Question: please help with #3 and #4. i already posted #4 but it was answered incorrectly. Thank you in advance. #3 #4 Homework: Homework Chapter 11

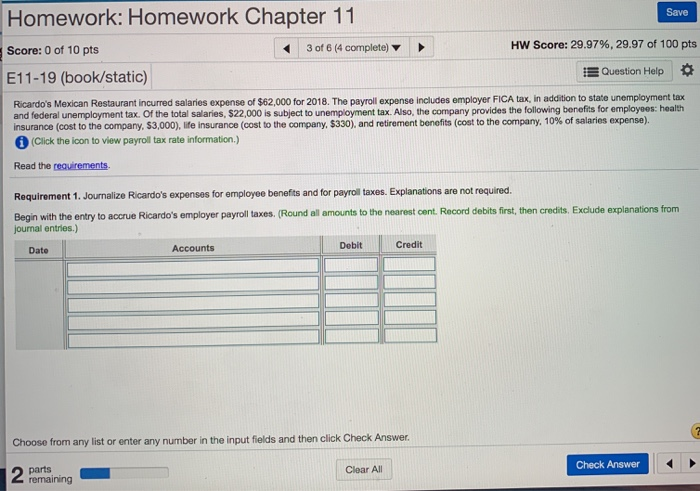

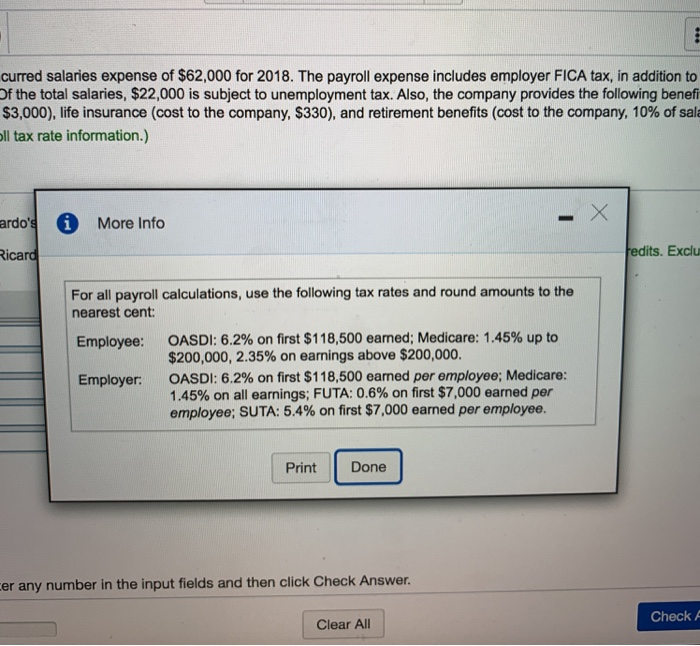

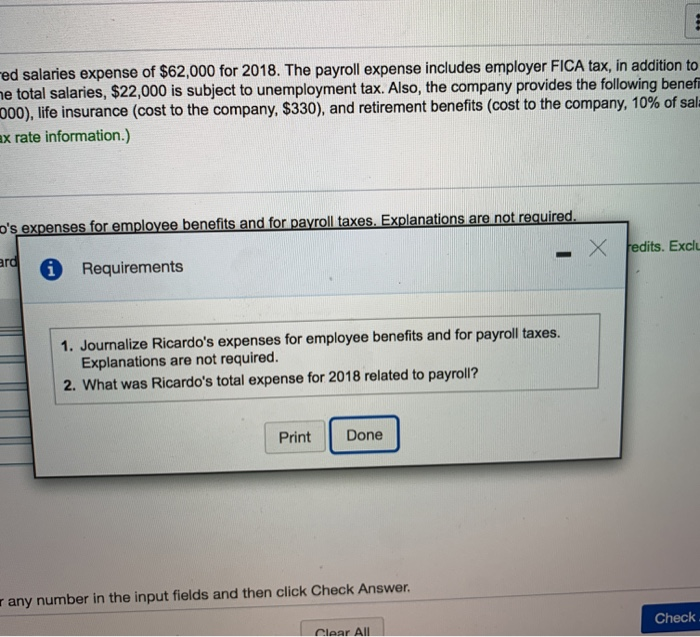

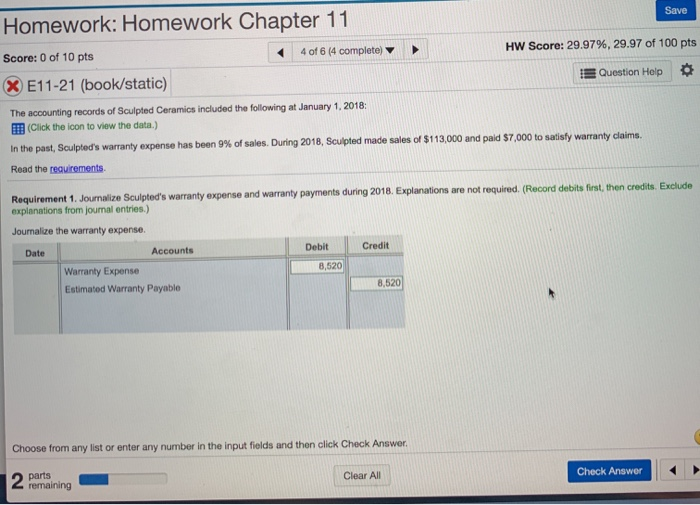

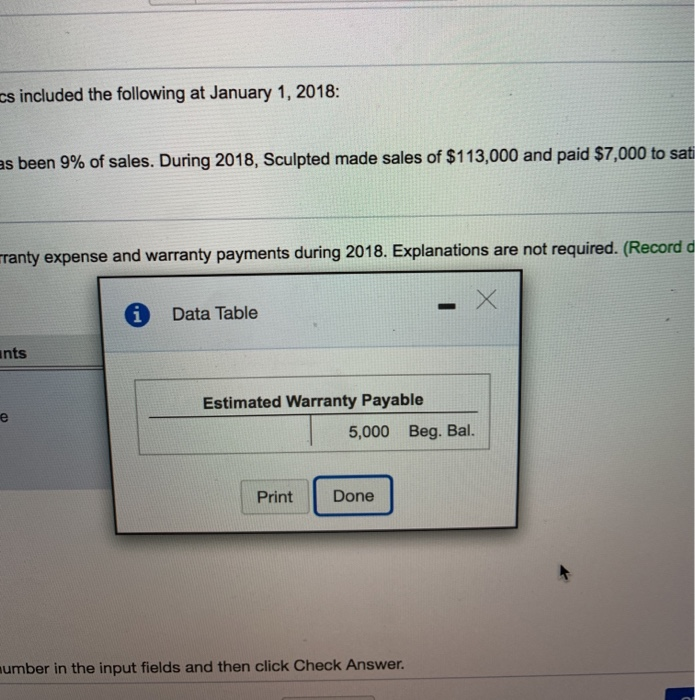

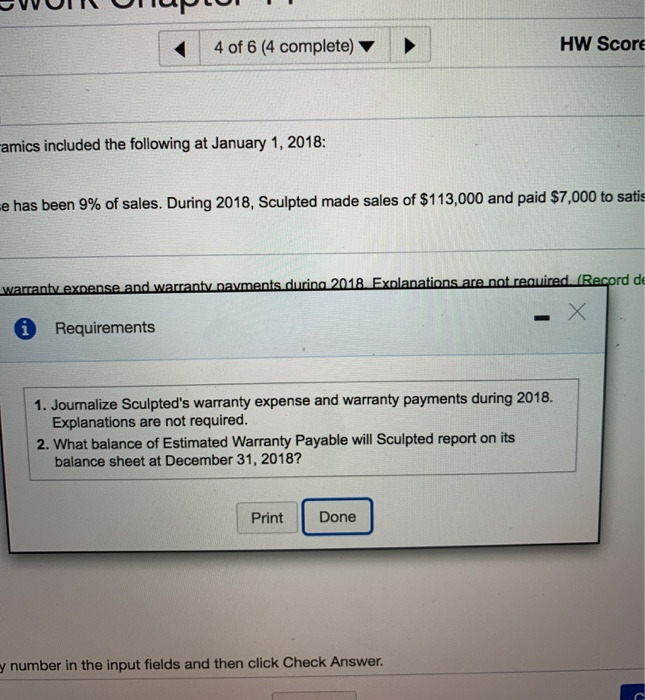

Homework: Homework Chapter 11 Save Score: 0 of 10 pts 3 of 6 (4 complete) HW Score: 29.97%, 29.97 of 100 pts E11-19 (book/static) I Question Help Ricardo's Mexican Restaurant incurred salaries expense of $62,000 for 2018. The payroll expense Includes employer FICA tax, in addition to state unemployment tax and federal unemployment tax. Of the total salaries, $22,000 is subject to unemployment tax. Also, the company provides the following benefits for employees: health Insurance (cost to the company, $3,000), life insurance (cost to the company. $330), and retirement benefits (cost to the company. 10% of salaries expense). (Click the icon to view payroll tax rate information.) Read the requirements Requirement 1. Journalize Ricardo's expenses for employee benefits and for payroll taxes. Explanations are not required. Begin with the entry to accrue Ricardo's employer payroll taxes. (Round al amounts to the nearest cent. Record debits first, then credits. Exclude explanations from journal entries.) Date Accounts Debit Credit Choose from any list or enter any number in the input fields and then click Check Answer 2 remaining parts Clear All Check Answer curred salaries expense of $62,000 for 2018. The payroll expense includes employer FICA tax, in addition to Of the total salaries, $22,000 is subject to unemployment tax. Also, the company provides the following benefi $3,000), life insurance (cost to the company, $330), and retirement benefits (cost to the company, 10% of sala oll tax rate information.) i More Info ardo's Ricard fedits. Exclu For all payroll calculations, use the following tax rates and round amounts to the nearest cent: Employee: OASDI: 6.2% on first $118,500 earned; Medicare: 1.45% up to $200,000, 2.35% on earnings above $200,000. Employer: OASDI: 6.2% on first $118,500 earned per employee; Medicare: 1.45% on all earnings; FUTA: 0.6% on first $7,000 earned per employee; SUTA: 5.4% on first $7,000 earned per employee. Print Done cer any number in the input fields and then click Check Answer. Clear All Check ed salaries expense of $62,000 for 2018. The payroll expense includes employer FICA tax, in addition to le total salaries, $22,000 is subject to unemployment tax. Also, the company provides the following benet 000), life insurance (cost to the company. $330), and retirement benefits (cost to the company, 10% of sa x rate information.) o's expenses for employee benefits and for payroll taxes. Explanations are not required. X edits. Exclu * Requirements 1. Journalize Ricardo's expenses for employee benefits and for payroll taxes. Explanations are not required. 2. What was Ricardo's total expense for 2018 related to payroll? Print Done any number in the input fields and then click Check Answer. Check Clear All Save Homework: Homework Chapter 11 Score: 0 of 10 pts 4 of 6 (4 complete) X E11-21 (book/static) HW Score: 29.97%, 29.97 of 100 pts Question Help The accounting records of Sculpted Ceramics included the following at January 1, 2018: FIF (Click the icon to view the data) In the past, Sculpted's warranty expense has been 9% of sales. During 2018, Sculpted made sales of $113,000 and paid $7,000 to satisfy warranty claims. Read the requirements Requirement 1. Journalize Sculpted's warranty expense and warranty payments during 2018. Explanations are not required. (Record debits first, then credits. Exclude explanations from journal entries.) Joumalize the warranty expense. Date Debit Credit Accounts Warranty Expense Estimated Warranty Payable 8,520 8.520 Choose from any list or enter any number in the input fields and then click Check Answer parts remaining Clear All Check Answer cs included the following at January 1, 2018: as been 9% of sales. During 2018, Sculpted made sales of $113,000 and paid $7,000 to sat ranty expense and warranty payments during 2018. Explanations are not required. (Record i Data Table Ints e Estimated Warranty Payable 5,000 Beg. Bal. Print Done umber in the input fields and then click Check Answer VOIP 4 of 6 (4 complete) HW Scor amics included the following at January 1, 2018: e has been 9% of sales. During 2018, Sculpted made sales of $113,000 and paid $7,000 to satis warranty expense and warranty payments during 2018. Explanations are not required. (Record de Requirements 1. Journalize Sculpted's warranty expense and warranty payments during 2018. Explanations are not required. 2. What balance of Estimated Warranty Payable will Sculpted report on its balance sheet at December 31, 2018? Print Done number in the input fields and then click Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts