Question: please help with 1, 3, 5, 6, 7, 11, 12, 13 X 1. A firm has a payout ratio of 60%, an expected dividend for

please help with 1, 3, 5, 6, 7, 11, 12, 13

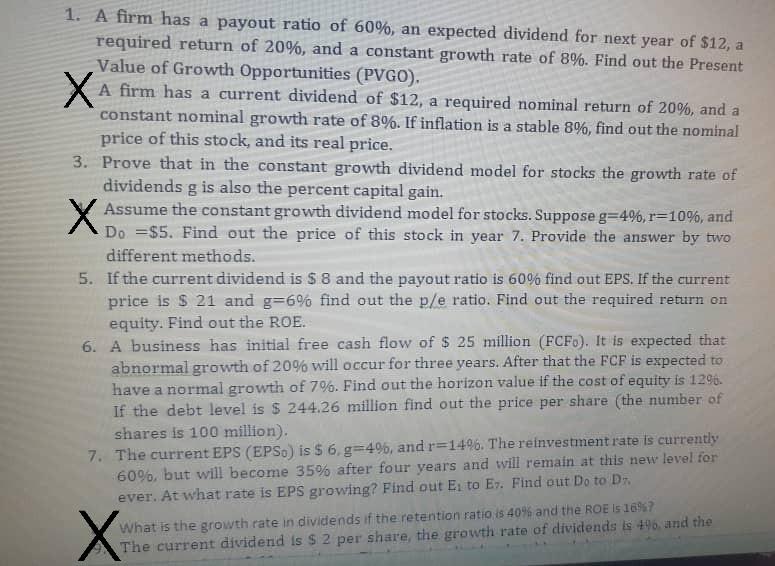

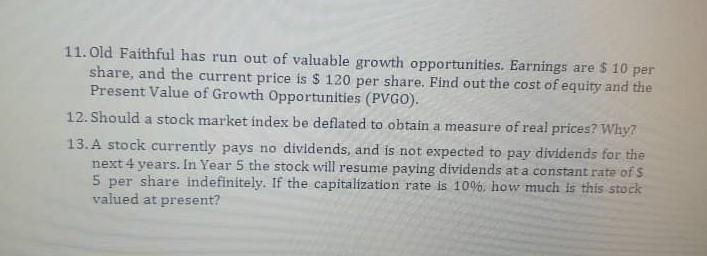

X 1. A firm has a payout ratio of 60%, an expected dividend for next year of $12, a required return of 20%, and a constant growth rate of 8%. Find out the Present Value of Growth Opportunities (PVGO), A firm has a current dividend of $12, a required nominal return of 20%, and a constant nominal growth rate of 8%. If inflation is a stable 8%, find out the nominal price of this stock, and its real price. 3. Prove that in the constant growth dividend model for stocks the growth rate of dividends g is also the percent capital gain. Assume the constant growth dividend model for stocks. Suppose g=496, r=10%, and Do =$5. Find out the price of this stock in year 7. Provide the answer by two different methods. 5. If the current dividend is $8 and the payout ratio is 60% find out EPS. If the current price is $ 21 and g=6% find out the p/e ratio. Find out the required return on equity. Find out the ROE. 6. A business has initial free cash flow of $ 25 million (FCF). It is expected that abnormal growth of 20% will occur for three years. After that the FCF is expected to have a normal growth of 7%. Find out the horizon value if the cost of equity is 1296. If the debt level is $ 244.26 million find out the price per share (the number of shares is 100 million). 7. The current EPS (EPS) is $ 6. g=496, and r=14%. The reinvestment rate is currently 60%, but will become 35% after four years and will remain at this new level for ever. At what rate is EPS growing? Find out E. to Ey. Find out Do to Dz. What is the growth rate in dividends if the retention ratio is 40% and the ROE IS 16%? The current dividend is $ 2 per share, the growth rate of dividends is 446, and the X 11. Old Faithful has run out of valuable growth opportunities. Earnings are $ 10 per share, and the current price is $ 120 per share. Find out the cost of equity and the Present Value of Growth Opportunities (PVGO). 12. Should a stock market index be deflated to obtain a measure of real prices? Why? 13. A stock currently pays no dividends, and is not expected to pay dividends for the next 4 years. In Year 5 the stock will resume paying dividends at a constant rate of s 5 per share indefinitely. If the capitalization rate is 10% how much is this stock valued at present

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts