Question: Please help with #3 - bull spread. 2. OPTIONS ON FUTURES Listed in the table are several options on futures contracts. Using this information, determine

Please help with #3 - bull spread.

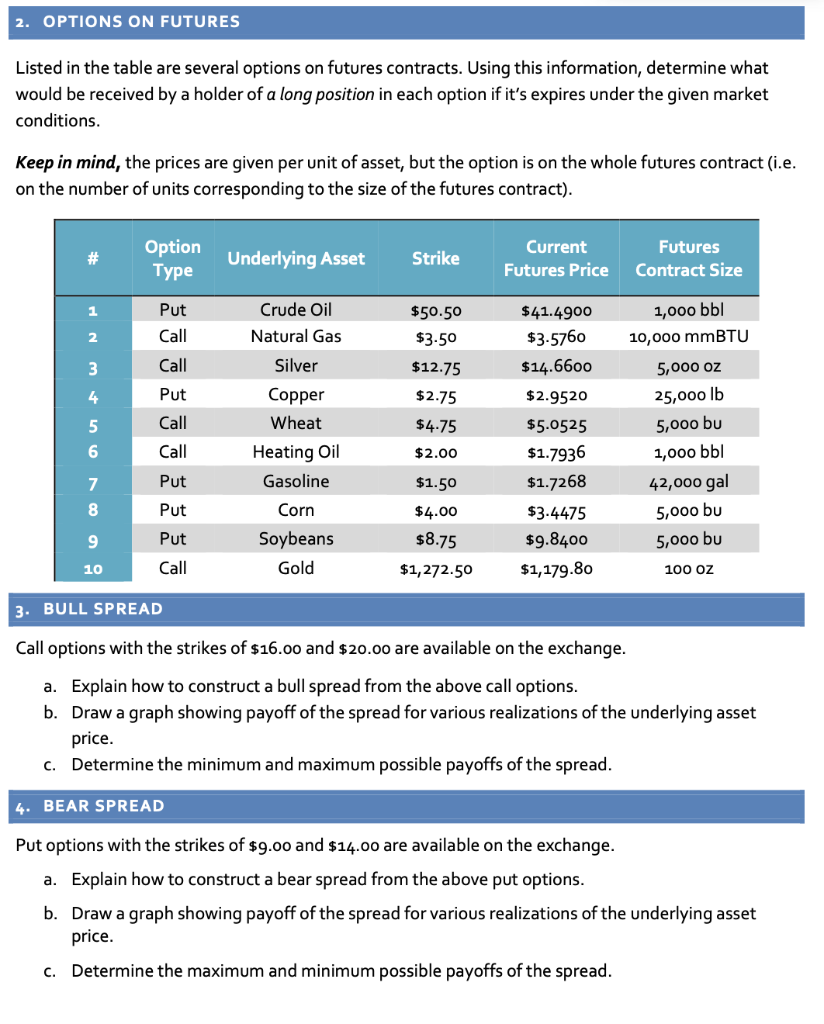

2. OPTIONS ON FUTURES Listed in the table are several options on futures contracts. Using this information, determine what would be received by a holder of a long position in each option if it's expires under the given market conditions. Keep in mind, the prices are given per unit of asset, but the option is on the whole futures contract (i.e. on the number of units corresponding to the size of the futures contract). Option Type Underlying Asset Strike Current Futures Price Futures Contract Size Put Call Call Put Call Bouw Crude Oil Natural Gas Silver Copper Wheat Heating Oil Gasoline Corn Soybeans Gold $50.50 $3.50 $12.75 $2.75 $4.75 $2.00 $1.50 $4.00 $8.75 $1,272.50 $41.4900 $3.5760 $14.6600 $2.9520 $5.0525 $1.7936 $1.7268 $3.4475 $9.8400 $1,179.80 1,000 bbl 10,000 mmBTU 5,000 oz 25,000 lb 5,000 bu 1,000 bbl 42,000 gal 5,000 bu 5,000 bu 100 OZ Call Put Put Put Call 3. BULL SPREAD Call options with the strikes of $16.00 and $20.00 are available on the exchange. a. Explain how to construct a bull spread from the above call options. b. Draw a graph showing payoff of the spread for various realizations of the underlying asset price. C. Determine the minimum and maximum possible payoffs of the spread. 4. BEAR SPREAD Put options with the strikes of $9.00 and $14.00 are available on the exchange. a. Explain how to construct a bear spread from the above put options. b. Draw a graph showing payoff of the spread for various realizations of the underlying asset price. c. Determine the maximum and minimum possible payoffs of the spread. 2. OPTIONS ON FUTURES Listed in the table are several options on futures contracts. Using this information, determine what would be received by a holder of a long position in each option if it's expires under the given market conditions. Keep in mind, the prices are given per unit of asset, but the option is on the whole futures contract (i.e. on the number of units corresponding to the size of the futures contract). Option Type Underlying Asset Strike Current Futures Price Futures Contract Size Put Call Call Put Call Bouw Crude Oil Natural Gas Silver Copper Wheat Heating Oil Gasoline Corn Soybeans Gold $50.50 $3.50 $12.75 $2.75 $4.75 $2.00 $1.50 $4.00 $8.75 $1,272.50 $41.4900 $3.5760 $14.6600 $2.9520 $5.0525 $1.7936 $1.7268 $3.4475 $9.8400 $1,179.80 1,000 bbl 10,000 mmBTU 5,000 oz 25,000 lb 5,000 bu 1,000 bbl 42,000 gal 5,000 bu 5,000 bu 100 OZ Call Put Put Put Call 3. BULL SPREAD Call options with the strikes of $16.00 and $20.00 are available on the exchange. a. Explain how to construct a bull spread from the above call options. b. Draw a graph showing payoff of the spread for various realizations of the underlying asset price. C. Determine the minimum and maximum possible payoffs of the spread. 4. BEAR SPREAD Put options with the strikes of $9.00 and $14.00 are available on the exchange. a. Explain how to construct a bear spread from the above put options. b. Draw a graph showing payoff of the spread for various realizations of the underlying asset price. c. Determine the maximum and minimum possible payoffs of the spread

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts