Question: Please help with #2 only. Just need the explanation there. I'm not sure why I'm being prompted to email someone with money. erential Analysis and

Please help with #2 only. Just need the explanation there. I'm not sure why I'm being prompted to email someone with money.

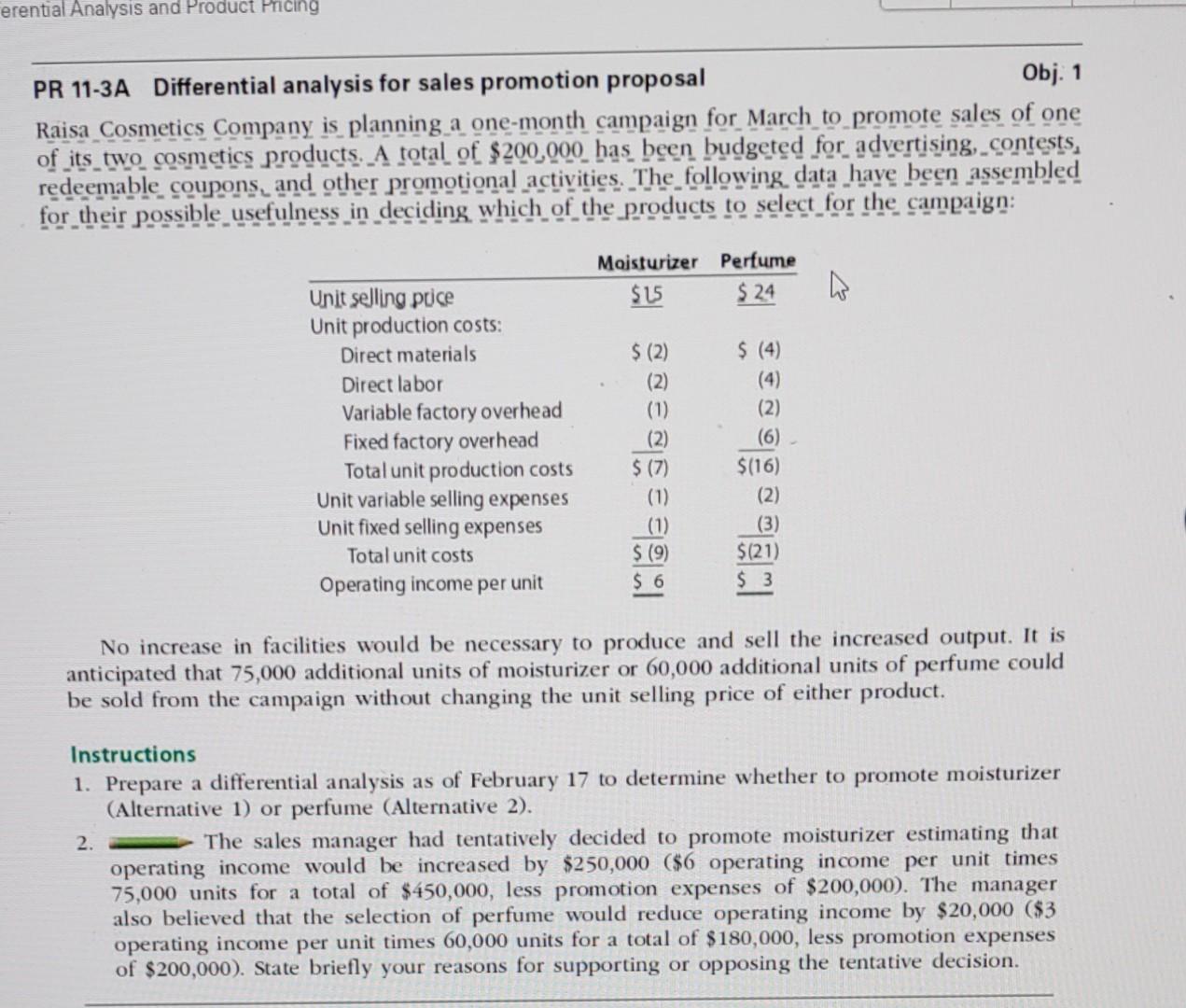

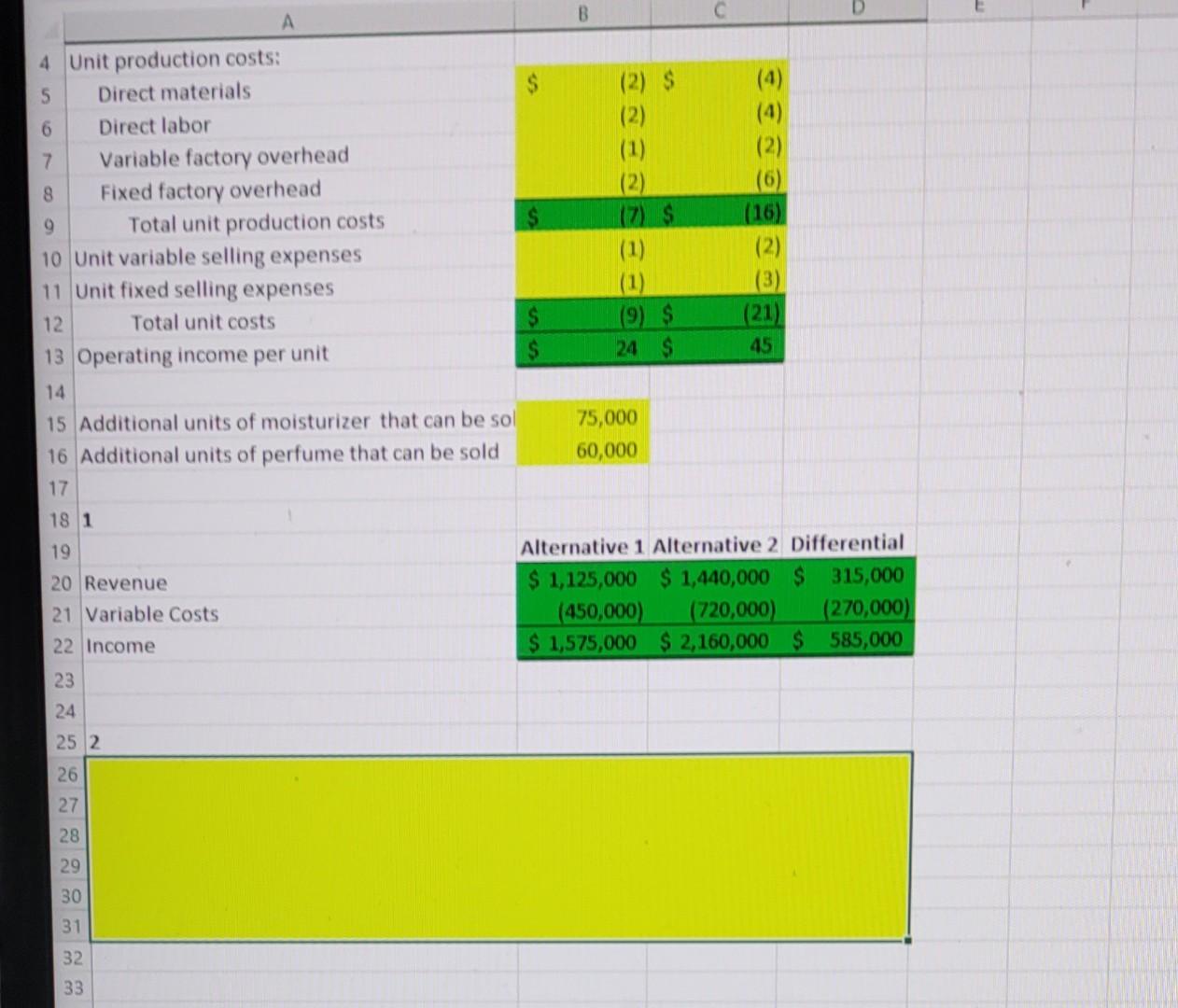

erential Analysis and Product Pricing PR 11-3A Differential analysis for sales promotion proposal Obj. 1 Raisa Cosmetics Company is planning a one-month campaign for March to promote sales of one of its two cosmetics products. A total of $200,000 has been budgeted for advertising, contests, redeemable coupons, and other promotional activities. The following data have been assembled for their possible usefulness in deciding which of the products to select for the campaign: Unit selling price Unit production costs: Direct materials Direct labor Variable factory overhead Fixed factory overhead Total unit production costs Unit variable selling expenses Unit fixed selling expenses Total unit costs Operating income per unit 2. Moisturizer Perfume $24 $15 $ (2) (2) (1) (2) $ (7) (1) (1) $(9) $6 $ (4) (2) (6) $(16) (2) (3) $(21) No increase in facilities would be necessary to produce and sell the increased output. It is anticipated that 75,000 additional units of moisturizer or 60,000 additional units of perfume could be sold from the campaign without changing the unit selling price of either product. Instructions 1. Prepare a differential analysis as of February 17 to determine whether to promote moisturizer (Alternative 1) or perfume (Alternative 2). The sales manager had tentatively decided to promote moisturizer estimating that operating income would be increased by $250,000 ($6 operating income per unit times 75,000 units for a total of $450,000, less promotion expenses of $200,000). The manager also believed that the selection of perfume would reduce operating income by $20,000 ($3 operating income per unit times 60,000 units for a total of $180,000, less promotion expenses of $200,000). State briefly your reasons for supporting or opposing the tentative decision. 4 Unit production costs: 5 6 7 Variable factory overhead 8 9 Total unit production costs 10 Unit variable selling expenses 11 Unit fixed selling expenses Total unit costs 12 13 Operating income per unit 14 15 Additional units of moisturizer that can be sol 16 Additional units of perfume that can be sold 17 18 1 19 20 Revenue 21 Variable Costs 22 Income Direct materials Direct labor 32 33 A 23 24 25 2 26 27 28 29 30 31 Fixed factory overhead B (2) $ (7) $ (1) (1) (9) $ 24 $ 75,000 60,000 C (2) (6) (16) (2) (3) (21) 45 Alternative 1 Alternative 2 Differential 1,125,000 $1,440,000 $315,000 (720,000) (270,000) (450,000) $1,575,000 $2,160,000 $ 585,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts