Question: Please help with 21 and 22, they are one question Given the information below tor Seger Corporation, compute the expected share price at the end

Please help with 21 and 22, they are one question

Please help with 21 and 22, they are one question

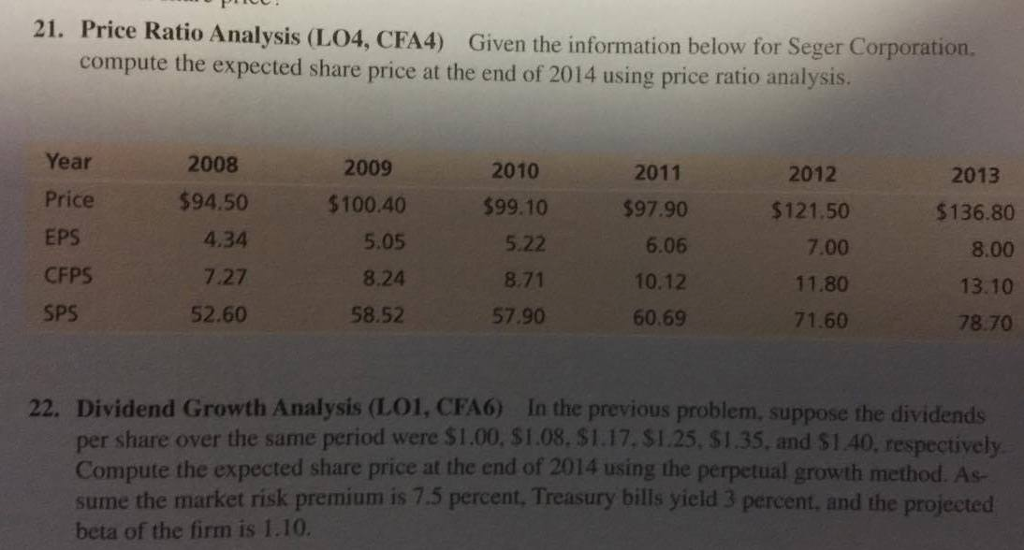

Given the information below tor Seger Corporation, compute the expected share price at the end of 2014 using price ratio analysis. In the previous problem, suppose the dividends per share over the same period were $1.00. $1.08. $1.17, $1.25, $1.35, and $1 40, respectively. Compute the expected share price at the end of 2014 using the perpetual growth method Assume the market risk premium is 7.5 percent. Treasury bills yield 3 percent, and the projected beta of the firm is 1.10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts