Question: please help with #7 a and b You manage a risky fund with expected return 17% and standard deviation 27%. The T-bill rate is 7%.

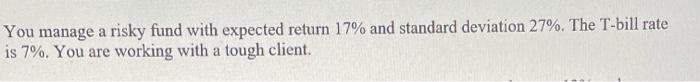

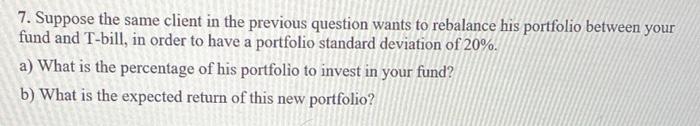

You manage a risky fund with expected return 17% and standard deviation 27%. The T-bill rate is 7%. You are working with a tough client. 7. Suppose the same client in the previous question wants to rebalance his portfolio between your fund and T-bill, in order to have a portfolio standard deviation of 20%. a) What is the percentage of his portfolio to invest in your fund? b) What is the expected return of this new portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts