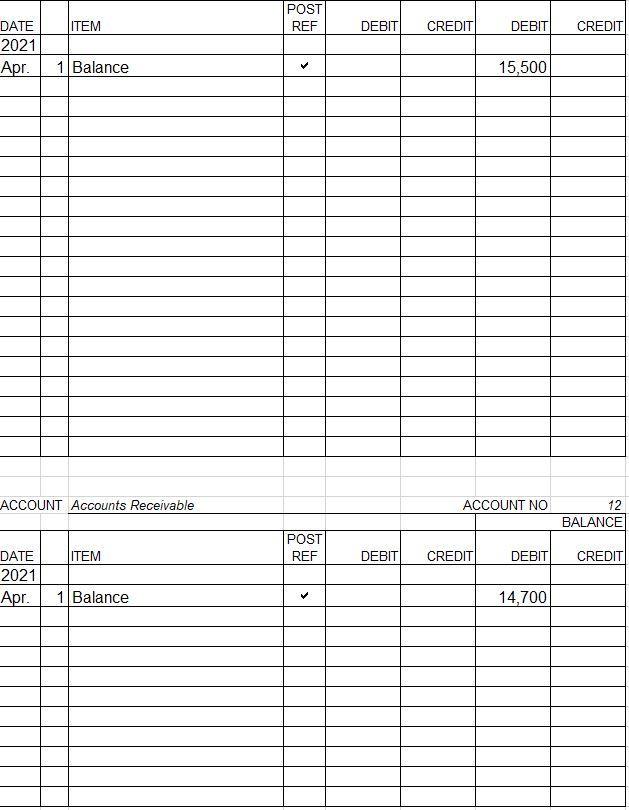

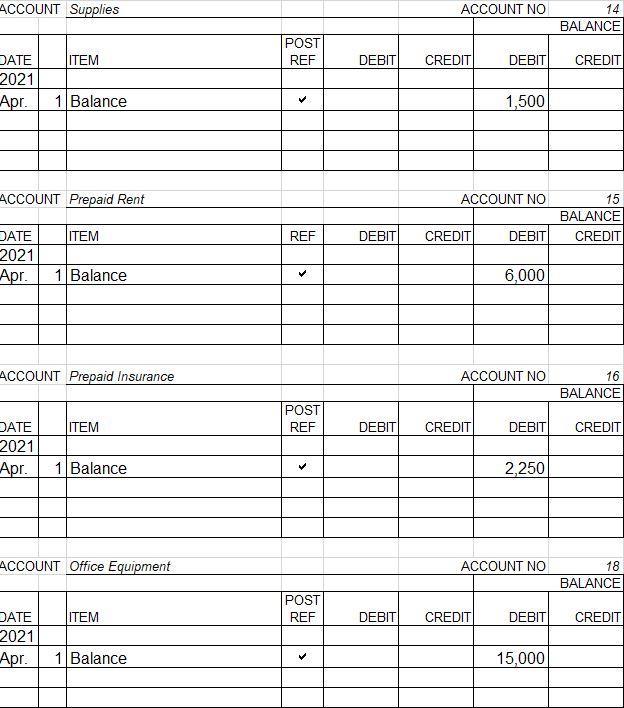

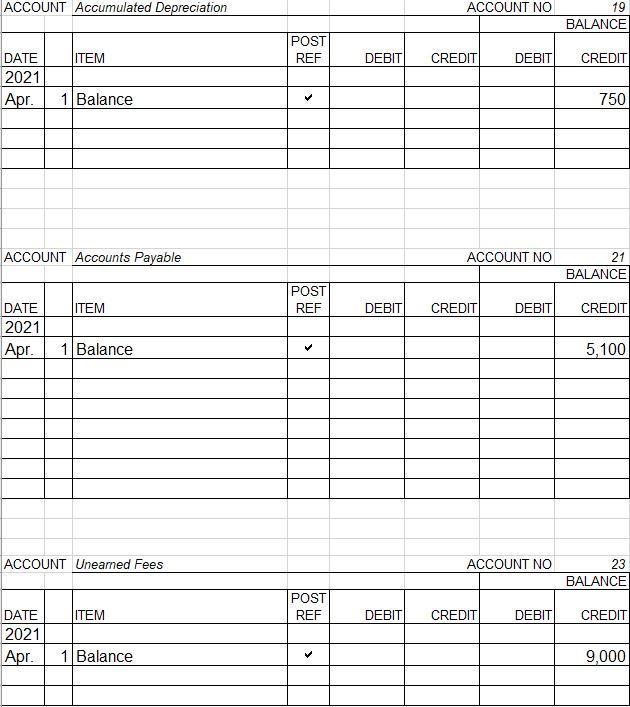

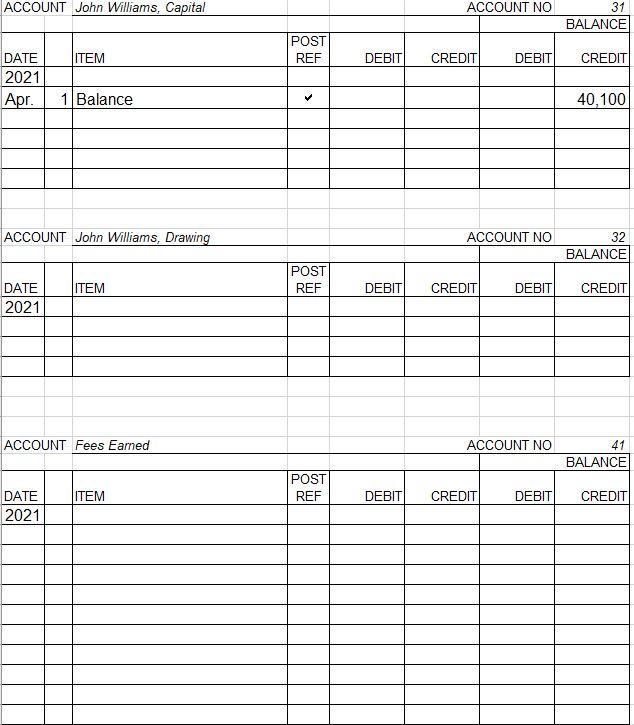

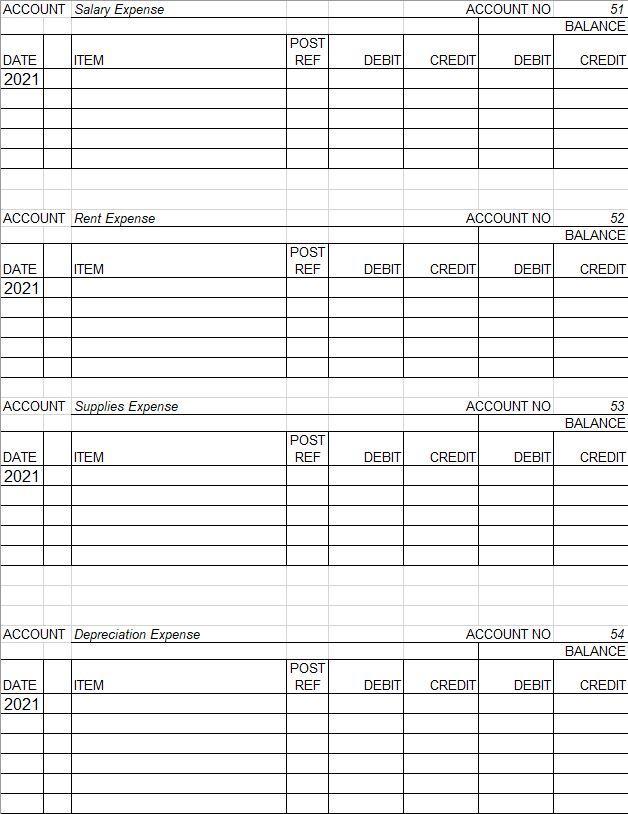

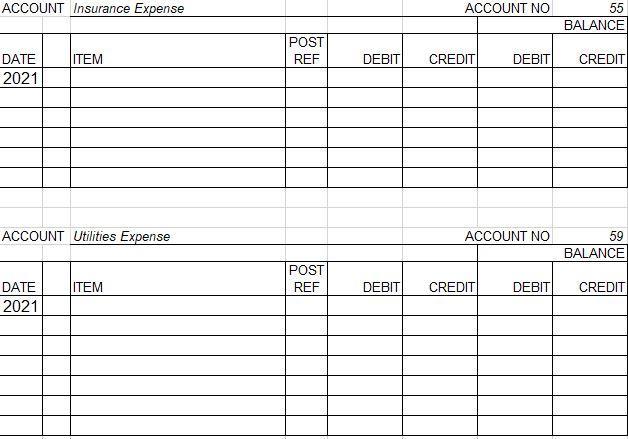

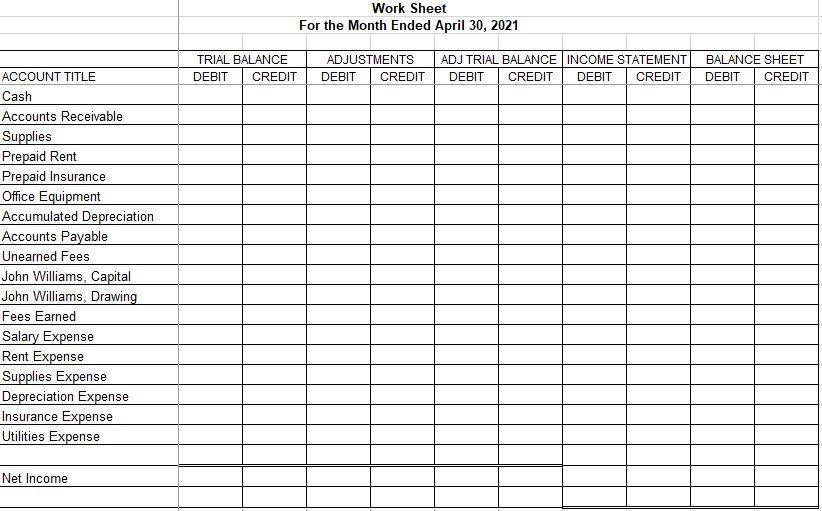

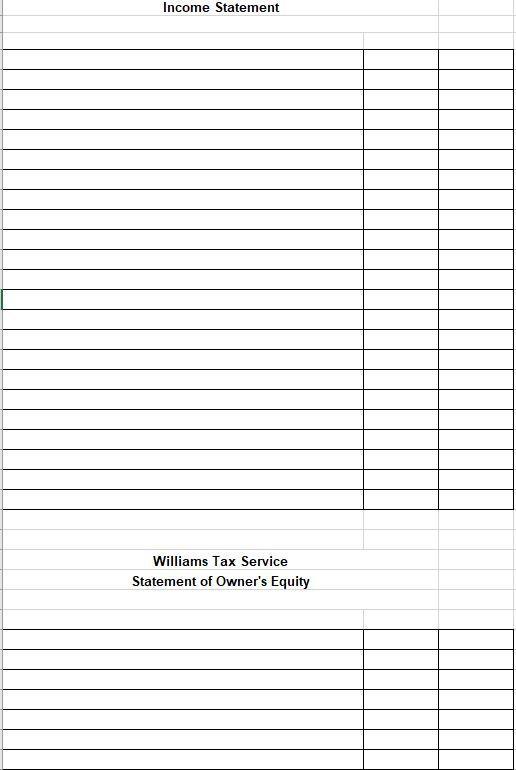

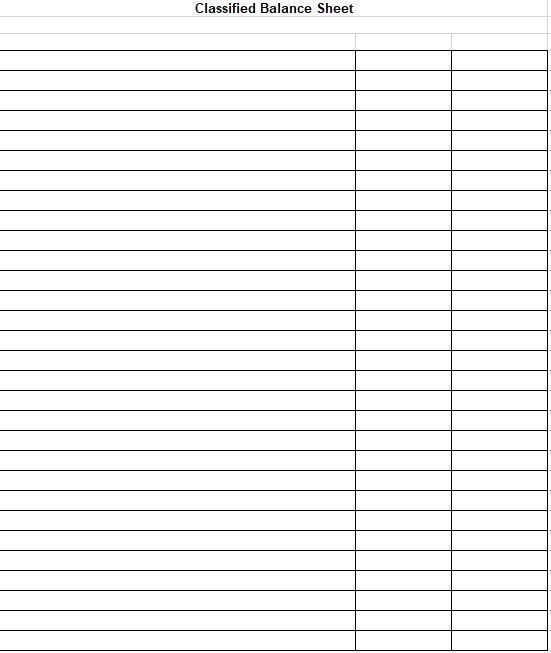

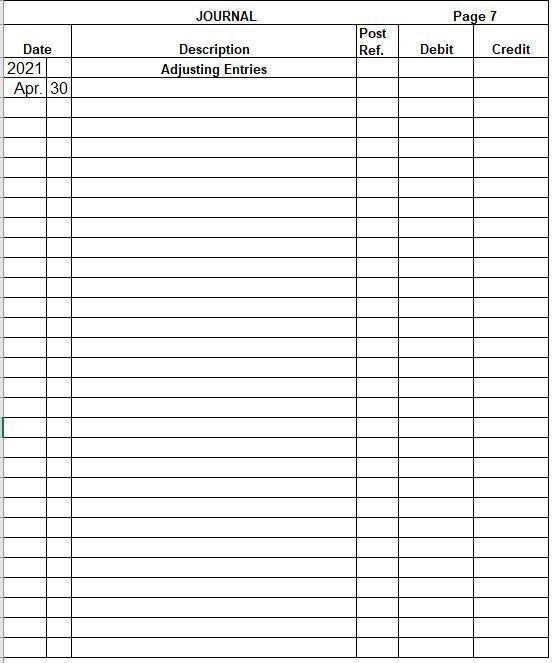

Williams Tax Service The Mid-Term Problem covers a monthly accounting cycle for Williams Tax Service, a sole proprietorship which is owned by John Williams. The business operations began on January 1, 2021. Williams Tax Service is a service organization and is located at 123 South Main Street in Graham, North Carolina. The company employs one employee, a receptionist/bookkeeper, Margaret Simmons, who is paid semi-monthly. Williams Tax Service rents the building they operate in and prepaid $12,000 for twelve months rent on January 1, 2021. Rent expense is allocated monthly. They also prepaid $6,000 for a twelve-month insurance policy on January 1, 2021, and allocate insurance expense monthly for expired insurance. To help in the operations of the business, Williams Tax Service purchased $15,000 worth of equipment on January 1, 2021 which will be depreciated over five years (60 months) at $250 per month. Williams Tax Service accepts both cash and credit (on account) from their clients, and have some clients who wish to pay in advance for their services (unearned fees). These fees are taken into Fees Earned as they are earned. Williams Tax Service prepares monthly financial statements, including the Income Statement, the Statement of Owner's Equity, and a Classified Balance Sheet. These statements are distributed internally as well as to outside users such as creditors and clients. A chart of accounts for Williams Tax Service is given, along with a post-closing trial balance for March 30, 2021. You will use the Excel template provided in Chapter 4 of this booklet to complete the activities for the month of April. The general ledger includes beginning balances for April. Williams Tax Service Chart of Accounts Acct # 11 12 14 16 18 19 21 23 Account Title Cash Accounts receivable Supplies Prepaid Rent Prepaid Insurance Office Equipment Accumulated Depreciation Accounts Payable Unearned Fees John Williams, Capital John Williams, Drawing Fees Earned Salary Expense Rent Expense Supplies Expense Depreciation Expense Insurance Expense Utilities Expense 31 32 41 51 52 53 54 55 59 After closing the books at the end of March, Williams Tax Service had the following post-closing trial balance: Williams Tax Service Post-Closing Trial Balance March 31, 2021 Acct # Account Title Debit Credit 11 Cash 15,500 12 Accounts Receivable 14,700 14 Supplies 1,500 15 Prepaid Rent 9,000 16 Prepaid Insurance 4,500 18 Office Equipment 15,000 Accumulated Depreciation 750 21 Accounts Payable 5100 23 Unearned Fees 9,000 31 John Williams, Capital 45,350 Totals 60,200 60,200 19 During the month of April, 2021, Williams Tax Service entered into the following transactions: Apr. 3. Received cash from clients as advance payments for services to be provided, $4,500 (Unearned Fees). 5. Received cash from clients on account, $10,500. 8. Paid cash for a water bill for $600. 10. Paid Office Depot on account, $2,500. 15. Recorded services provided on account for the period of April 1-15, $10,500. 15. Paid receptionist/bookkeeper a semi-monthly salary of $3,000. 15. Recorded cash from cash clients for fees earned during the period of April 1-15, $7,500. 16. Purchased office supplies on account, $2,300. 20. Paid telephone bill, $1,060. 21. Paid electricity bill, $850. 25. Recorded cash received from clients on account, $6,200. 30. Paid receptionist/bookkeeper a semi-monthly salary of $3,000. 30. Recorded cash from cash clients for fees earned for the period April 16-30, $9,600. 30. Recorded services on account for April 16-30, $10,600. 30. John withdrew $10,000 for personal use. Instructions: 1. Journalize each of the April transactions in the two-column journal provided in the Excel template. Record transactions for April 1-15 on page 5 of the journal. Record transactions for April 16-30 on page 6 of the journal. 2. Post the transactions from the journal to the general ledger accounts. 3. Prepare an unadjusted trial balance on the worksheet provided. 4. Using information below, the lecture notes and the unadjusted trial balance, prepare and journalize the adjusting journal entries in journal page 7: o Supplies on hand on April 30, $900. o Insurance expired during the month of April. Expired rent for the month of April. o Depreciation on office equipment for April. - Unearned fees on April 30, $7,600. 5. Enter the adjusting entries on the worksheet and complete all ten columns of the worksheet. 6. Post the adjusting journal entries in the general ledger accounts. 7. Prepare an income statement, statement of owner's equity, and classified balance sheet. 8. Prepare and journalize the closing entries on page 8 of the journal. 9. Post the closing entries in the general ledger accounts. 10. Prepare a post-closing trial balance as of April 30, 2021. JOURNAL Page 5 Post Ref. Description Debit Credit Date 2021 Apr. POST REF ITEM DEBIT CREDIT DEBIT CREDIT DATE 2021 Apr. 1 Balance 15,500 ACCOUNT Accounts Receivable ACCOUNT NO 12 BALANCE POST REF ITEM DEBIT CREDIT DEBIT CREDIT DATE 2021 Apr. 1 Balance V 14,700 ACCOUNT Supplies ACCOUNT NO 14 BALANCE POST REF ITEM DEBIT CREDIT DEBIT CREDIT DATE 2021 Apr. 1 Balance 1,500 ACCOUNT Prepaid Rent ACCOUNT NO 15 BALANCE CREDIT ITEM REF DEBIT CREDIT DEBIT DATE 2021 Apr. 1 Balance 6,000 ACCOUNT Prepaid Insurance ACCOUNT NO 16 BALANCE POST REF ITEM DEBIT CREDIT DEBIT CREDIT DATE 2021 Apr. 1 Balance 2,250 ACCOUNT Office Equipment ACCOUNT NO 18 BALANCE POST REF ITEM DEBIT CREDIT DEBIT CREDIT DATE 2021 Apr. 1 Balance V 15,000 ACCOUNT Accumulated Depreciation ACCOUNT NO 19 BALANCE POST REF | | DEBIT CREDIT DEBIT CREDIT DATE 2021 Apr. 1 Balance 750 ACCOUNT Accounts Payable ACCOUNT NO 21 BALANCE POST REF ITEM DEBIT CREDIT DEBIT CREDIT DATE 2021 Apr. 1 Balance 5,100 ACCOUNT Uneamed Fees ACCOUNT NO 23 BALANCE POST REF ITEM DEBIT CREDIT DEBITI CREDIT DATE 2021 Apr. 1 Balance 9,000 ACCOUNT John Williams, Capital ACCOUNT NO 31 BALANCE POST ITEM REF DEBIT CREDIT DEBIT CREDIT DATE 2021 Apr. 1 Balance 40,100 ACCOUNT John Williams, Drawing ACCOUNT NO 32 BALANCE POST REF ITEM DEBIT CREDIT DEBIT CREDIT DATE 2021 ACCOUNT Fees Earned ACCOUNT NO 41 BALANCE POST REF ITEM DEBIT CREDIT DEBIT CREDIT DATE 2021 ACCOUNT Salary Expense ACCOUNT NO 51 BALANCE POST REF ITEM DEBIT CREDIT DEBIT CREDIT DATE 2021 ACCOUNT Rent Expense ACCOUNT NO 52 BALANCE POST REF ITEM DEBIT CREDIT DEBIT CREDIT DATE 2021 ACCOUNT Supplies Expense ACCOUNT NO 53 BALANCE POST REF ITEM DEBIT CREDIT DEBIT CREDIT DATE 2021 ACCOUNT Depreciation Expense ACCOUNT NO 54 BALANCE POST REF ITEM DEBIT CREDIT DEBIT CREDIT DATE 2021 ACCOUNT Insurance Expense ACCOUNT NO 55 BALANCE POST REF ITEM DEBIT CREDIT DEBIT CREDIT DATE 2021 ACCOUNT Utilities Expense ACCOUNT NO 59 BALANCE POST REF ITEM DEBIT CREDIT DEBIT CREDIT DATE 2021 Work Sheet For the Month Ended April 30, 2021 TRIAL BALANCE DEBIT CREDIT ADJUSTMENTS DEBIT CREDIT ADJ TRIAL BALANCE INCOME STATEMENT DEBIT CREDIT DEBIT CREDIT BALANCE SHEET DEBIT CREDIT ACCOUNT TITLE Cash Accounts Receivable Supplies Prepaid Rent Prepaid Insurance Office Equipment Accumulated Depreciation Accounts Payable Unearned Fees John Williams, Capital John Williams, Drawing Fees Earned Salary Expense Rent Expense Supplies Expense Depreciation Expense Insurance Expense Utilities Expense Net Income Income Statement Williams Tax Service Statement of Owner's Equity Classified Balance Sheet JOURNAL Page 7 Post Ref. Debit Credit Date 2021 Apr. 30 Description Adjusting Entries Post-Closing Trial Balance April 30, 2021 Account Title Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts