Question: please help wirh the ones i got wrong. all info is present Rudd Clothiers is a small company that manufactures tall-men's suits. The company has

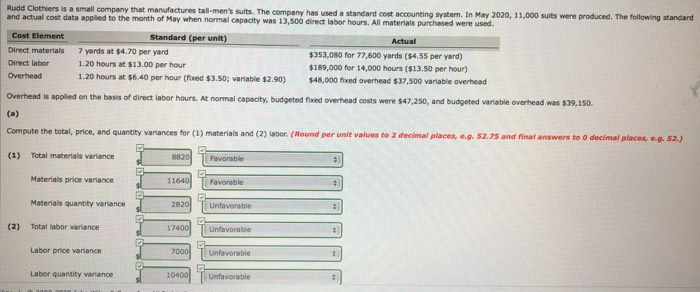

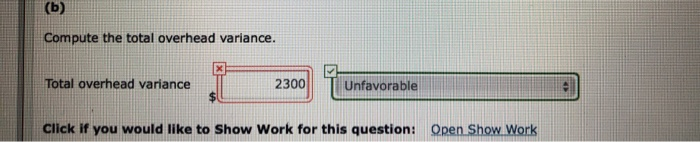

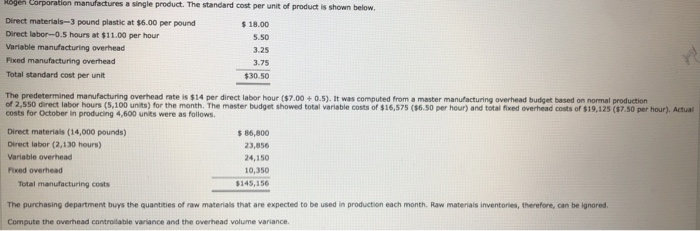

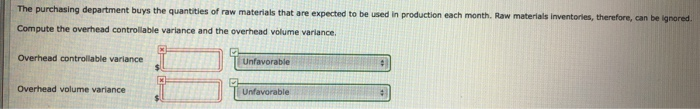

Rudd Clothiers is a small company that manufactures tall-men's suits. The company has used a standard cost accounting system. In May 2020, 11,000 sults were produced. The following standard and actual cost data applied to the month of May when normal capacity was 13,500 direct labor hours. All materials purchased were used Cost Element Actual Direct materials Direct labor Overhead Standard (per unit) 7 yards at $4.70 per yard 1.20 hours at $13.00 per hour 1.20 hours at $6.40 per hour (fixed $3.50; variable $2.90) $353,080 for 77,600 yards ($4.55 per yard) $189,000 for 14,000 hours ($13.50 per hour) $48,000 fixed overhead $37,500 variable overhead Overhead is applied on the basis of direct labor hours. At normal capacity, budgeted foed overhead costs were $47.250, and budgeted variable overhead was $39,150. Compute the total, price, and quantity variances for (1) materials and (2) labor. (Round per unit values to 2 decimal places,... 52.75 and inal answers to decimal places, e.g. 52.) (1) Total materiais variance 8820 Favorable Materials price variance - Favorable Materials quantity variance - Unfavorable (2) Total labor variance - 17400 Unfavorable Labor price variance Two Labor quantity wariance 10400) Tuntuvorable (b) Compute the total overhead variance. Total overhead variance 2300 Unfavorable Click if you would like to Show Work for this question: Open Show Work Mogen corporation manufactures a single product. The standard cost per unit of product is shown below. Direct materials-3 pound plastic at $6.00 per pound $18.00 Direct labor-0.5 hours at $11.00 per hour 5.50 Variable manufacturing overhead Feed manufacturing overhead Total standard cost per unit 3.25 The predetermined manufacturing overhead rate is $14 per direct labor hour ($7.00+ 0.5). It was computed from a master manufacturing overhead budget based on normal production of 2,550 direct labor hours (5,100 units) for the month. The master budget showed total variable costs of $16,575 ($6.50 per hour) and total fixed overhead costs of $19,125 ($7.50 per hour). Actual costs for October in producing 4,600 units were as follows. Direct materials (14,000 pounds) Direct labor (2,130 hours) Variable overhead Pored overhead Total manufacturing costs $ 86,800 23.856 24,150 10.350 5145.156 The purchasing department buys the quantities of raw materials that are expected to be used in production each month raw materials inventories, therefore can be ignored Compute the overhead controllable variance and the overhead volume variance The purchasing department buys the quantities of raw materials that are expected to be used in production each month. Raw materials inventories, therefore, can be ignored Compute the overhead controllable variance and the overhead volume variance Overhead controllable variance T| Unfavorable Overhead volume variance Unfavorable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts