Question: Please Help with 19-20-21 Question 19 What is the expected after-tax cash flow from selling a piece of equipment if Orange Valley Shipping purchases the

Please Help with 19-20-21

Please Help with 19-20-21

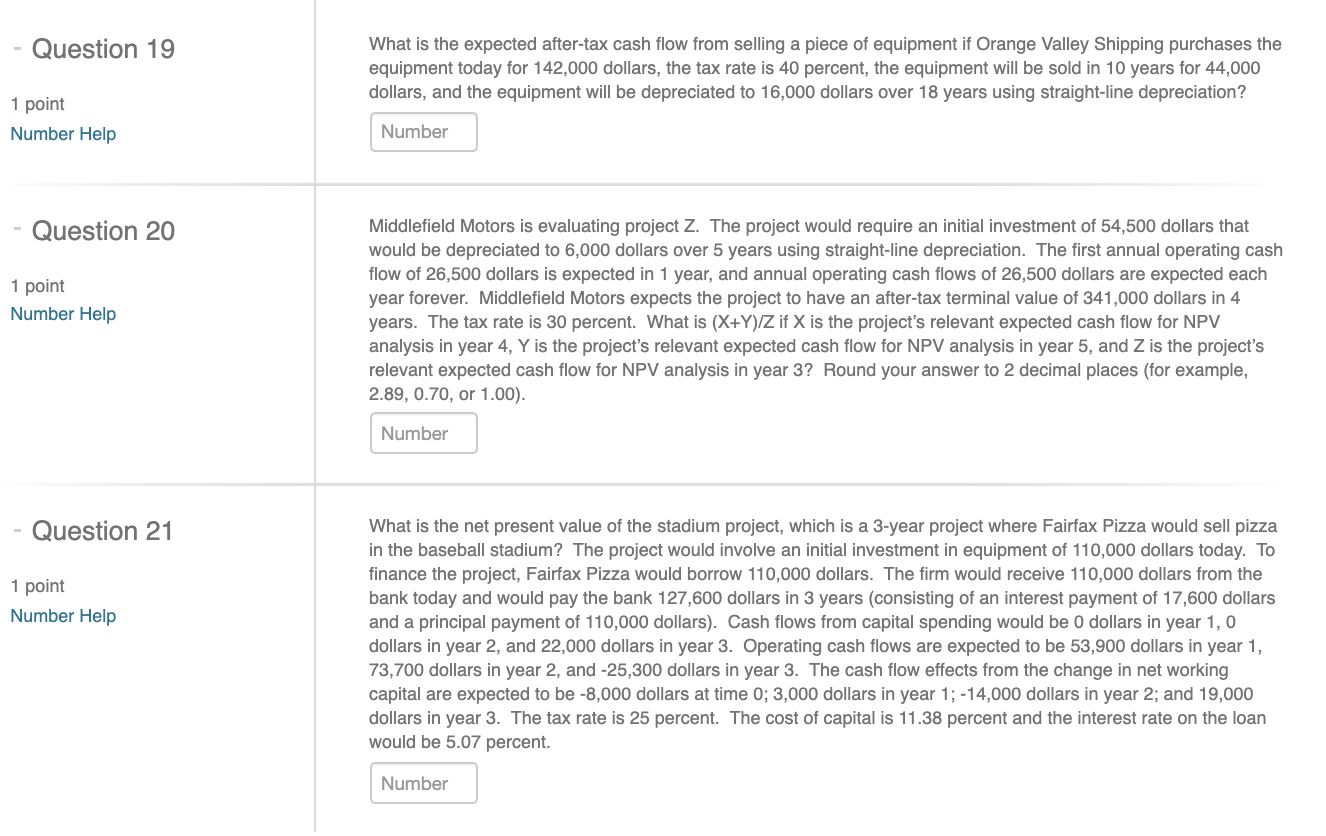

Question 19 What is the expected after-tax cash flow from selling a piece of equipment if Orange Valley Shipping purchases the equipment today for 142,000 dollars, the tax rate is 40 percent, the equipment will be sold in 10 years for 44,000 dollars, and the equipment will be depreciated to 16,000 dollars over 18 years using straight-line depreciation? 1 point Number Help Number Question 20 1 point Number Help Middlefield Motors is evaluating project Z. The project would require an initial investment of 54,500 dollars that would be depreciated to 6,000 dollars over 5 years using straight-line depreciation. The first annual operating cash flow of 26,500 dollars is expected in 1 year, and annual operating cash flows of 26,500 dollars are expected each year forever. Middlefield Motors expects the project to have an after-tax terminal value of 341,000 dollars in 4 years. The tax rate is 30 percent. What is (X+Y)/Z if X is the project's relevant expected cash flow for NPV analysis in year 4, Y is the project's relevant expected cash flow for NPV analysis in year 5, and Z is the project's relevant expected cash flow for NPV analysis in year 3? Round your answer to 2 decimal places (for example, 2.89, 0.70, or 1.00). Number Question 21 1 point Number Help What is the net present value of the stadium project, which is a 3-year project where Fairfax Pizza would sell pizza in the baseball stadium? The project would involve an initial investment in equipment of 110,000 dollars today. To finance the project, Fairfax Pizza would borrow 110,000 dollars. The firm would receive 110,000 dollars from the bank today and would pay the bank 127,600 dollars in 3 years (consisting of an interest payment of 17,600 dollars and a principal payment of 110,000 dollars). Cash flows from capital spending would be 0 dollars in year 1,0 dollars in year 2, and 22,000 dollars in year 3. Operating cash flows are expected to be 53,900 dollars in year 1, 73,700 dollars in year 2, and -25,300 dollars in year 3. The cash flow effects from the change in net working capital are expected to be -8,000 dollars at time 0; 3,000 dollars in year 1; -14,000 dollars in year 2; and 19,000 dollars in year 3. The tax rate is 25 percent. The cost of capital is 11.38 percent and the interest rate on the loan would be 5.07 percent. Number

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts