Question: Please help wirh Question #3. Sicily Inc. purchased a machine on January 1,2020 , at a cash cost of $15,800. The estimated residual value was

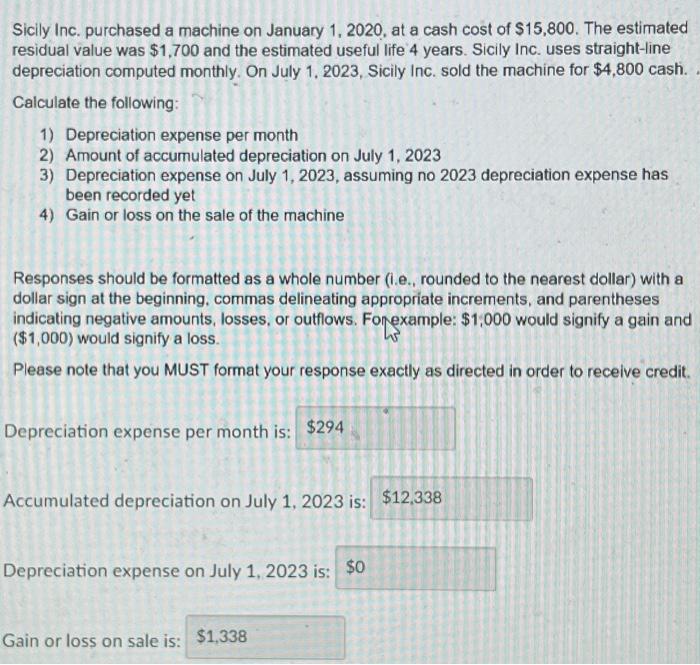

Sicily Inc. purchased a machine on January 1,2020 , at a cash cost of $15,800. The estimated residual value was $1,700 and the estimated useful life 4 years. Sicily Inc. uses straight-line depreciation computed monthly. On July 1, 2023, Sicily Inc. sold the machine for $4,800cash. Calculate the following: 1) Depreciation expense per month 2) Amount of accumulated depreciation on July 1, 2023 3) Depreciation expense on July 1, 2023, assuming no 2023 depreciation expense has been recorded yet 4) Gain or loss on the sale of the machine Responses should be formatted as a whole number (i.e., rounded to the nearest dollar) with a dollar sign at the beginning. commas delineating appropriate increments, and parentheses indicating negative amounts, losses, or outfows. Fonexample: $1,000 would signify a gain and ($1,000) would signify a loss. Please note that you MUST format your response exactly as directed in order to receive credit. Depreciation expense per month is: Accumulated depreciation on July 1, 2023 is: Depreciation expense on July 1,2023 is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts