Question: Please help with 3-6. (1) - Saved to this PC Search Mailings Review View Help a po -A 33 A1 3 - AaBBCI AaBbCcI AaBbc

Please help with 3-6.

Please help with 3-6.

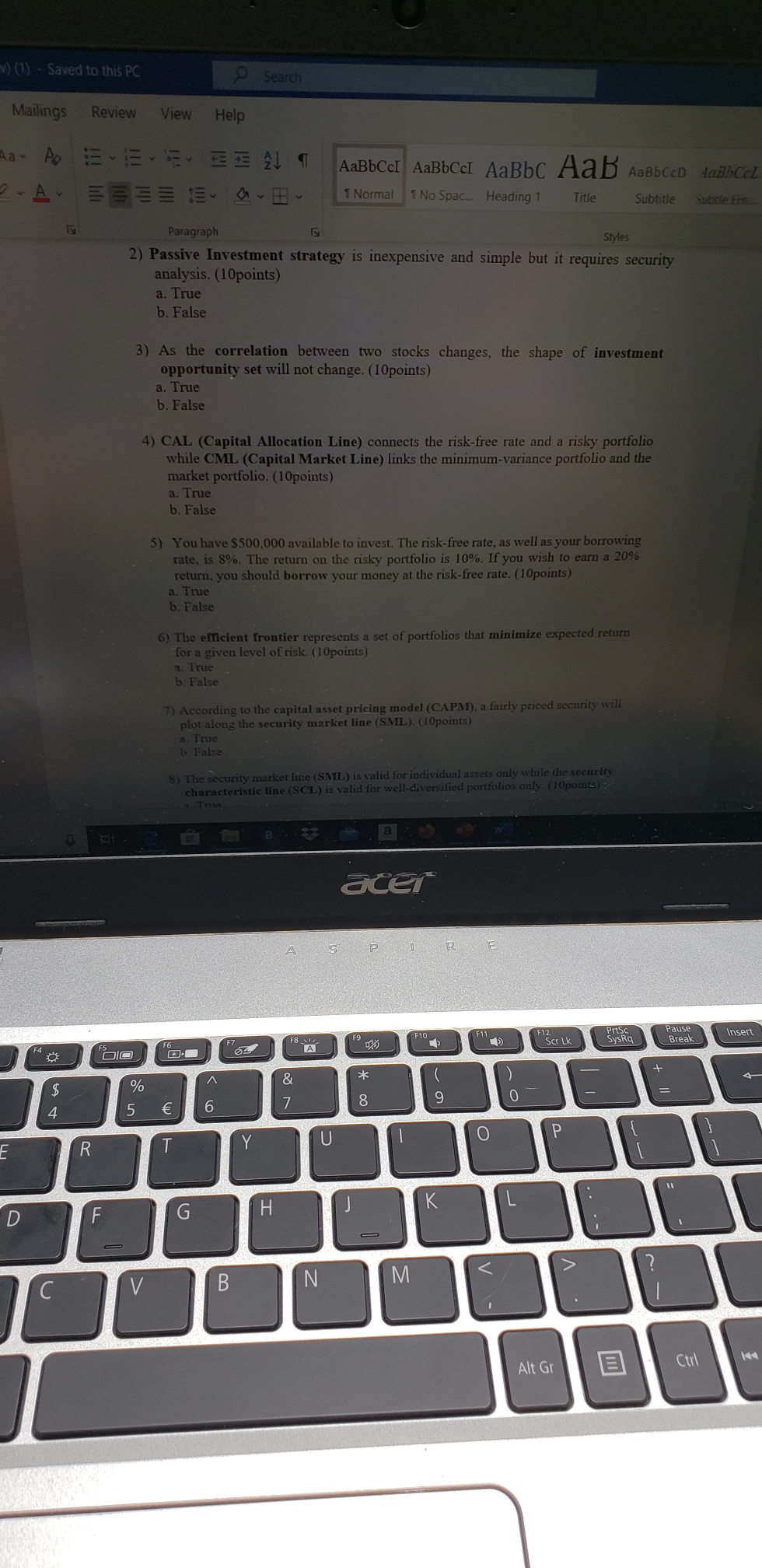

(1) - Saved to this PC Search Mailings Review View Help a po -A 33 A1 3 - AaBBCI AaBbCcI AaBbc AaB Aabbccd AaB 1 Normal 1 No Spac.. Heading 1 Paragraph Styles 2) Passive Investment strategy is inexpensive and simple but it requires security analysis. (10points) a. True b. False 3) As the correlation between two stocks changes, the shape of investment opportunity set will not change. (10points) a. True b. False 4) CAL (Capital Allocation Line) connects the risk-free rate and a risky portfolio while CML (Capital Market Line) links the minimum-variance portfolio and the market portfolio. (10points) a. True b. False 5) You have $500,000 available to invest. The risk-free rate, as well as your borrowing rate, is 8%. The return on the risky portfolio is 10%. If you wish to earn a 20% return, you should borrow your money at the risk-free rate. (10points) a. True b. False 6) The efficient frontier represents a set of portfolios that minimize expected return for a given level of risk. (10points) a. True b. False 7) According to the capital asset pricing model (CAPM), a fairly priced security will plot along the security market line (SML). (10points) a True b. False 8) The security market line (SBL) is valid for individual assets only while the security characteristic line (SCL) is valid for well-diversified portfolios only. (10points) acer RO . JUOOUOUDOU OOONMOOO Alt Gr Ctrl

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts