Question: please help with #4. please show work and try to explain what numbers are being used and why 1. Retirement Funding. Barry has just become

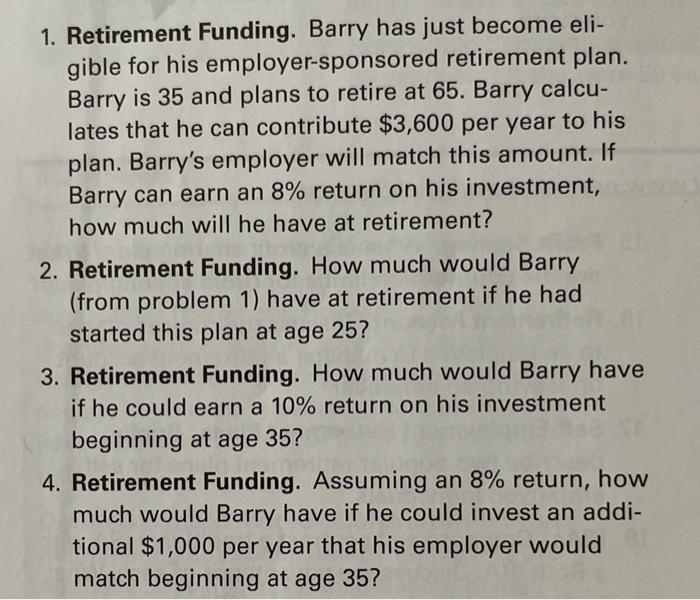

1. Retirement Funding. Barry has just become eli- gible for his employer-sponsored retirement plan. Barry is 35 and plans to retire at 65. Barry calcu- lates that he can contribute $3,600 per year to his plan. Barry's employer will match this amount. If Barry can earn an 8% return on his investment, how much will he have at retirement? 2. Retirement Funding. How much would Barry (from problem 1) have at retirement if he had started this plan at age 25? 3. Retirement Funding. How much would Barry have if he could earn a 10% return on his investment beginning at age 35? 4. Retirement Funding. Assuming an 8% return, how much would Barry have if he could invest an addi- tional $1,000 per year that his employer would match beginning at age 35

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts